Bitcoin gets an additional boost from the Fed

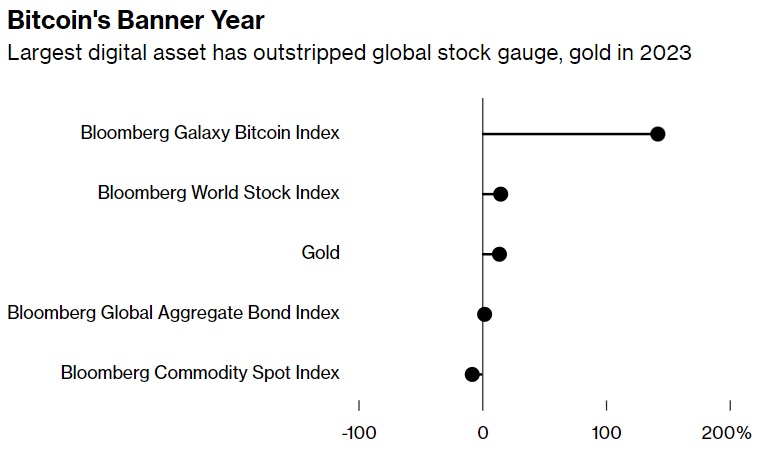

Bitcoin is overtaking traditional financial instruments by a significant margin. BTC's price has seen a 150% increase in less than 12 months, while the Bloomberg World Stock Market Index has risen 15%, and gold gained 14% over the same time.

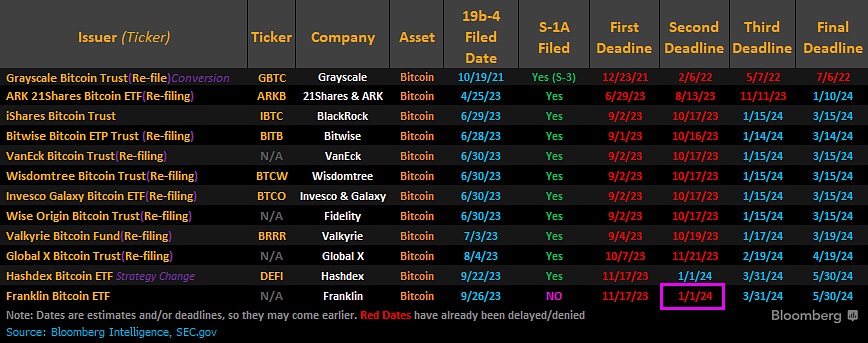

Bitcoin's price is rising due to two anticipated events. First is approval to launch spot Bitcoin ETFs in the US. There are currently 12 applications, and the number continues to grow. The applicants include the world's largest financial services companies, BlackRock and Fidelity, which have over $10 trillion in assets under management.

An ETF will raise capital from institutional investors who can't interact with cryptocurrency directly. This would include pension funds and insurance companies, first and foremost. Institutional investors are likely to allocate part of their funds to cryptocurrencies to diversify their portfolios, and 1% of BlackRock's assets already accounts for 12.5% of Bitcoin's total capitalisation.

