Bitcoin outflow from Grayscale's fund exceeds $5 billion

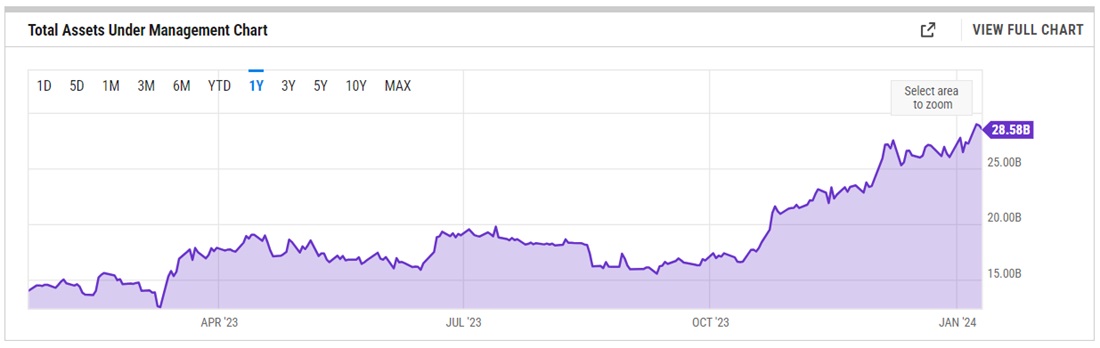

The emergency of spot Bitcoin ETFs in the US is putting downward pressure on the crypto. The conversion of Grayscale's trust fund into a Bitcoin ETF, with over 620,000 BTC worth $28.6 billion as of the transformation date, was one of the key reasons.

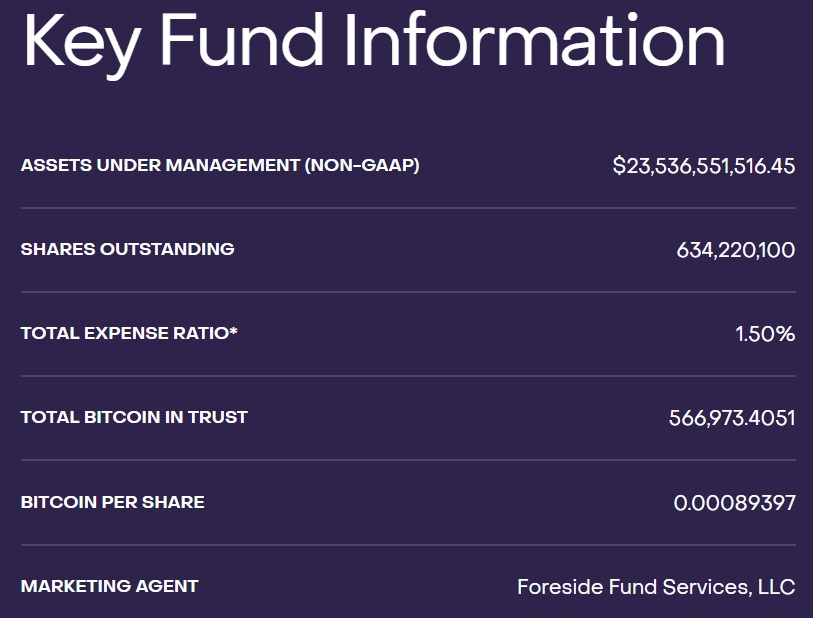

Now, the GBTC fund has $23.5 billion in its piggy bank. The outflow amounted to $5.1 billion or 18% over ten days.

