Bitcoin: hoarding sentiment at its highest

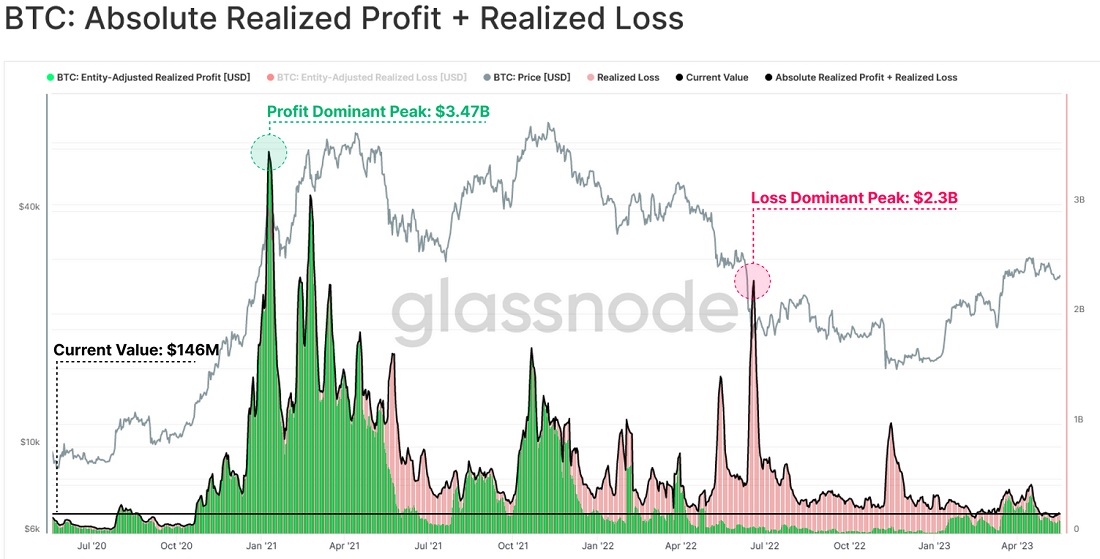

Bitcoin's great take-off in Q1 brought the market back to life, but the following calm led activity to reach three-year lows. Trading volume now stands at $146 million, while the record for realised gains is $3.5 billion and $2.3 billion for recorded losses.

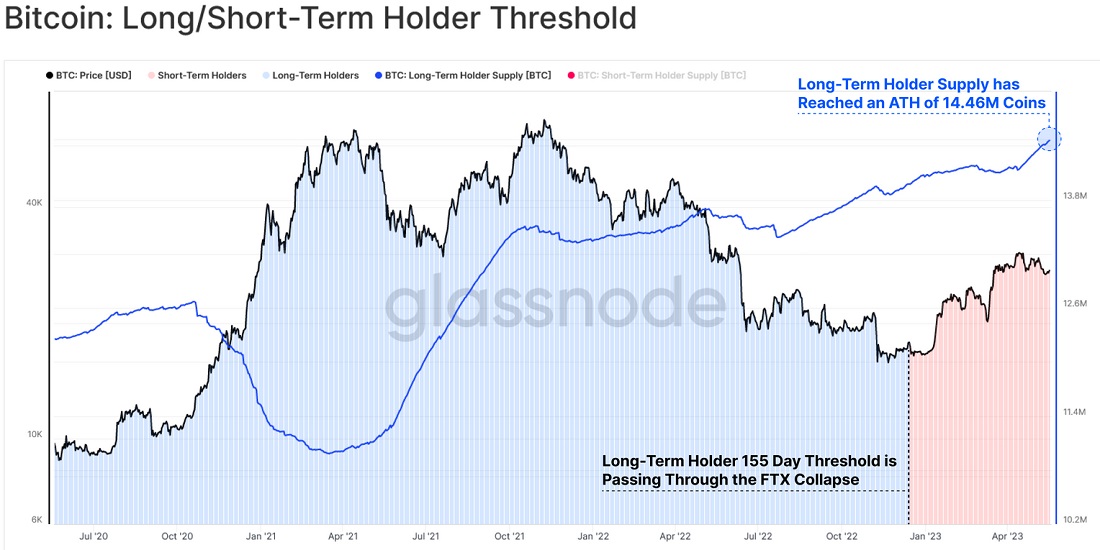

Much of the result is related to investors' unwillingness to spend coins at current prices. Hoarding sentiments are reaching new highs, with long-term holders (LTHs) accumulating 14.5 million BTC. Glassnode considers LTHs to be those with coins that haven't moved for over 155 days. The addresses of cryptocurrency exchanges and other aggregators are excluded from the analysis.

Liveliness is another indicator to measure sentiment. When the majority of coins remain idle, the indicator decreases. But when the expenditure of both new and old coins grows, liveliness does, too (read more about liveliness here). Despite the market's decline in 2022, hoarding sentiment still prevails.

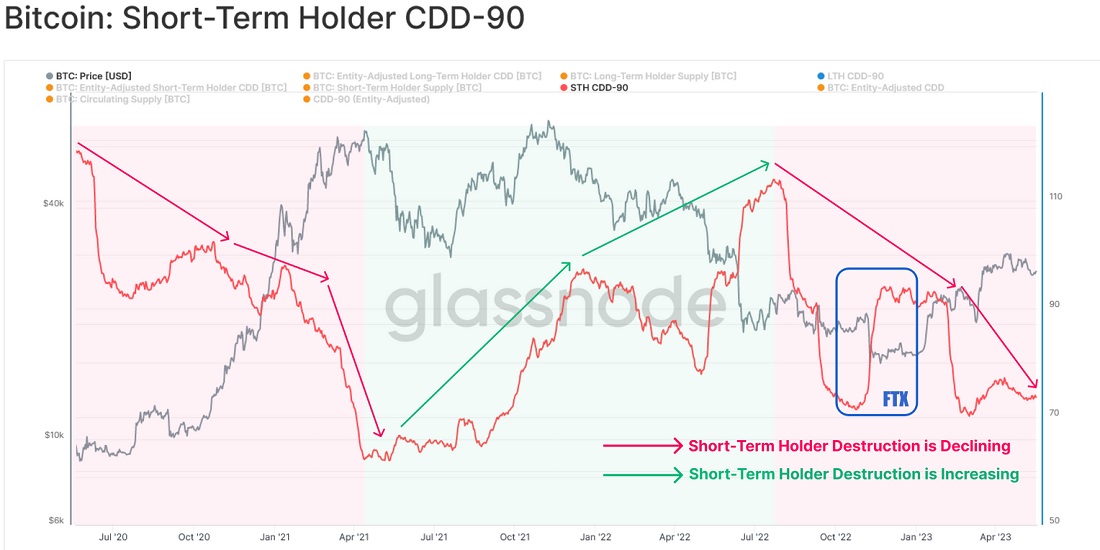

Even short-term holders (STHs) remain indifferent to sales at current prices. The indicator of destroyed coins for the past 90 days remains around local lows. The last significant activity of this group was observed during November's FTX collapse.

Excluding skyrocketing network activity caused by the implementation of ordinals, users froze in anticipation of Bitcoin reaching new highs.

The trigger that gets this group moving again could be news from the US on the extremely last-minute national debt ceiling or a pause in the Fed's hawkish monetary policy.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.