Bitcoin's new records in investment inflows

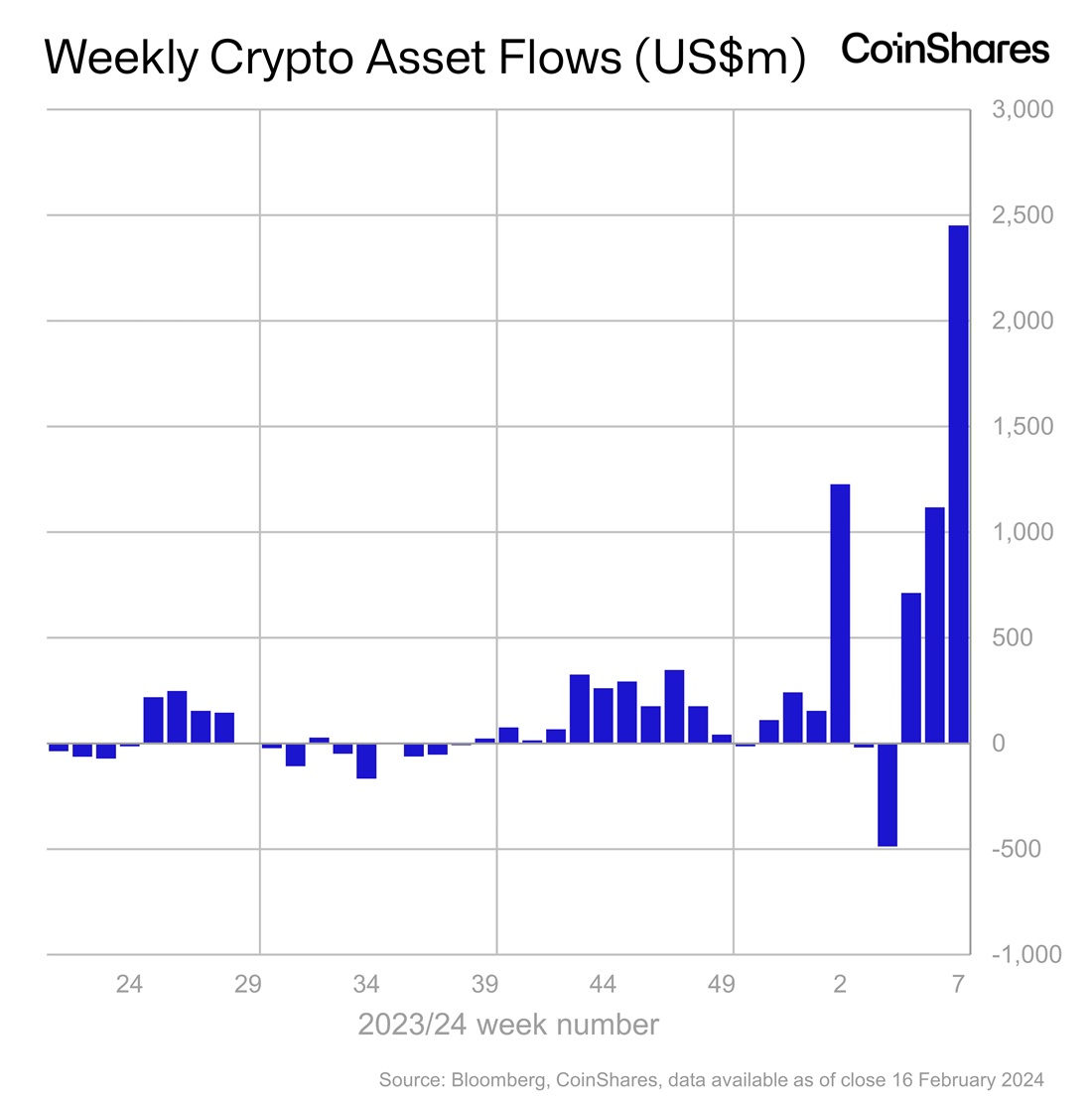

Investment interest in Bitcoin is reaching new heights. The net inflow of investments into ETFs last week was a record-high $2.45 billion and $5.2 billion in total since the beginning of the year.

