Bitcoin to fall as ETFs fail to create new demand

Economy Peter Schiff predicts that Bitcoin's price will fall further. He believes that the approval of ETFs isn't creating new demand for the crypto. In his opinion, investors who used to buy crypto on the spot market, shares of mining companies or Coinbase will now shift their investments to ETFs.

Rearranging the deck chairs won't stop the ship from sinking.

Schiff believes that the fate of investors in the spot product will be similar to those who invested in the BITO futures ETF that launched in the autumn of 2021. Now, the fund's shares are trading at a 50% discount, which means Bitcoin is expected to fall to around $25,000.

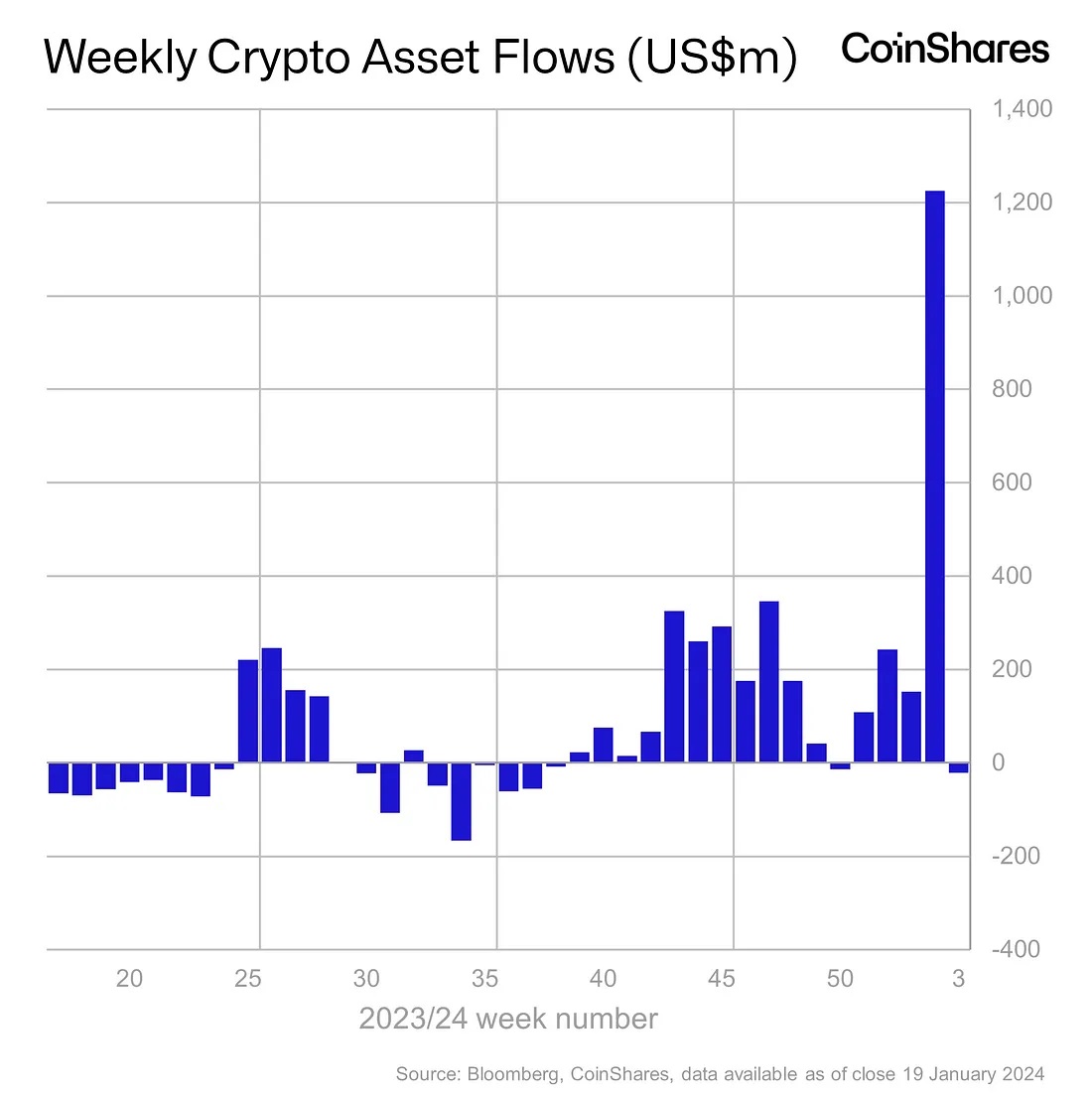

His words are supported by statistics on capital inflows into Bitcoin ETFs. Last week, the inflow shifted to a net outflow of $25 million. In comparison, investments in short ETFs (for which profit is made when the asset's price falls) increased by $13 million.

