Why Bitcoin is Falling Despite Positive Statistics

Bitcoin's rate of exchange outflow to user addresses exceeded 96,000 BTC per month, and the total balance on cryptocurrency exchanges reached a mid-2018 low of 2.47 million BTC. Both small players and whales are involved in the stockpiling. So, why isn't Hodl sentiment working to drive prices higher?

The reason is that the main investment force for cryptocurrencies since 2020 has been institutional investors, i.e., large companies with investments of at least $1 million. Institutional investors' interest largely influences current prices.

Due to rising inflation, which reached 8.5% in the US in March, the financial community expects more decisive action from the Fed at its May meeting. The regulator will be forced to raise its key interest rate again (likely by 0.5% in one go). For market players, this will lead to higher rates on loans and other borrowings, which shifts interest from high-risk assets to more conservative instruments. Just the other day, Pantera Capital announced the closure of its cryptocurrency investment fund, which had raised $1.3 billion in six months.

The revaluation of assets and the abandonment of risky products reflect the traditional decline in the stock market whenever the Fed shifts from a soft to a tighter monetary policy. Since the beginning of the year, the S&P 500 index has shrunk by 7.8%.

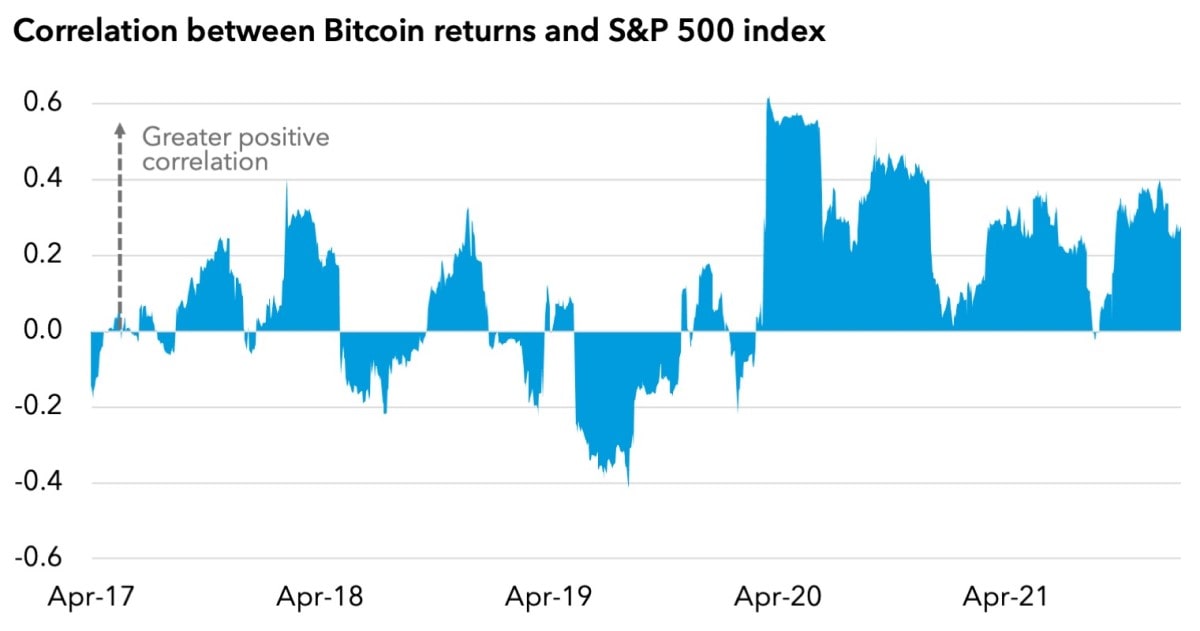

Some might argue that it's impossible to compare the cryptocurrency and stock markets. However, statistics show the emergence of a relationship due to the massive influx of institutional investors into crypto in 2020. As of March 2022, Arcana Research estimated that the correlation coefficient between the dynamics of Bitcoin and the S&P 500 stands at 0.497.

