Bitcoin: Hodlers' accumulation hits new high

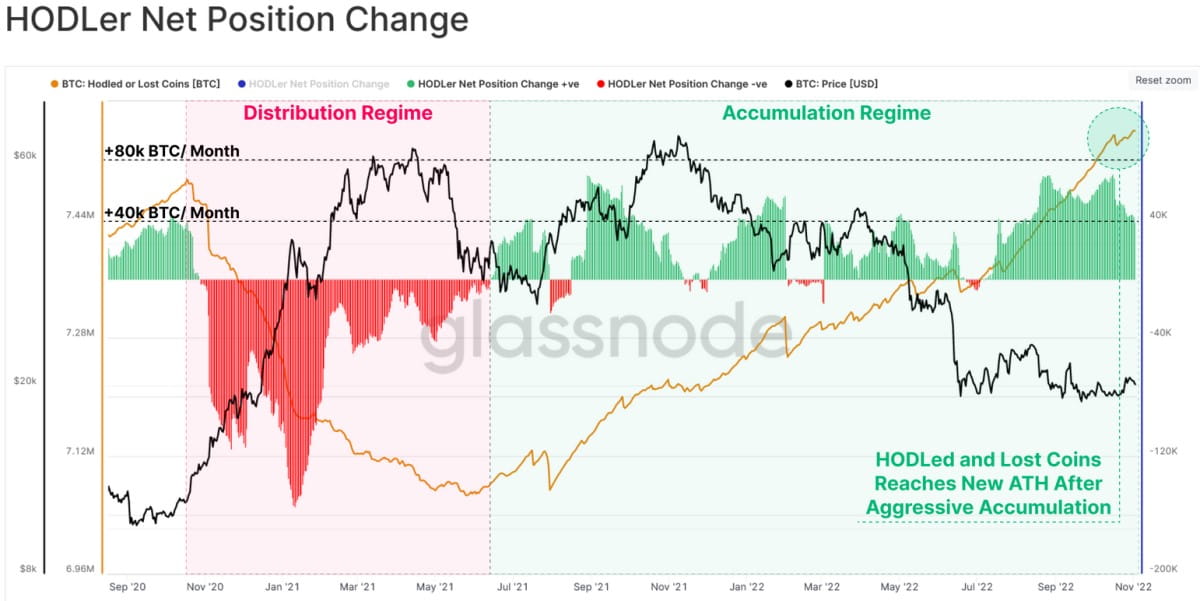

Despite the tough macroeconomic environment, some network parameters suggest Bitcoin's bottom is continuing to form. During the bull run at the end of 2020, hodlers were actively getting rid of coins. Now, however, thanks to efforts to accumulate reserves, the number of inactive coins has reached a new high.

At the same time, the volume of available coins that have been idle for less than six months on the market is at historic lows. This suggests a gradual withdrawal from the market to keep coins in cold wallets in anticipation of better conditions.

