Bitcoin investors suffer their worst losses since 2018

The pressure on the cryptocurrency market persists, coins are increasingly less likely to stay in wallets, and the rate of new users is close to multi-year lows. In the past 10 years, investors suffered their most substantial losses in 2018.

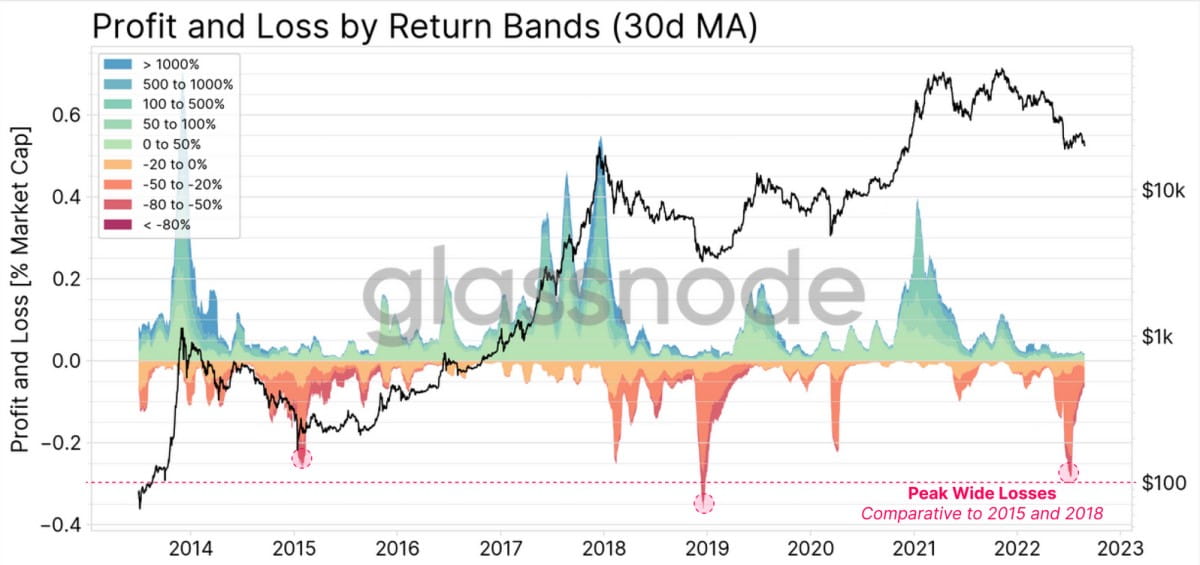

Following speculators and 'tourists', medium-term Bitcoin holders (i.e., with a 5-month or longer coin history), who prefer to sell when the market rises, have been heading for the exits. As a result, cumulative investor losses in recent weeks have reached 0.28% of market capitalisation per day. This figure was only worse in 2018 when it approached 0.35%.