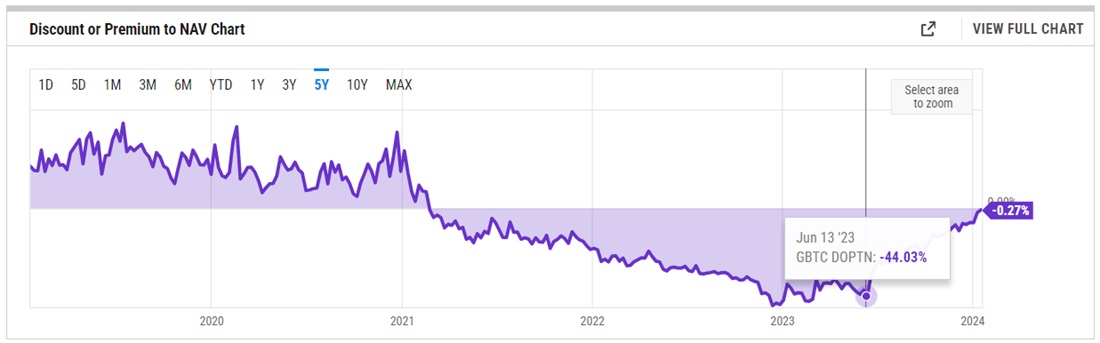

Last June, the discount on the fund's shares relative to the underlying asset was over 40%, but after Grayscale won its appeal against the SEC, it rallied sharply. Savvy players started buying up the fund's shares, investing about $3 billion.

This amount can be considered non-refundable, meaning it isn't driven by interest in Bitcoin directly but only by a desire to profit from the reduction in the discount due to the upcoming conversion.

