Bitcoin is entering the final phase of the bear market

A significant decline in prices is followed by a period of market climax and saturation when the share of speculators in the volume of transactions is reduced, and coins continue to be held (without movement) by only long-term holders who are the most resistant to price unrest.

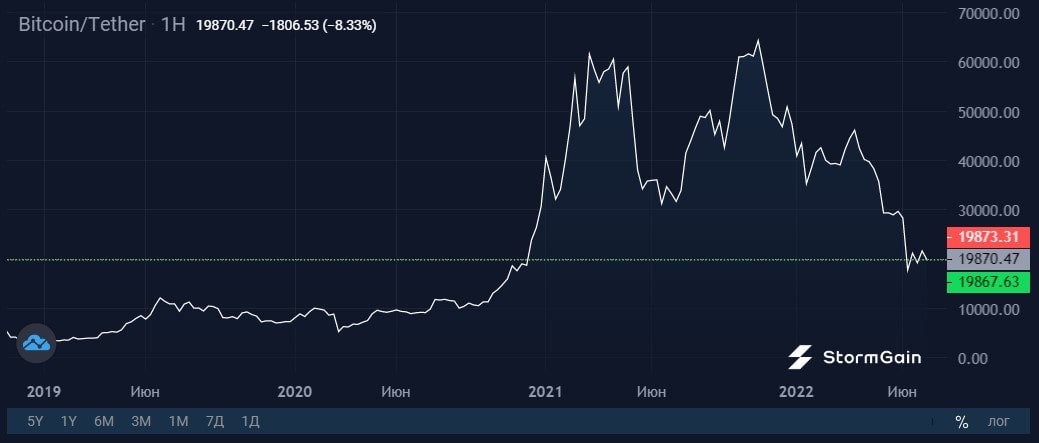

Since a deep correction is not a new phenomenon for Bitcoin, there are many similarities with previous crises, which means we can say that it's entering the final phase of the bear market. At the end of 2018, the price formed a shelf in the region of $6,000 that was broken by a strong price movement. The total drop was 84% of the previous historical maximum. A similar picture can now be seen after stopping in the region of $30,000 and a strong subsequent fall. In June, Bitcoin saw the largest monthly decline it had experienced in the past 10 years.

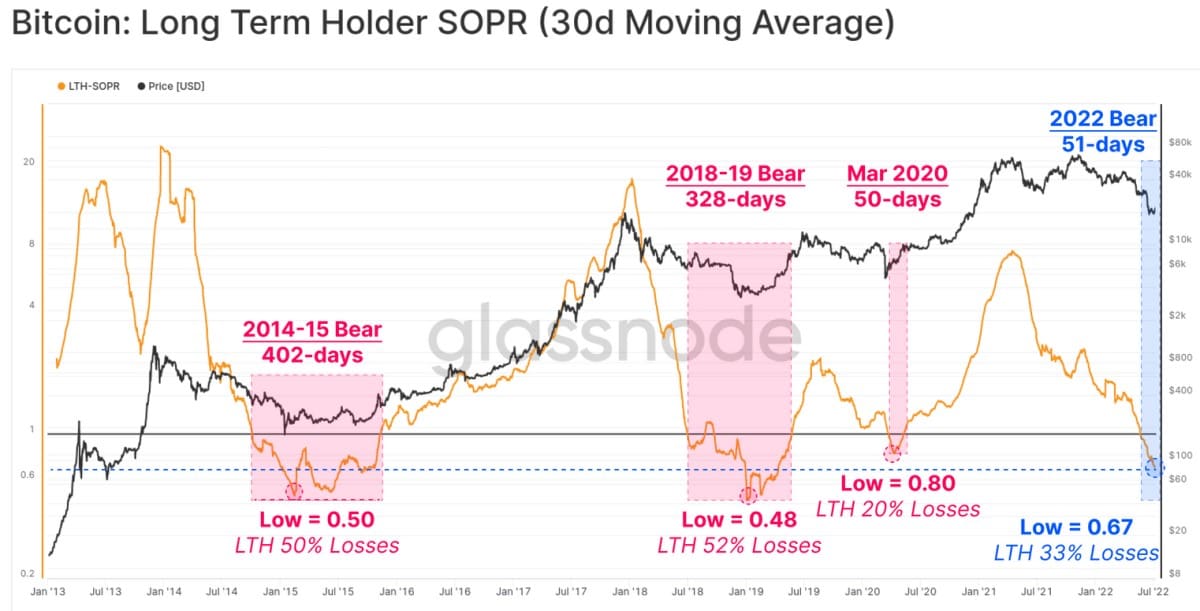

As in previous crises, a group of long-term holders (LTHs) are being tested for durability. The average unrealised loss for these LTHs is now 33%. This is not the worst number seen in Bitcoin's history, meaning there is a chance of further price declines. Statistics also suggest that the final bearish phase has just begun, and consolidation could last more than a year.