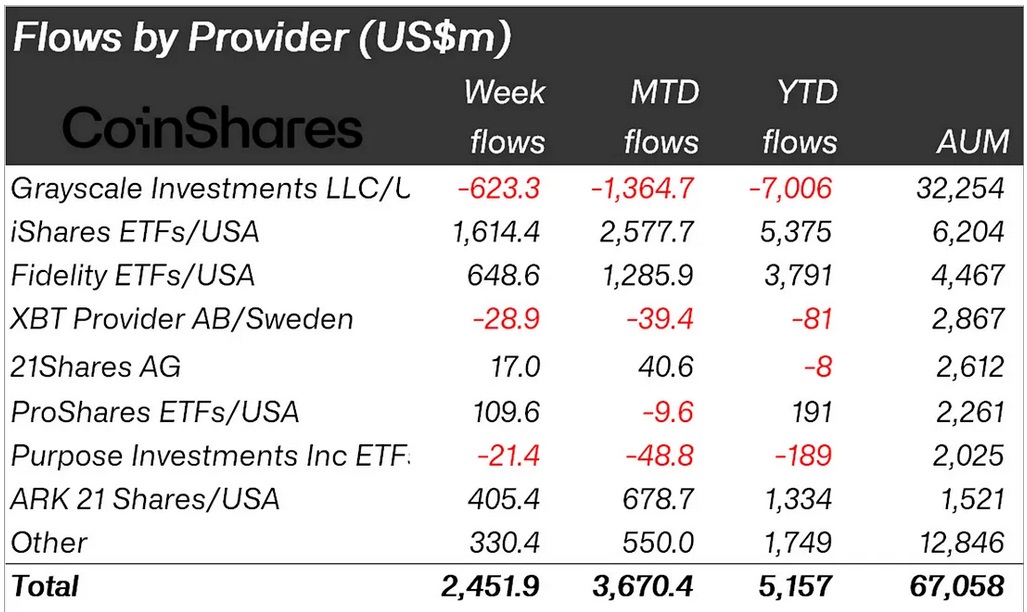

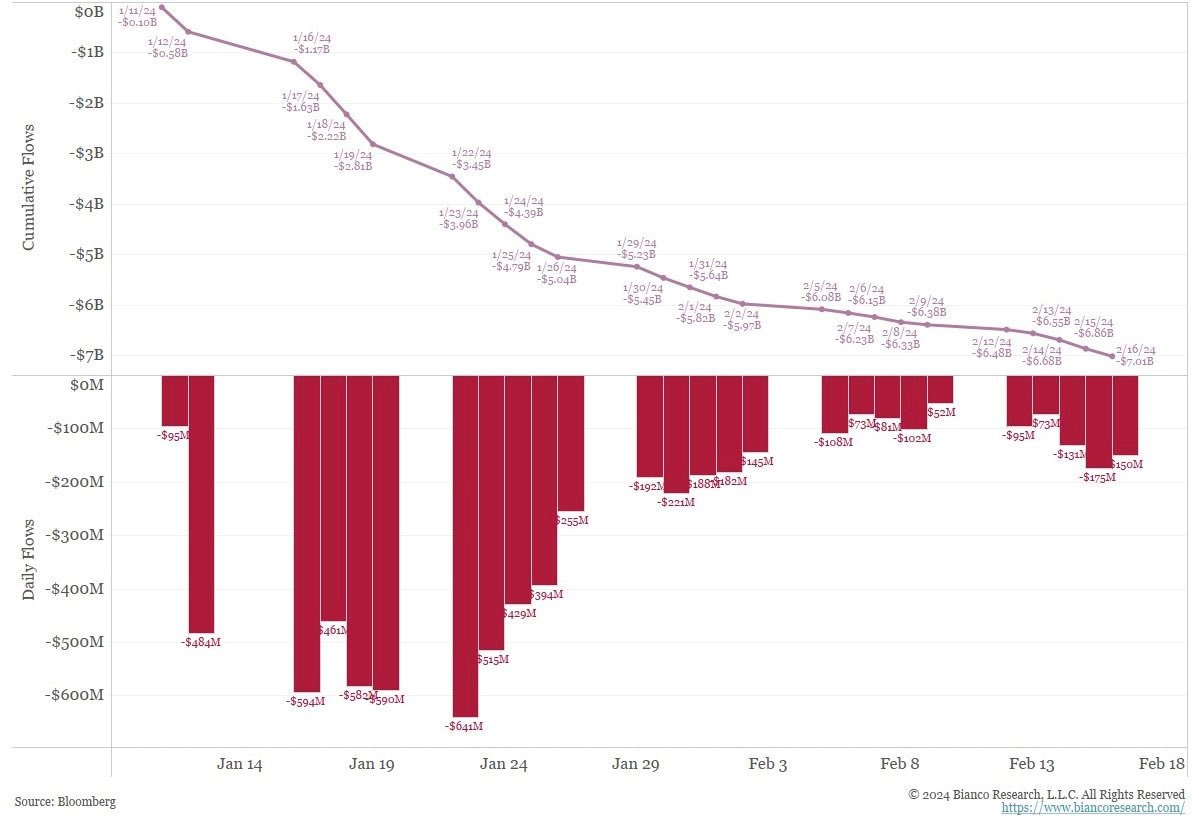

Freshly launched spot ETFs performed well, with BlackRock leading the way with $6.2 billion under management, followed by a product from Fidelity with $4.5 billion. Combined, the two funds beat Grayscale's $7 billion outflow (GBTC).

It's worth remembering that the outflow from GBTC is not related to the investment appeal of the cryptocurrency but is caused by a significant discount on the shares against the underlying asset in 2023 and increased fund management fees if compared to competitors. The reduction in GBTC's 'blood-letting' is a positive factor.