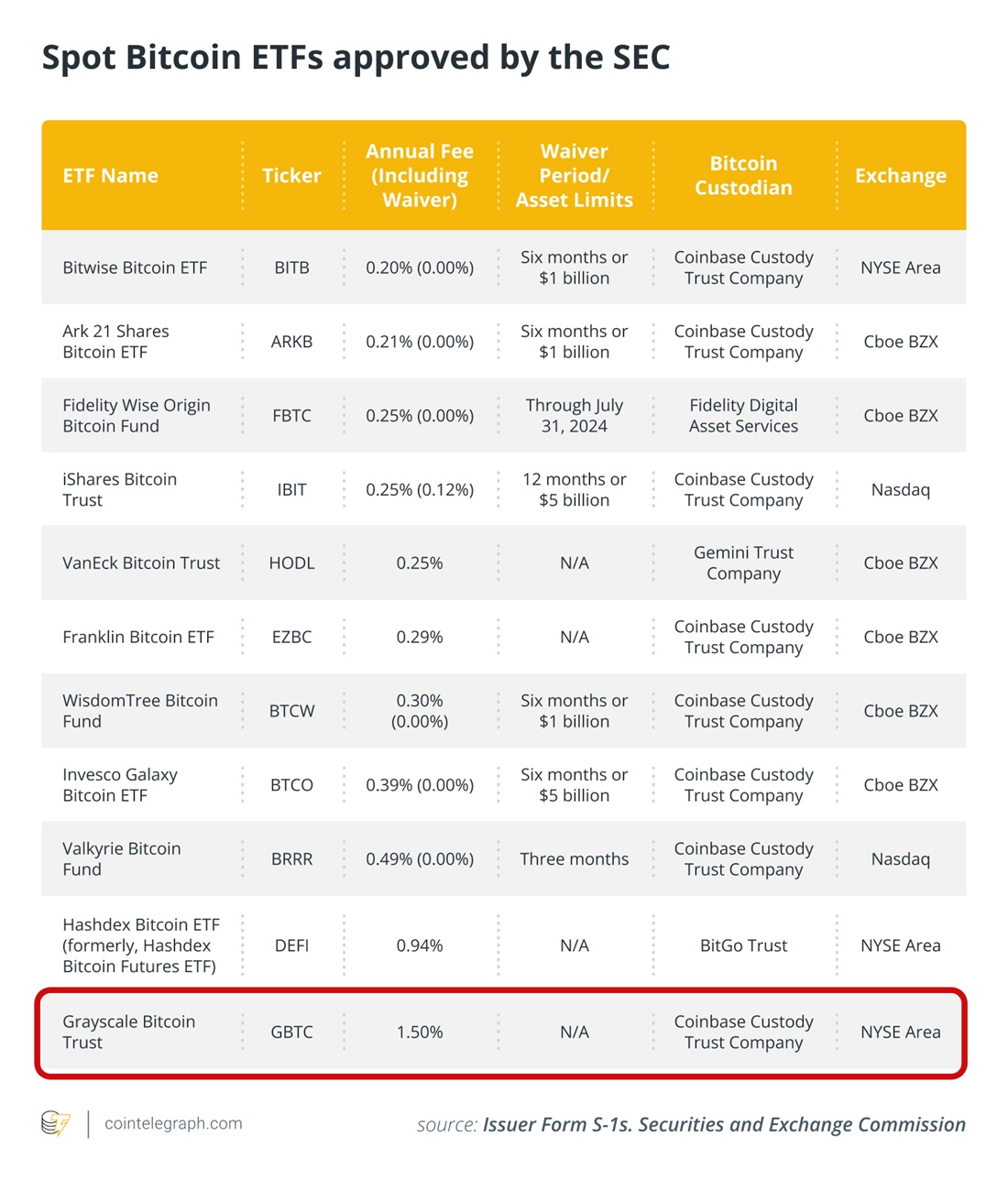

The rest of the outflow volume is due to the GBTC's high fees for fund management. The fees are way higher than competitors', coming in at 1.5% versus 0.2%-0.5% (excluding the free period). Note: Hashdex doesn't count because they were approved for a futures ETF, not a spot ETF.

Grayscale CEO Michael Sonnenschein, defending the high fees, has said there is a risk of bankruptcy for most spot ETFs over the long run. He was supported by Quantum Economics founder Mati Greenspan: "Having a dozen ETFs for one asset is pretty ridiculous."

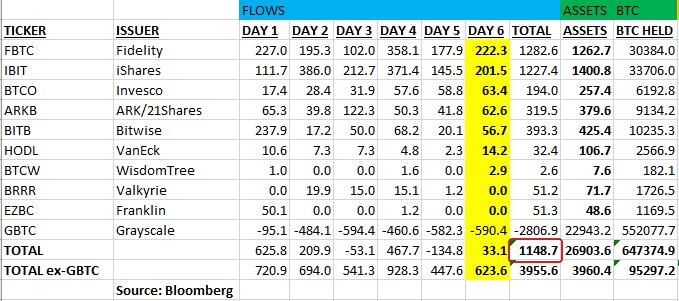

Based on the last six days, inflows into exchange-traded funds still exceed outflows from Grayscale by $1.1 billion.

However, this data doesn't consider outflows from futures ETFs of more than $3 billion since the launch of spot ones. Futures funds are more burdensome for investors due to losses when switching from contract to contract.

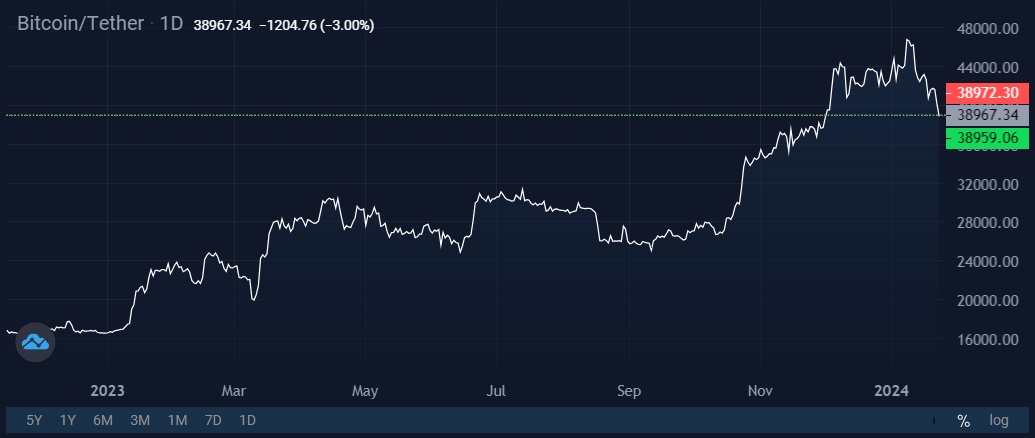

The dynamics of exchange-traded products are turning negative, which hurts Bitcoin. Miners also contributed, sending $5 billion worth of Bitcoin to crypto exchanges in the first three days after the launch of ETFs (read more here).

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.