Bitcoin is in a recovery phase, but there is a nuance

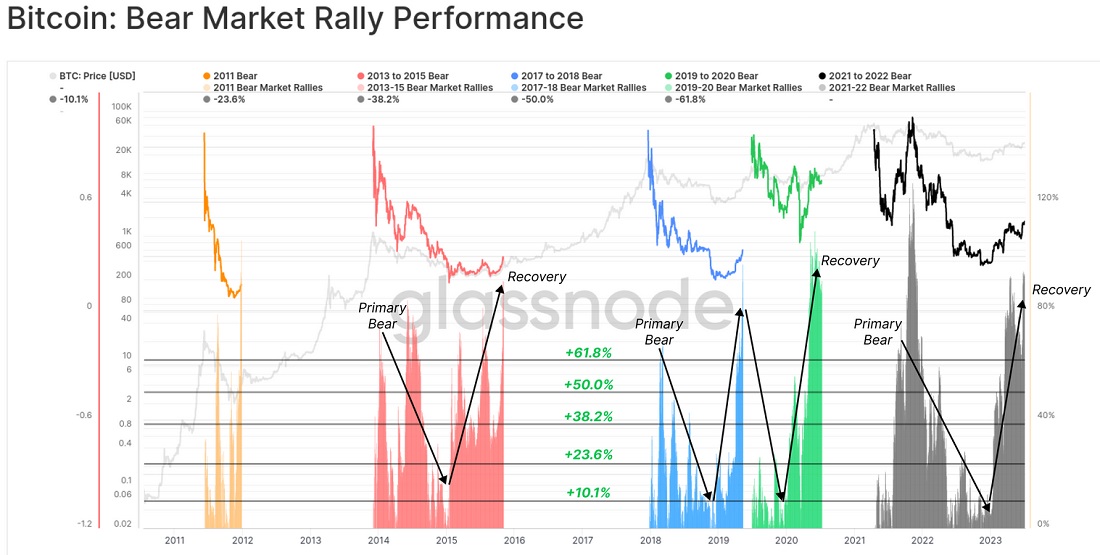

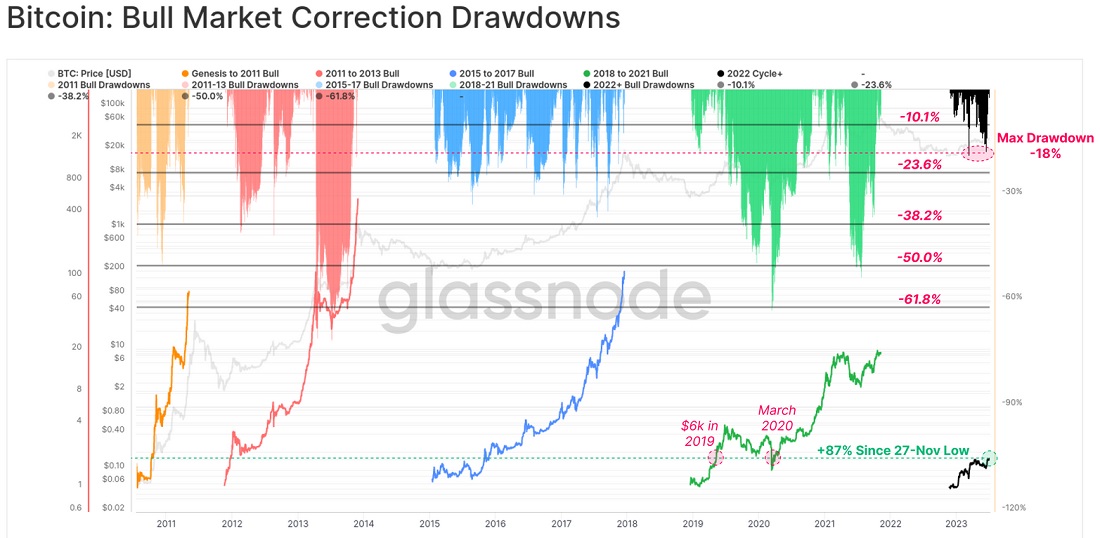

Network metrics show significant similarities between the emerging bull cycle and previous periods. For example, Bitcoin's 90% recovery from its November lows is identical to the recoveries it saw in previous cycles.