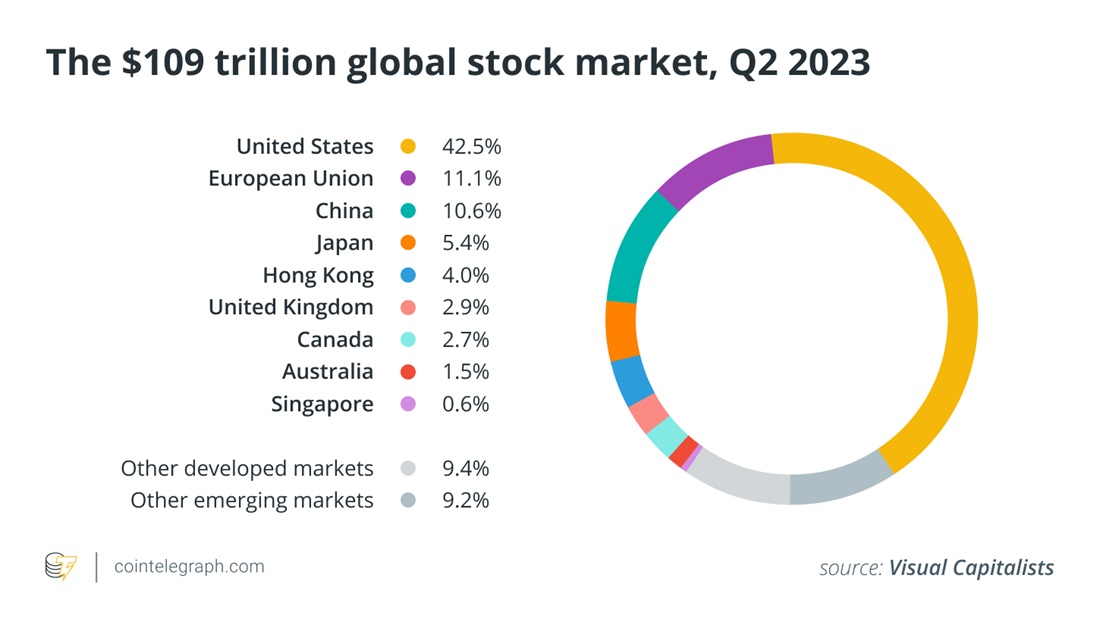

The boost from the emergence of ETFs in the US is hard to exaggerate. For example, the US accounts for 42.5% of the $109 trillion global stock market.

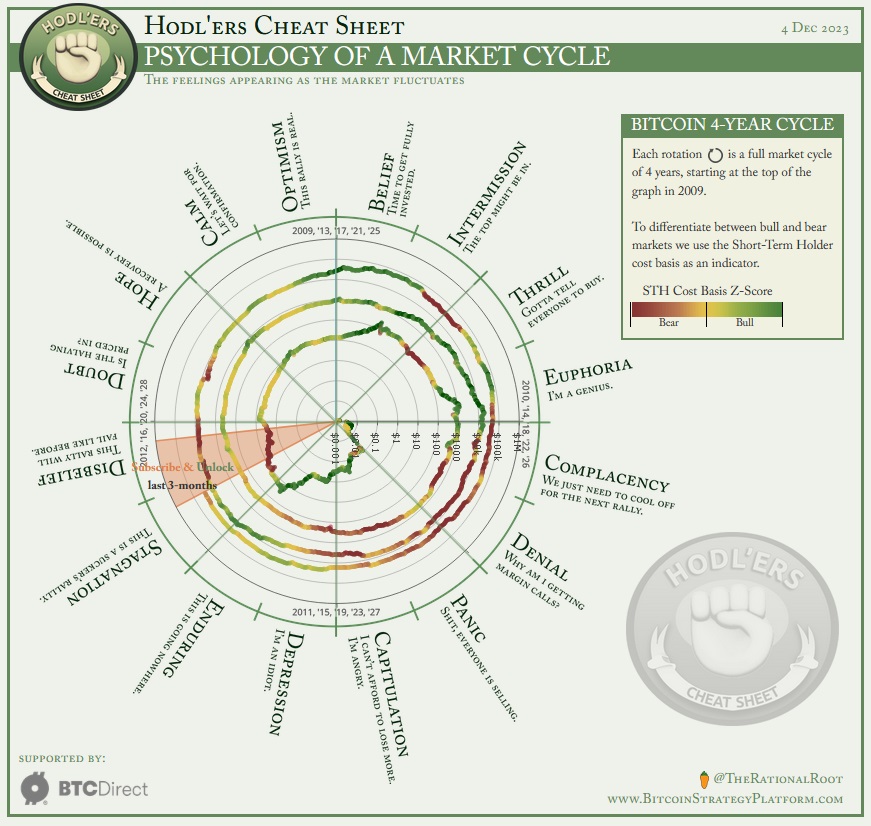

Bitcoin's halving event and the reduction of the supply rate is the second anticipated event. The deflationary mechanism contrasts with excessive money printing by governments to cover rising costs. Each time halving has occurred, it's led to Bitcoin experiencing a rally.

The third factor of growth is the strengthening of the belief that the US Federal Reserve has reached the end of its interest rate hike cycle. The reason was the latest speech by Federal Reserve Chairman Jerome Powell, in which he discussed the success of the regulator's monetary policy and the gradual decline in inflation. Powell's favourite indicator, core inflation, has fallen to 2.5% over the past six months. This is close to the Fed's 2% target rate. Nevertheless, the Fed Chairman gave a clear signal that this isn't a reason for a rate reversal just yet, saying:

It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.

The market reacted to his words in its own way, and a number of media outlets interpreted Powell's speech as a signal that the key interest rate would decline rapidly. Gold and stock indices shot upwards, and Bitcoin gained 10% in this month alone to reach $41,500 per coin.

This assumption among market participants isn't groundless. According to the minutes of the regulator's meetings, the majority of FOMC members expect the first rate cut to happen as early as next year. The Fed's reversal will further increase investors' interest in risky assets.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.