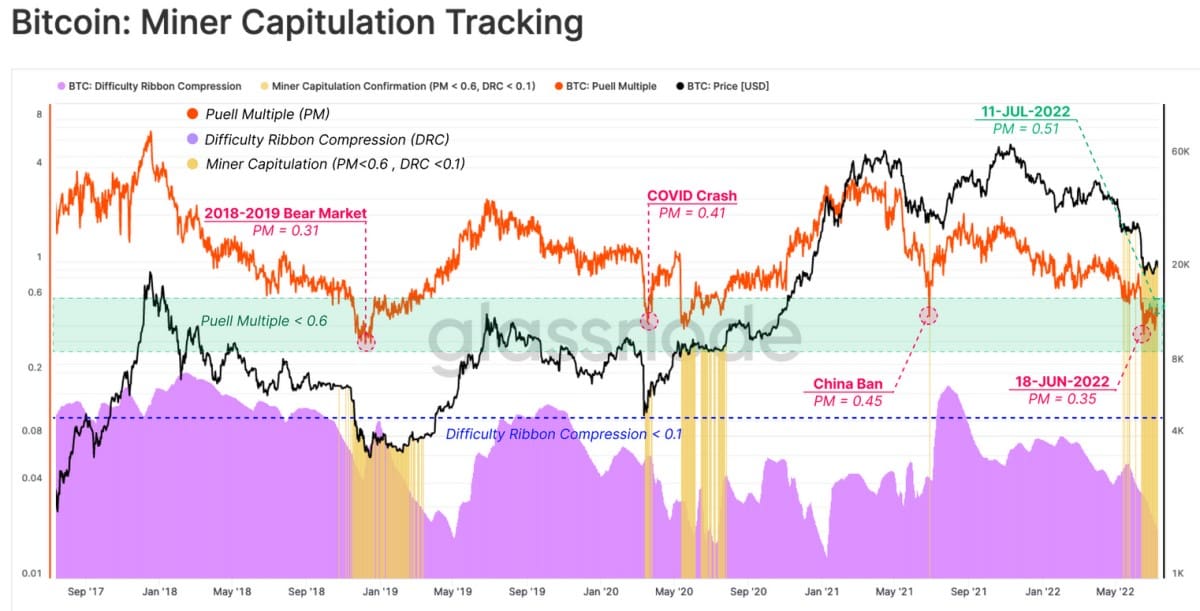

In addition to LTHs, the beginning of the final phase is evidenced by miners throwing in the towel. Their income fell to 50% of the average annual level (the Puell multiplier), which forced some of them to shut down their equipment. As can be seen from the chart below, miners giving up has a high correlation with Bitcoin bottoming out.

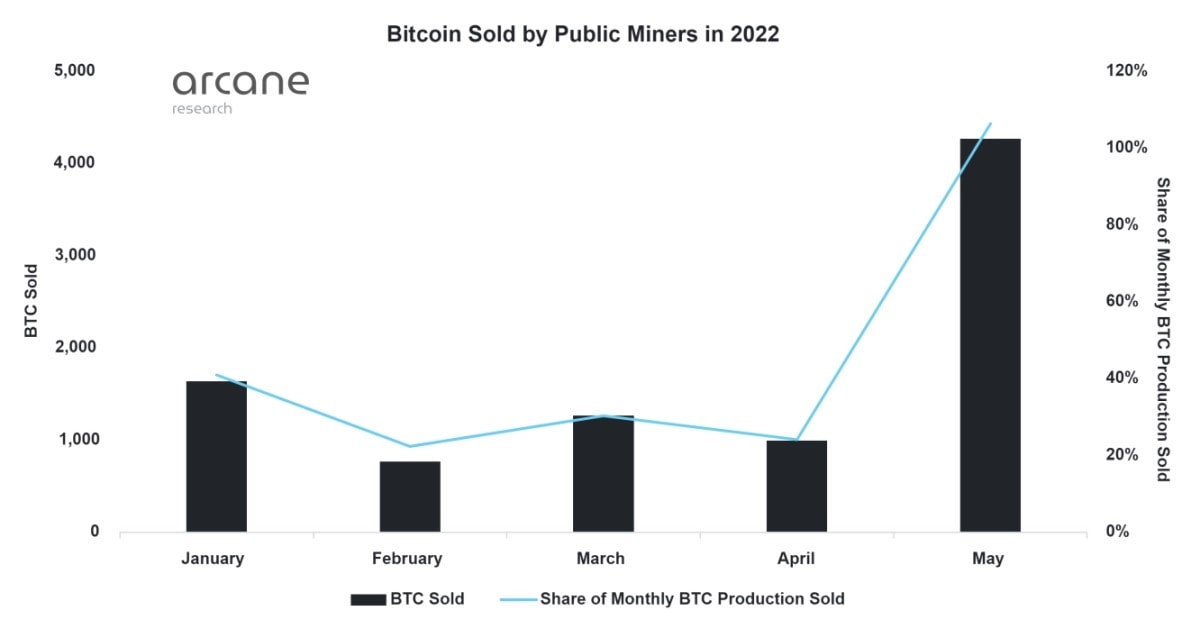

The capitulation of miners in 2018-19 lasted four months. The current cycle has only been going on for one month so far. Miners hold reserves of 70,000 BTC (according to Glassnode's estimates) or $1.3 billion. Public mining companies sold more coins in May than they mined during the month because of a lack of funds to cover operating costs. In the event of protracted consolidation, they will be forced to increase their sales.

Metrics demonstrate that the market is entering the final bearish phase, but at the moment, there are no signs of a quick exit. Miners, like a number of investment crypto projects, are facing a crisis that is forcing them to sell cryptocurrency holdings at low prices. At the same time, the US Federal Reserve will continue to tighten monetary policy, and the global economy may plunge into a recession in the next 12 months.

StormGain Analytical Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.