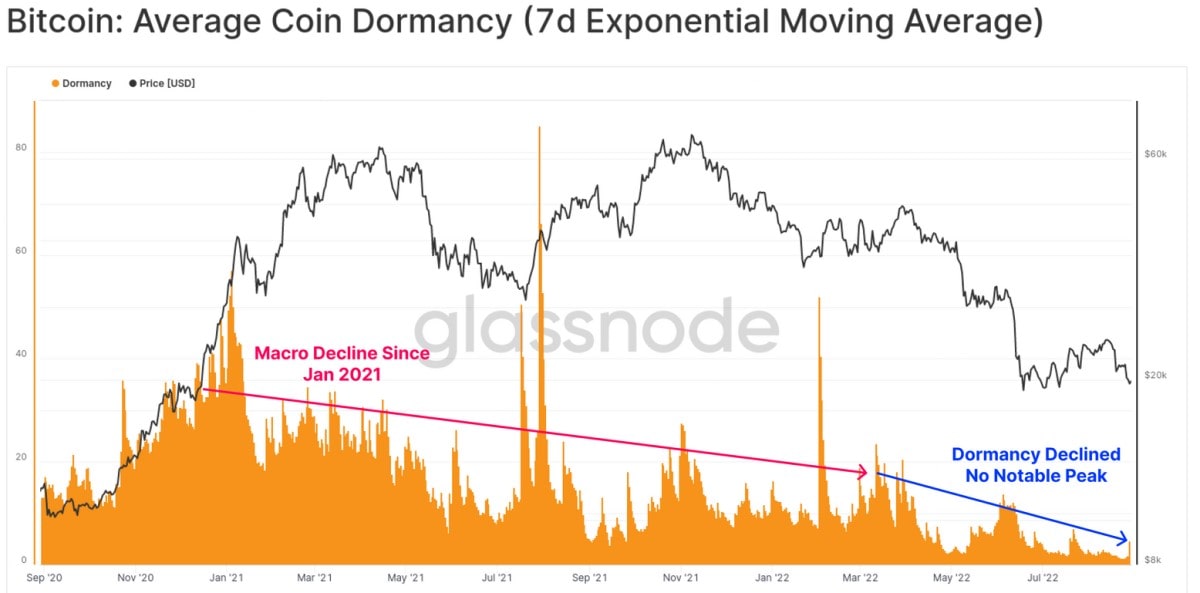

Due to the shaken faith among some of the 'Bitcoin will rapidly recovery' crypto enthusiasts, coins are increasingly changing hands. The situation is typical for a deep bearish market, where investors try to enter at the lowest price but offload coins as soon as the price rises slightly or returns to the level they were bought at.

The increased volume of leveraged trades creates the risk of greater volatility, as demonstrated by the historically high open interest rate ratio. In the open-ended futures market, traders are increasingly opting for leveraged trades. In the event of a sudden price decline, this will lead to a short squeeze (forced closing of positions by the exchanges) and add fuel to the fire. For Bitcoin, the rate is 0.02, and for Ethereum, it's 0.03. Because of the upcoming merger, speculative interest in Ethereum is much higher.

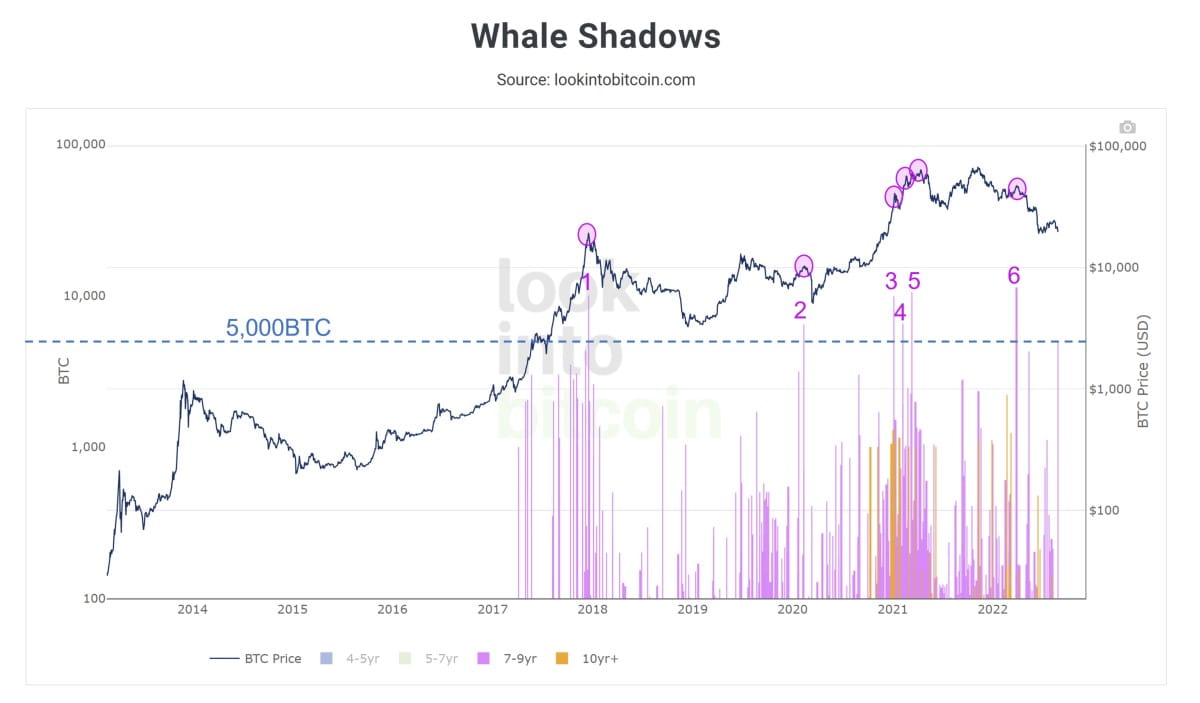

A curious warning of a further price drop came from two transactions, each for 5,000 BTC that remained untouched since 2013. An unknown whale sent coins to a large number of addresses not linked to crypto exchanges. The statistics record only six such episodes, and each time, these large transactions occurred at local highs.

The key drivers of the cryptocurrency market's decline remain the challenging macroeconomic environment, some crypto project bankruptcies and monetary policy tightening by leading central banks. Due to the increasing share of leveraged trades, higher market volatility is expected soon.

StormGain analytics team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.