Bitcoin risks a strong decline amid the DeFi crisis

The high interdependence of projects and cross-lending is once again hurting the entire cryptocurrency market. This time, a vulnerability in early versions of the Vyper programming language led to the theft of funds from several exchange pools on the Curve Finance platform. To make matters worse, its potential collapse could drag other DeFi players down with it.

Vyper is a programming language designed for the Ethereum Virtual Machine (EVM). It's used to write the smart contracts on which decentralised exchanges (DEX) operate. DEXs allow for exchanges between cryptocurrencies and passive income from lending.

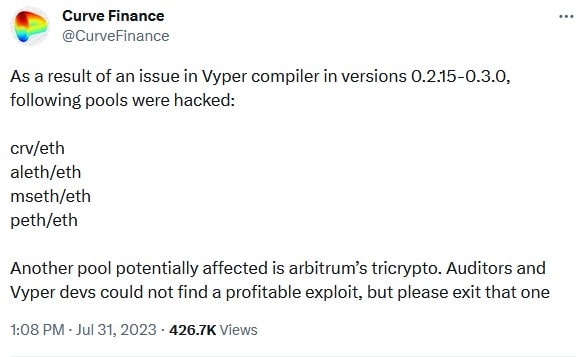

On 30 July, Curve Finance faced the breach of liquidity pools in CRV/ETH, alETH/ETH, msETH/ETH and pETH/ETH pairs, which used earlier instances of Vyper, versions 0.2.15 to 0.3.0. Another over 200 pools weren't affected.

While losses are still being counted, leaks on the following pools have been identified:

- CRV/ETH - Curve - $22 million

- alETH/ETH - Alchemix - $13.6 million

- pETH/ETH - PEGd - $11.4 million

- msETH/ETH - Metronome - $1.6 million

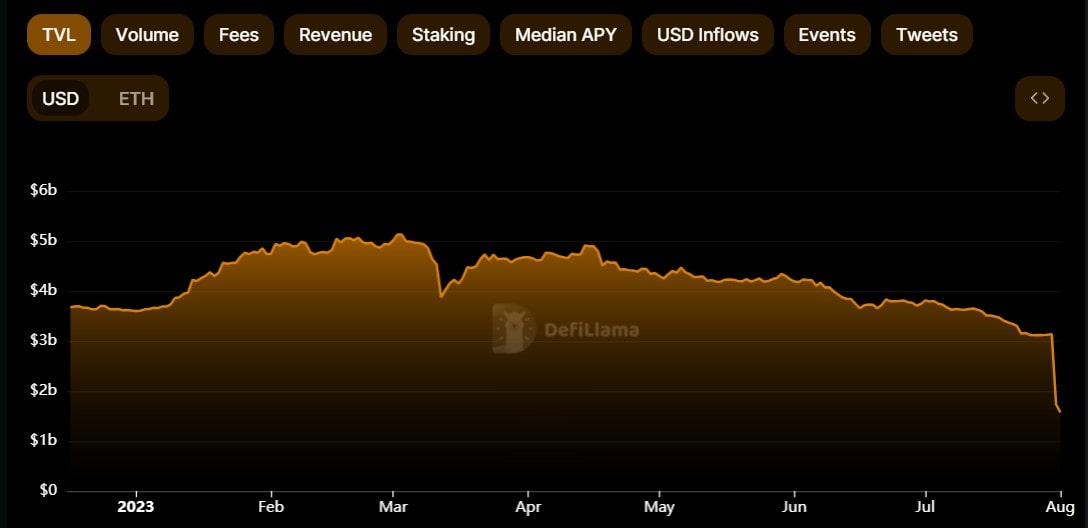

The hack led to panic among participants, with a 50% outflow from the platform and its total value locked in (TVL) dropping to $1.6 billion.

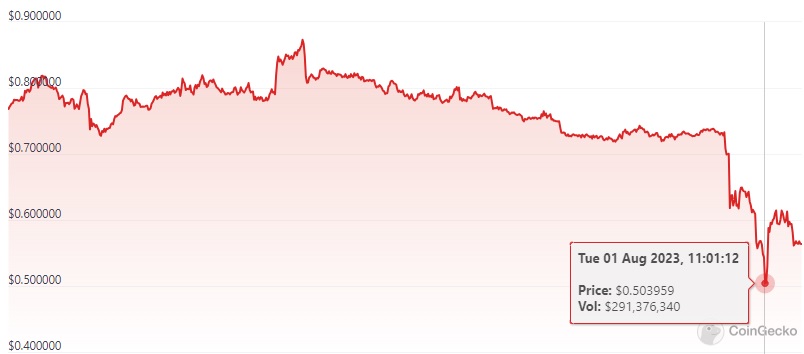

The fact that the crisis has the potential to spill over to other platforms is making matters even worse. Curve CEO Michael Egorov borrowed $63 million worth of stablecoins on the Aave platform secured by CRV (Curve). Over the past two days, the CRV has fallen 30% to $0.51. When the price reaches $0.37, Egorov's position will be forced closed, and Aave will flood the market with 168 million CRV coins.

The problem for Aave is that they won't be able to sell all coins, which represent 34% of their total circulating supply, at current prices at the time of liquidation. Selling off even a portion of the position would inevitably lead to a further fall in CRV and more panic in the DeFi sector.

Behind the scenes, platform executives are trying to find a solution, while Egorov is selling off stockpiles of other coins to increase its collateral. The community is puzzled as to why Aave accepted such a substantial amount for a loan and failed to consider the obvious systemic risk.

Amid the news, Bitcoin has lost some 1.5%, but the decline could get worse, given the Aave and Curve crisis will get out of hand. The DeFi sector is reacting by declining 8.2% to $40.2 billion.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.