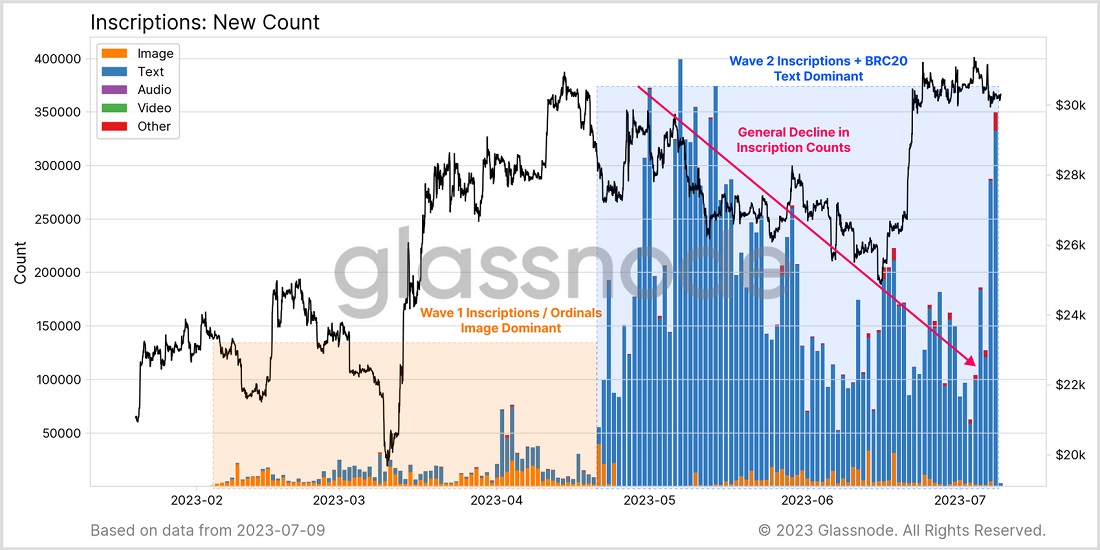

Behind this spring's surge in network activity is Ordinals, a protocol that allows the exchange of digital artefacts (an analogue of NFTs). In March and April, images were predominantly being minted, while in May, BRC-20-based tokens came into play (the transfer occurs in the form of adding a JSON text part to the transaction). A total of 1 million images and 15 million tokens were sent across the network.