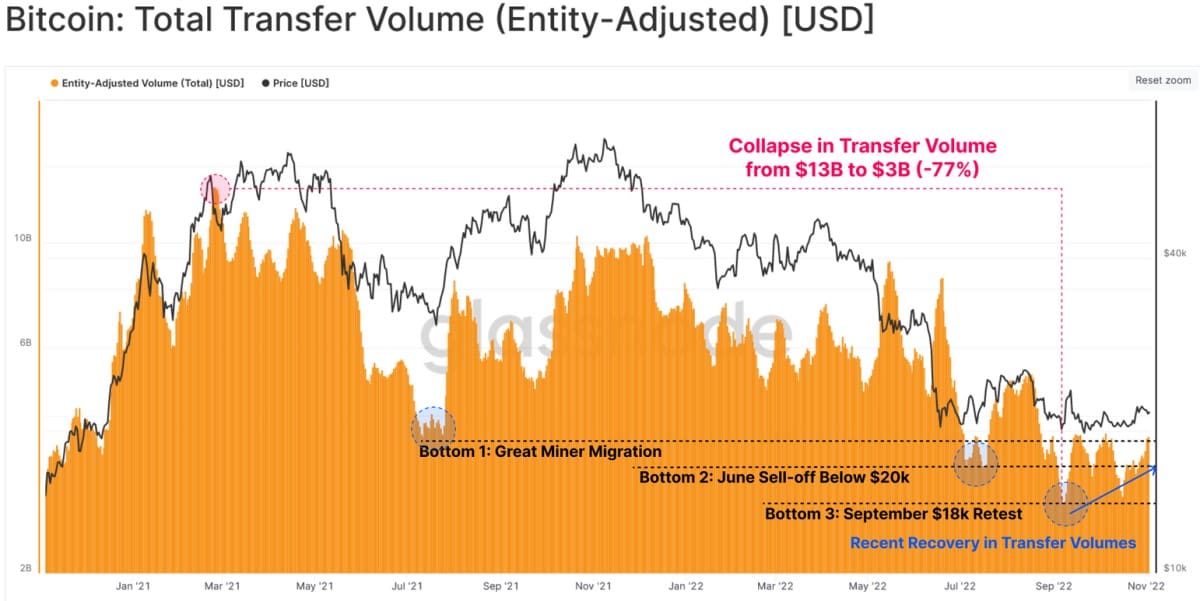

User activity is another important indicator. During periods of bull runs and rapid price declines, transfer volumes denominated in US dollars are near all-time highs. On the contrary, when interest in the market cools, the figure decreases. In March 2021, for example, the peak was $13 billion a day, while in September, a local low of $3 billion was reached. It has seen slight growth since then, and a figure above $4 billion would mark a change in market sentiment.

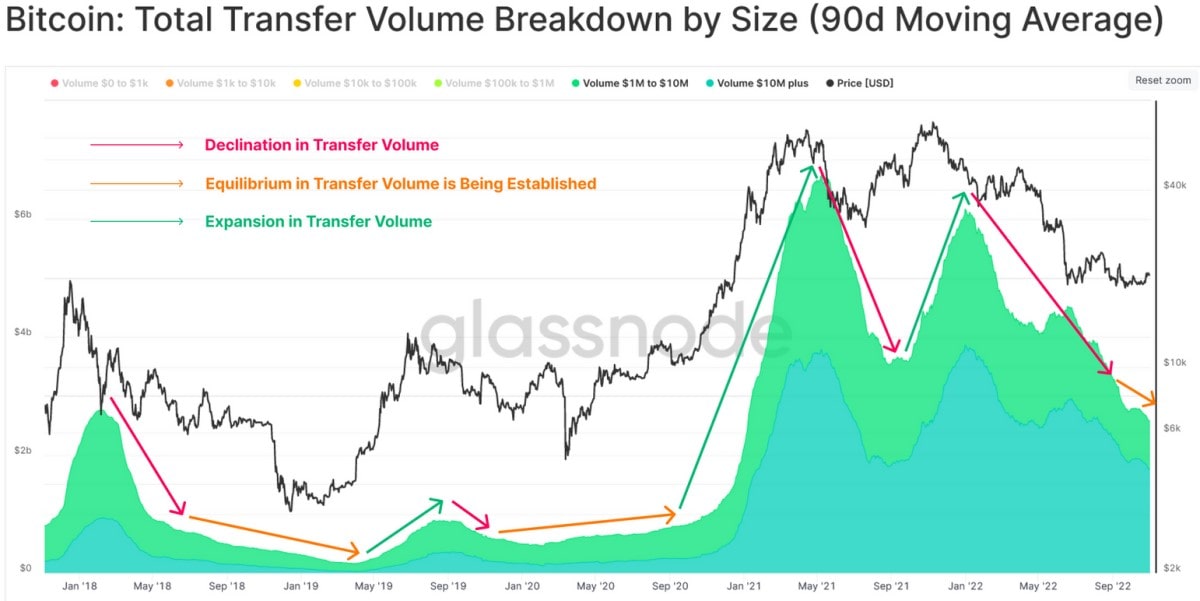

Looking at user activity by transfer volume, the group with transactions up to $10,000 has seen a period of consolidation in recent months. Whereas in the group with transfers of $1 million or more, activity continues to decline. This speaks to major players being cautious and unwilling to search for the bottom until the market actually reverses.

Traders, on the other hand, are overly optimistic, having considered Bitcoin's move above $21,000 a signal of reverse. The funding rate reached a six-month high on 6 November. In other words, traders paid an increased fee to hold a long position in open futures contracts, followed by a correction.

Forming a bottom for Bitcoin is statistically a long and painful process for some participants. On average, this process takes 197 days, whereas the current consolidation has only been going on for less than 150 days.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.