Bitcoin: Buying the Dip or the End of the Bull Cycle?

Investors have split into two camps: some are warning about a sell-off and the risk of a big correction, while others point to the opportunity to buy Bitcoin at discounted prices. Let's look at the arguments on both sides.

Reasons for the price to continue to drop:

- Bitcoin has already reached its four-year cycle target, updating its price record.

- The chart shows a double top pattern.

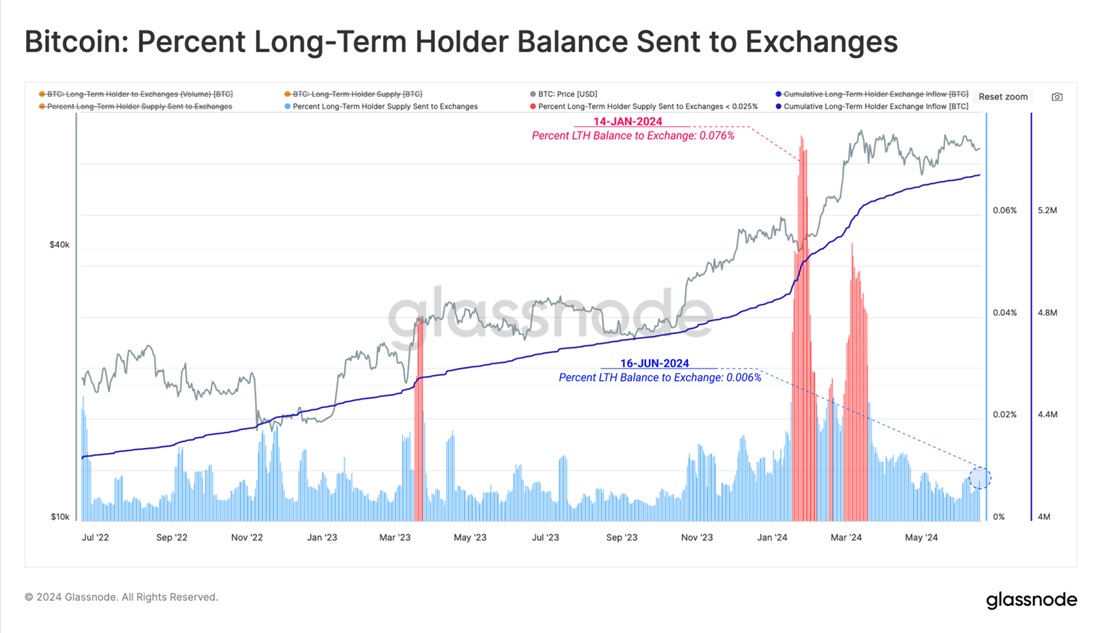

- Long-term holders are locking in profits.

- Retail investors are panicking and selling ETFs.

- Old coins are now in play.

- The U.S. and German governments are selling bitcoin.

- In the coming months, Mt.Gox will return over 140k of BTC to former customers.

All of this news has bombarded investors in recent weeks, adding to the negative sentiment. But if you look closely at each point, things are not actually so bad. For example, the movement of older coins is due to the consolidation of Mt.Gox assets before the payouts (the crypto exchange went bankrupt in 2014), and the profit taking by long-term holders in June was a far cry from the March peaks.

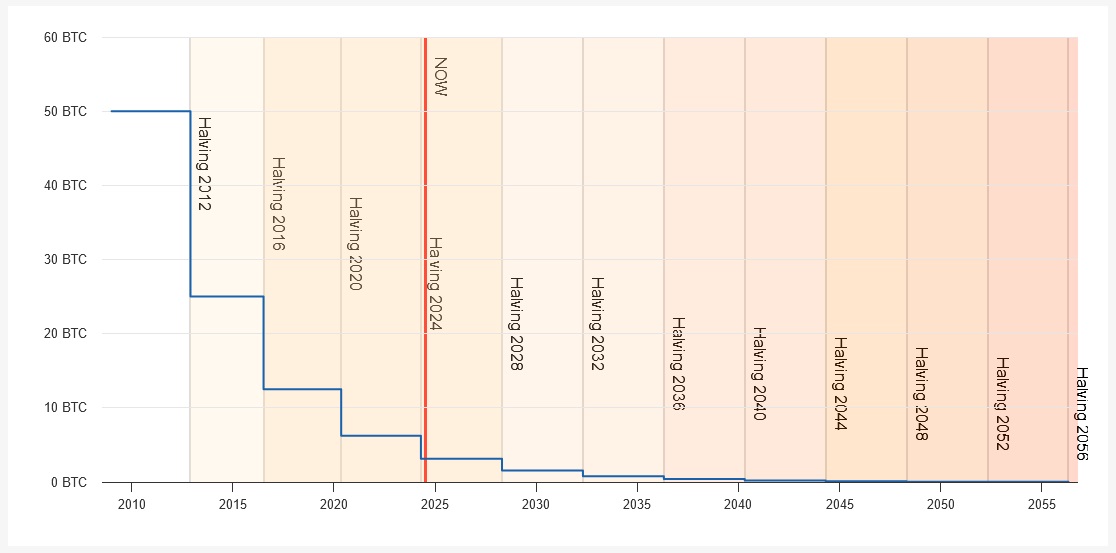

Coin sales by government agencies and former Mt.Gox customers may have a short-term negative impact and cause a correction, but over the course of the year, this will be offset by the April halving. Supply is estimated to have decreased by 164,000 BTC a year.

Reasons for buying the dip:

- Bitcoin gaining the status as an investment asset (commodity) through the authorization of spot ETFs.