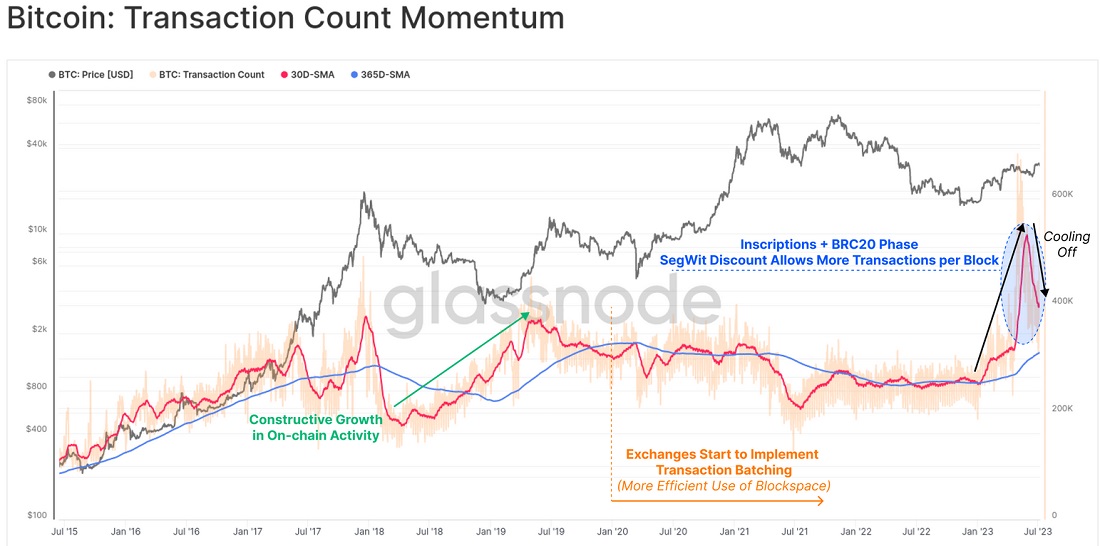

Barring the last two days, the excitement for Ordinals is slowly waning. This is also evidenced by the decrease in the number of transactions executed.

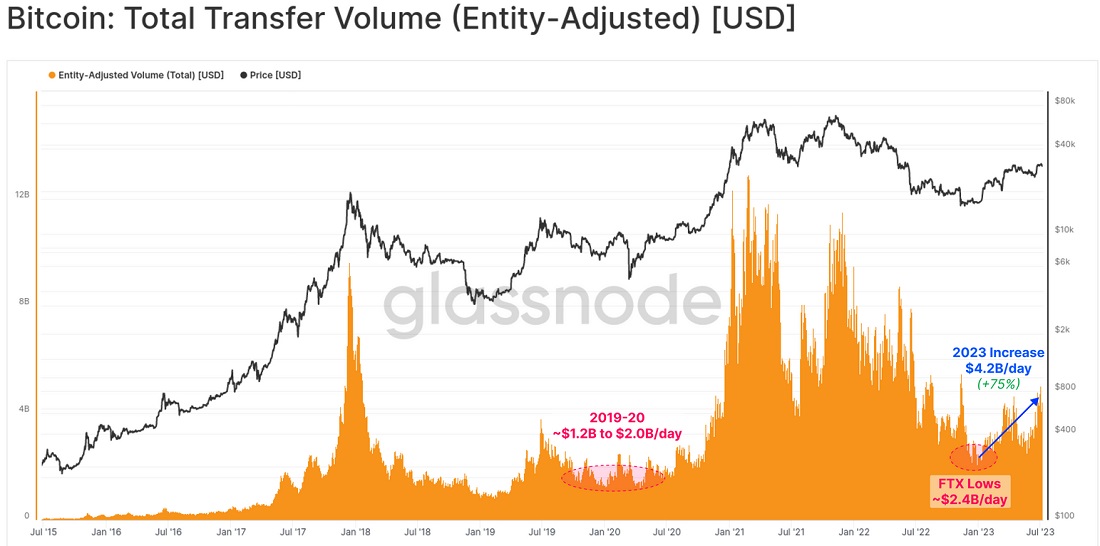

As a rule, Ordinals are sent in the minimum possible amounts (no more than 10,000 satoshis). To reduce their impact on the statistics, it's worth looking at the volume of remittances conducted on the network. Since the collapse of FTX, remittances have risen 75% to 4.2 billion a day. This is a good indicator of the return of widespread demand for BTC.

Network metrics tell us that the current recovery is similar to the start of previous bull cycles, as well as the growing demand for value transfers across the network. Commitment to accumulation (13.4 million BTC haven't moved for over a year now) and the third consecutive week of investment inflows into crypto funds from institutional investors are also positive factors worth considering.

The nuance, however, lies in the fact that as Bitcoin's price rises, it's seeing large corrections exceeding 23% of the local maximum.

However, in the latest cycle, the maximum drawdown only reached 18%. From a statistical standpoint, the current consolidation is more likely to translate into a drop to the $20,000–$25,000 range rather than rising to the $40,000 mark.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.