The growth of open interest (the total volume of all open positions) in futures on the Chicago Mercantile Exchange (CME) to $6.8 billion was another record for Bitcoin. Like the growth of inflows into ETFs, this indicates increased interest in the cryptocurrency among institutional investors.

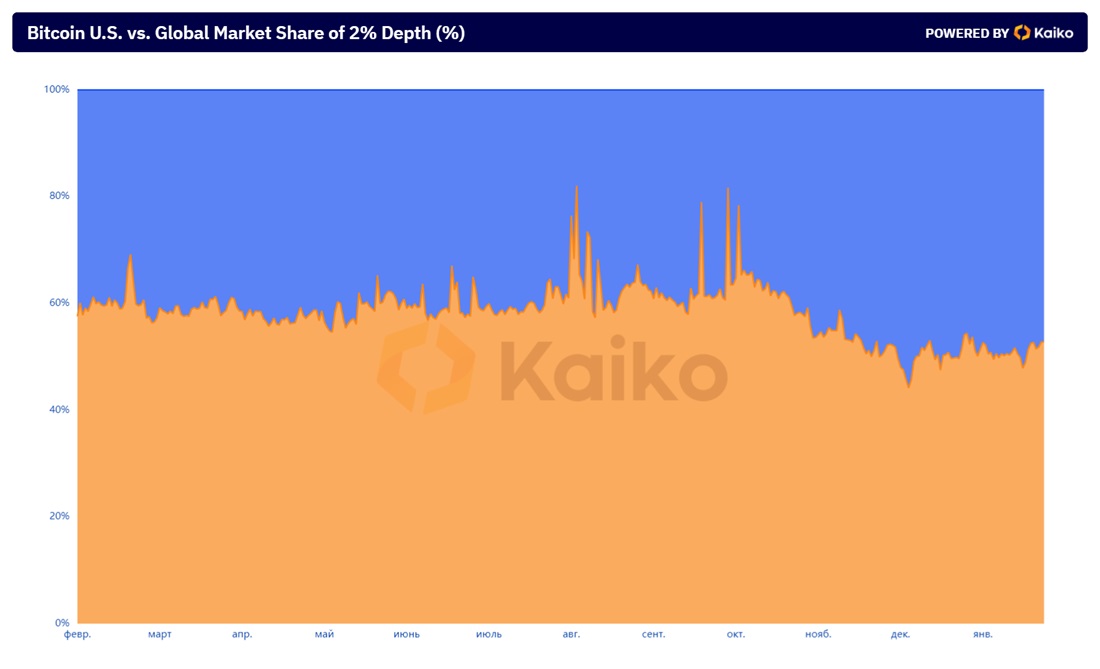

According to CryptoQuant, over 70% of all Bitcoin investments in recent weeks have been generated by US ETFs. As a result, the share of US capital by market depth has increased from an average of 40% in 2023 to 50%. And the indicator increased from $454 million to $539 million in 2024.

For reference, market depth is the total volume of open orders from the current price in both directions (in this case, by 2%). The greater the indicator is, the more resistant the asset is to market manipulations and the more restrained volatility is.

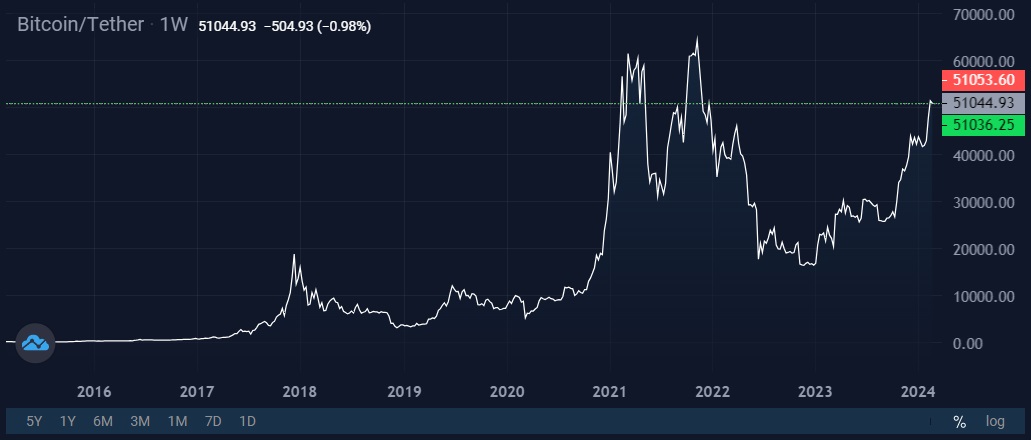

This surge of interest has led to Bitcoin's 22% growth in 2024. In addition, most forecasts predict a new all-time high and reaching the six-figure level as early as this year.

On 19 February, former US intelligence official Edward Snowden called Bitcoin the most significant achievement in the history of money.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.