Bitcoin metrics: the spring is compressing

Generally speaking, a protracted consolidation leads to a sharp breakout in financial markets. Over a four-month period, Bitcoin has been ‘circling’ around $40,000, and that breakout could happen as soon as next week.

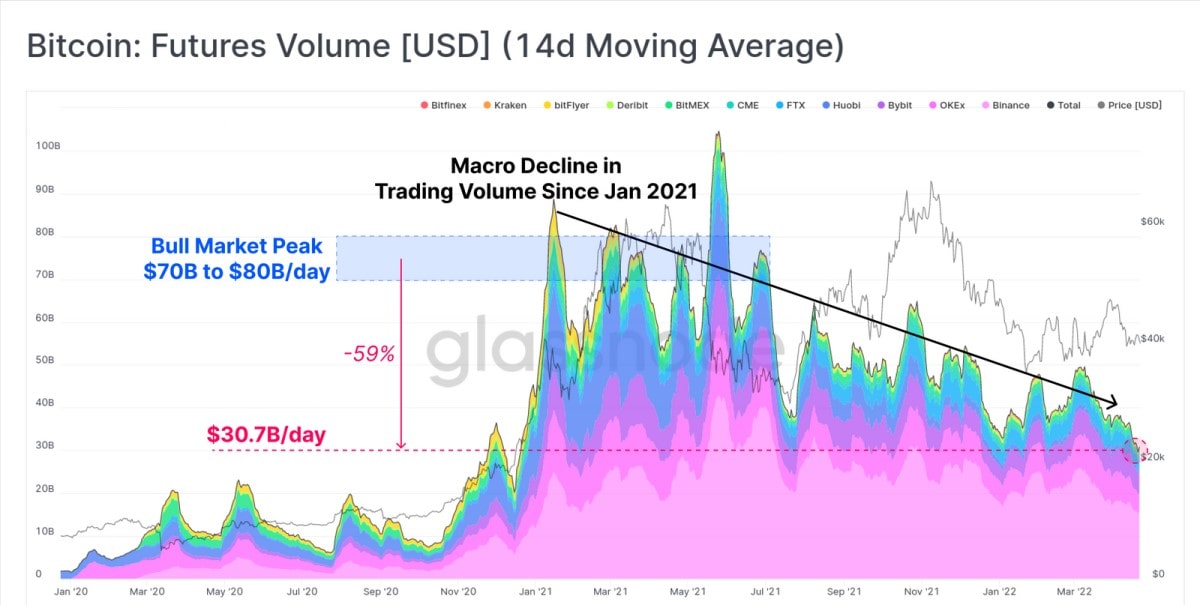

The trading volume for perpetual Bitcoin futures (i.e., without actually delivering the cryptocurrency) last year compared to the volume seen on the spot market due to a large influx of speculators and short-term investors. However, in the past eight months, a significant drop in the trading volume of derivatives has been seen, going from an average of $70-$80 billion per day to the current $31 billion per day.

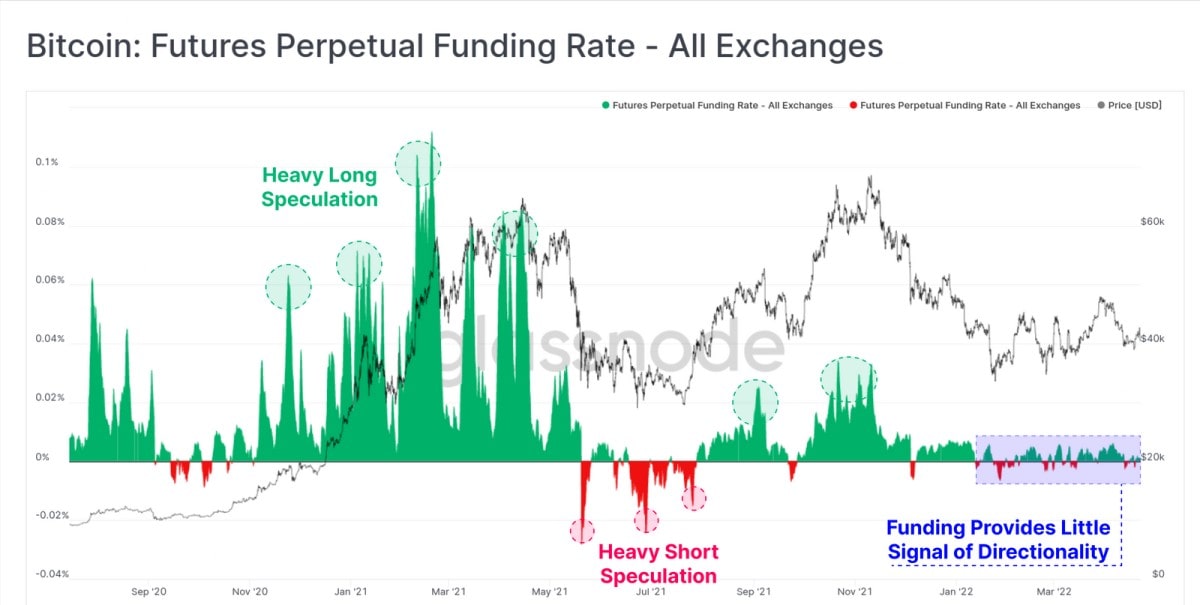

The funding rate is payments to traders for holding a perpetual futures contract. If a majority of investors are buying, then they pay funding to sellers to hold a long position (i.e., buying). Conversely, if bears prevail, the funding rate becomes positive for buyers.

This instrument perfectly illustrates market sentiments. The current funding rate is being significantly compressed, which speaks to the drop in both trader activity and growing market uncertainty.

One argument for a price increase for Bitcoin is the strong sentiments in favour of accumulation on the spot market. According to analytics agency CryptoQuant, total Bitcoin holdings on 21 tracked exchanges are at their lowest levels since September 2018. What’s more, the outflow of BTC from crypto exchanges is close to record highs.

We previously covered why efforts among crypto enthusiasts alone are insufficient to trigger a price increase. Institutional investors continue to roll back investment programmes, and US GDP dropped into negative territory in Q1 2022. Now, the yield on crypto futures is 3%, which is comparable to the yield on 10-year US Treasury bonds and significantly lower than the current inflation rate of 8.5%. Not sure that Bitcoin will rise quickly, investors are moving their money to higher-yield assets.

On 3-4 May, the US Federal Reserve will have a scheduled FOMC meeting at which the country’s key interest rate could be increased by 0.75% in one go (in favourable conditions, the rate is usually increased by 0.25% increments). This will boost the long-term value of the dollar, increase the risk of a recession in the United States and may provoke a sell-off of risky assets such as Bitcoin.

In anticipation of a new correction, various analytics agencies are calculating the strongest support level below which Bitcoin’s price is unlikely to fall. According to Whalemap, this level falls in the range of $25,000-$27,000. With that, whales are already prepared to actively buy up BTC at $34,000, which is also the approximate break-even level for Bitcoin miners.

StormGain analytical group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.