Without getting too into the weeds, it looks like investors became very disappointed by the crypto. The 20% drawdown also plays a role here for those who invested in the first days of the funds' operation. However, Bitcoin's fall can't be separated from the reasons for it.

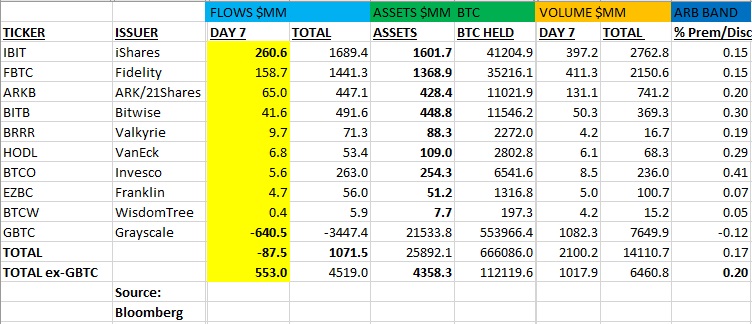

Since the ETF was approved in the US, Grayscale investors, miners, FTX's bankruptcy trustee and short-term holders have triggered a sell-off. Collectively, they've dumped $20 billion worth of coins.

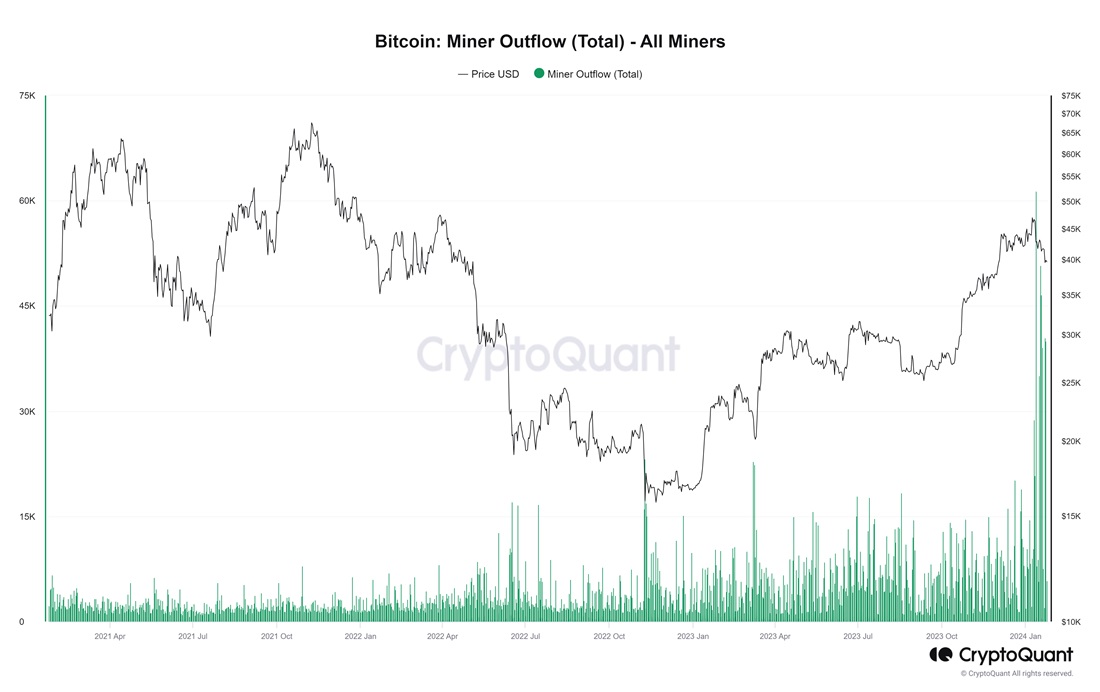

For example, traders made about $3 billion on Grayscale's discount (the securities were trading at a decent discount to the underlying asset in 2023). They aren't interested in Bitcoin as an asset. They just used the opportunity to make money. On the other hand, miners are concerned about the growing complexity and halving in April. Since 10 January, they've sent a six-year record of 355,000 BTC worth $15 billion to crypto exchanges.