- Record institutional interest at the end of the first quarter.

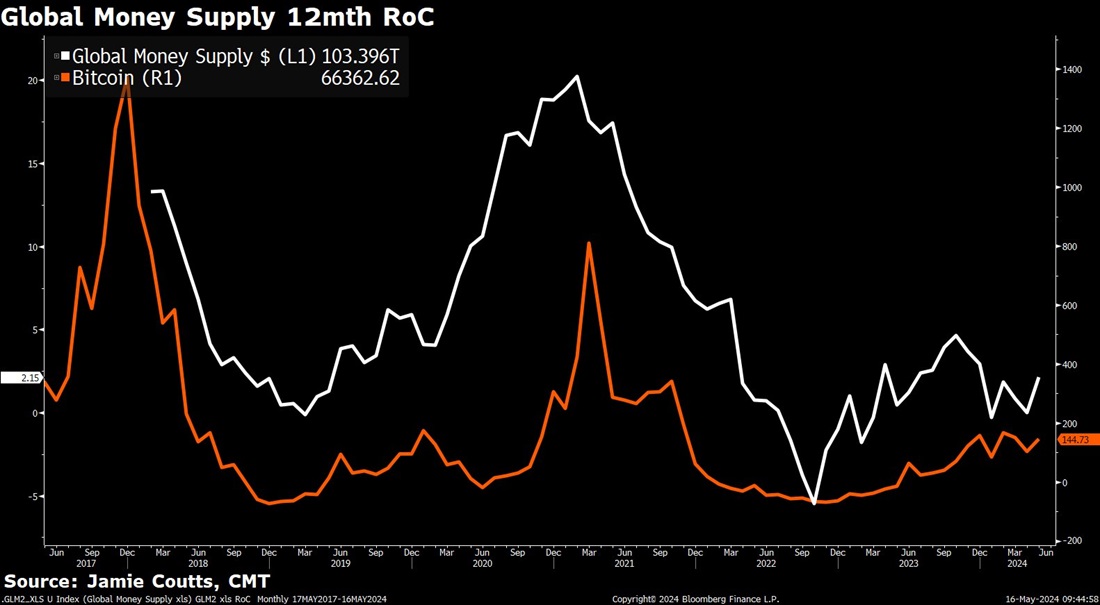

- Growth of the global money supply.

- Global institutionalization of cryptocurrencies (e.g. the MiCA regulation).

- Halving and the relentless churn from crypto exchanges to cold wallets.

- The entry of new companies with reserves in Bitcoin (e.g. Metaplanet).

- The growing number of hedge funds that now have Bitcoin in their portfolios.

As can be seen, the reasons for selling are predominantly short-term, while the reasons for buying are long-term. The impact of long-term factors is most clearly illustrated in the chart showing the growth of the money supply and Bitcoin as a limited-issue instrument. Each printing press run was accompanied by a new cycle of cryptocurrency growth. The world's central banks are now blowing the dust off them again: this year the ECB and the Bank of Canada have already lowered their key rates.

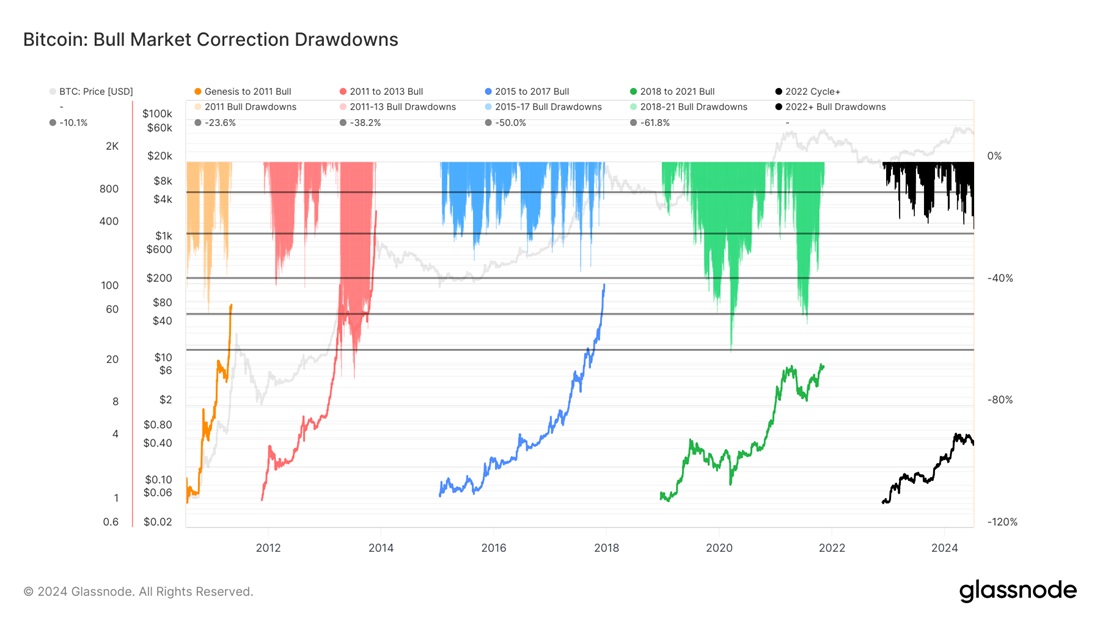

We should also not forget that Bitcoin was and remains a highly volatile instrument, which is characterized by both explosive growth and big drawdowns.

In the current cycle, the drawdown is minor and uncharacteristic of a bull market. Even now it stands at 26%, whereas in previous growth phases it regularly surpassed 30%.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.