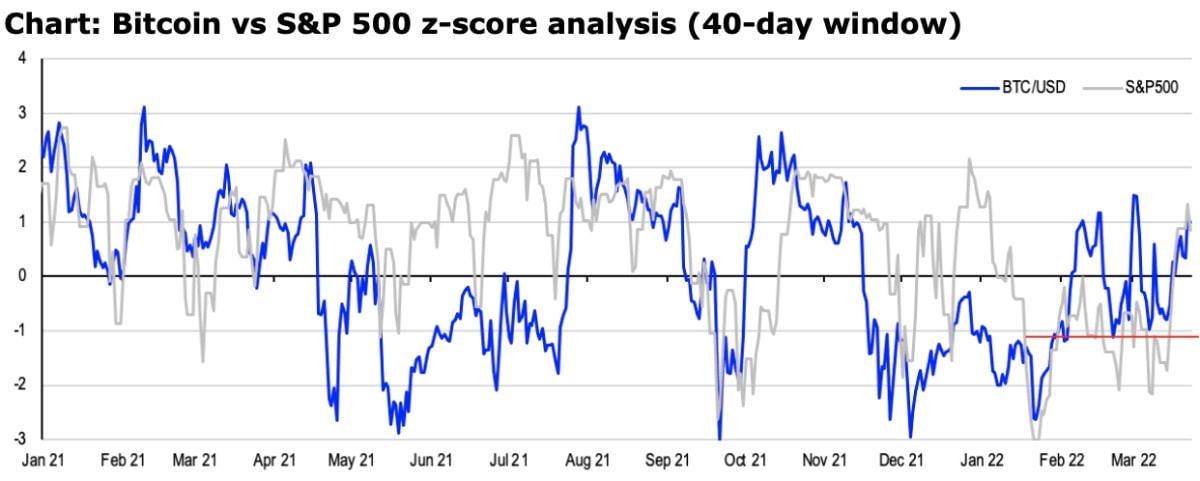

This is more clearly reflected in the Coinbase analysis using the а Z-Score model, when, in order to compare price dynamics, the values are preliminarily "calibrated" against their own spread of indicators (standard deviations relative to average values). This approach demonstrates an altogether more stable position for cryptocurrency. In March, stocks corrected three times by two standard deviations; Bitcoin corrected by only one standard deviation.

As we can see, the expected further tightening of monetary policy is driving down the price of most risky assets, with Bitcoin being no exception. The interesting thing is, how long will it last?

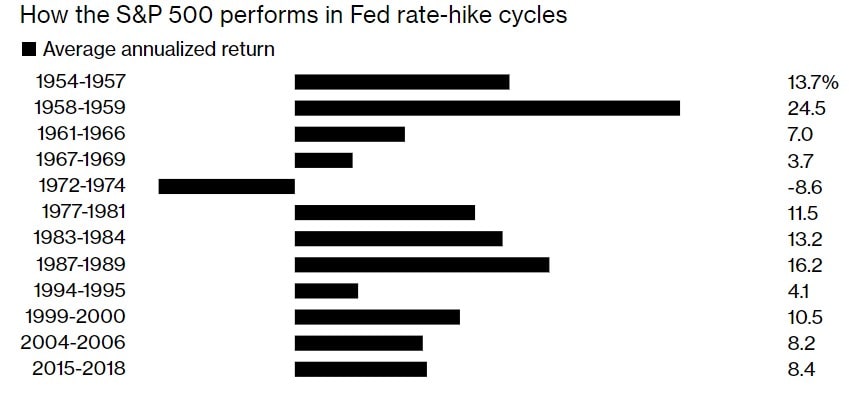

According to statistics, in most cases, markets returned to growth 6-12 months after the Fed began to raise interest rates. The exception to this pattern took place in the early 1970s due to the imposition of the oil embargo.

It's difficult to say whether the current cycle will resemble the recession of the 1970s or whether inflation will experience a "soft landing". In most cases, after a brief pause, interest in risky assets returned with renewed vigour.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.