In these conditions, $4 billion in demand for spot ETFs looks very modest and can't compensate for the resulting outflow of funds from the crypto sector. That's why the ETF launch caused the asset's price to drop.

At the same time, one should consider that the resulting pressure is primarily due to temporary factors, while long-term trends are still on Bitcoin's side.

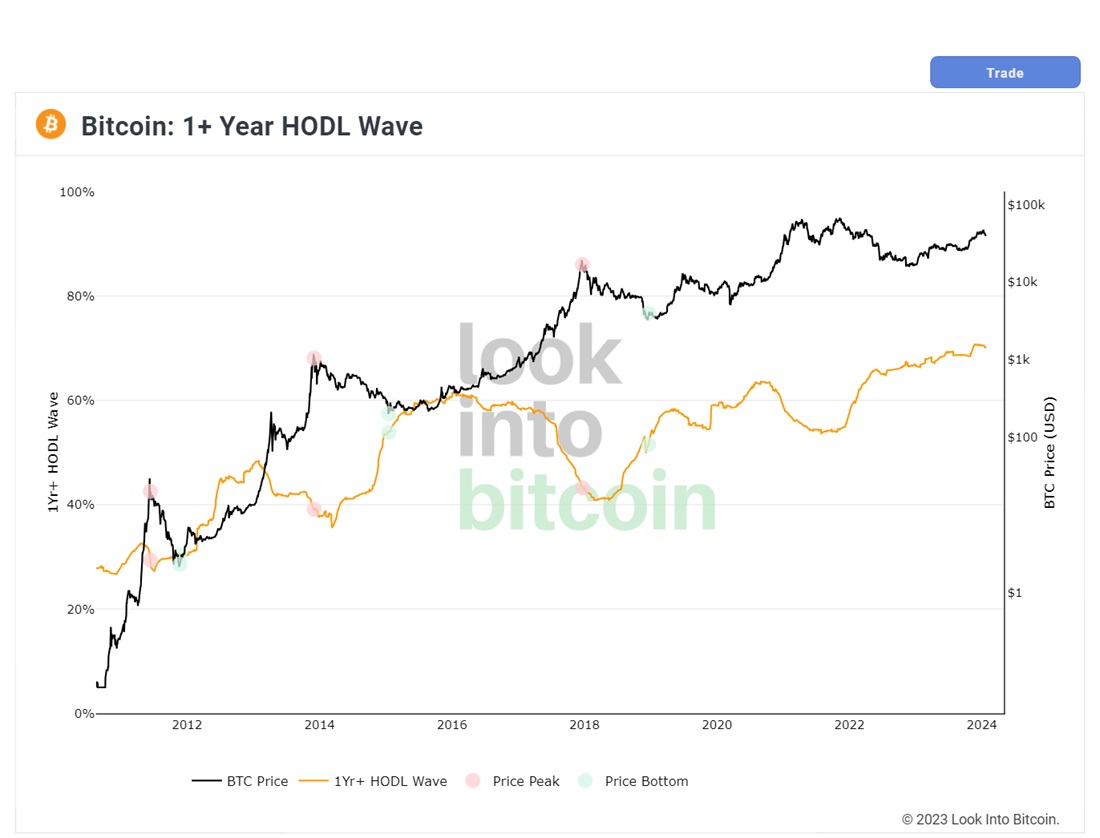

For example, the share of coins that have been idle for over a year has been growing since the autumn of 2021. The figure is at a record-high 70%. More and more people find Bitcoin to be a suitable savings tool. The emergence of ETFs isn't the most important event in this story. That's why it's not so important whether the ETFs provoke additional inflows or simply accumulate investments from related areas.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.