Investments in crypto startups have broken through the bottom

The expectation of a broad recovery in the cryptocurrency market may be premature if only because startups are raising increasingly fewer funds each quarter. In a recent study, Galaxy Research warns that the pain caused by the collapse of companies in 2022 and tighter borrowing conditions are continuing to negatively impact venture capital investing.

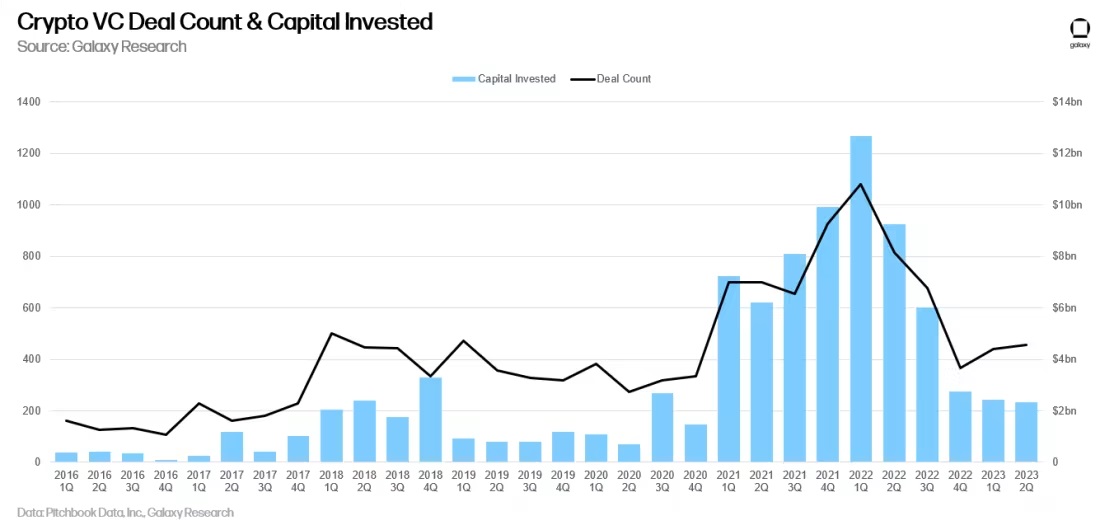

In Q2 2023, investments in crypto startups totalled just $2.3 billion, the lowest amount since Q4 2020. In comparison, the peak came in Q1 2022, when investment reached $13 billion.

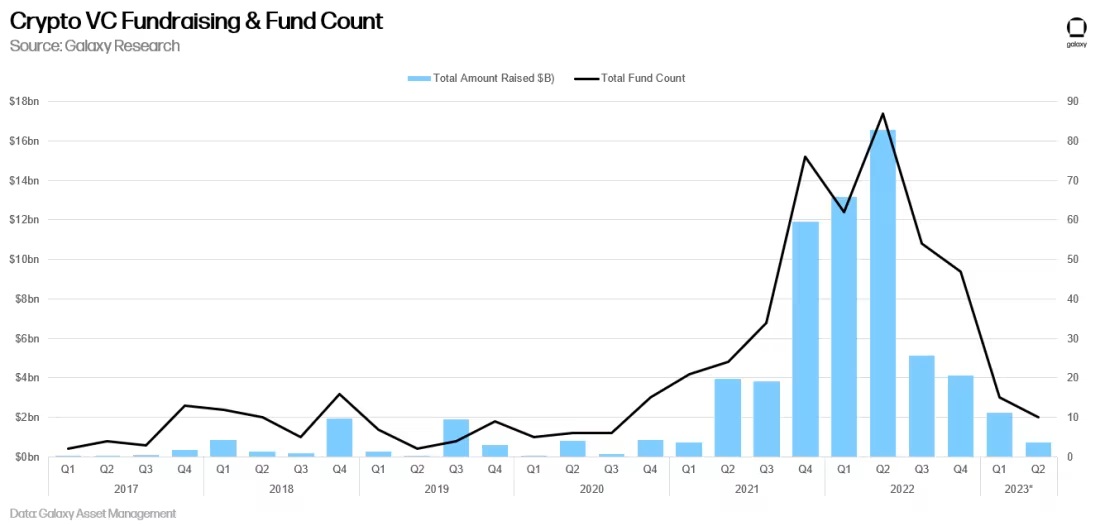

The last quarter also saw the fewest number of venture capital funds launched. There were just 10 compared to 87 a year ago. Altogether, they raised just $720 million, the poorest showing since Q3 2020.

The dismal performance was reinforced by the unscrupulous behaviour of a number of projects towards investors, which was exposed in the series of collapses that occurred in 2022. However, much of the decline in investments is due to the Fed's monetary policy.

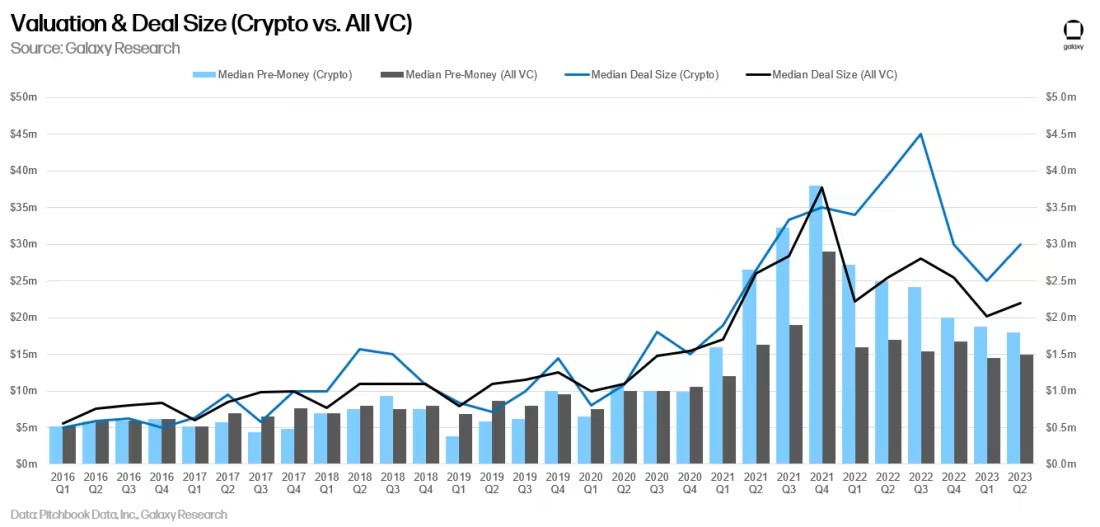

The high key interest rate has led to a decrease in investments in high-risk sectors of the economy. This is clearly demonstrated by the bar chart showing a breakdown of venture capital investments in the crypto industry and other areas. This decline is taking place no matter what the startups' specialisation is.

The Fed's interest rate has such a significant impact because the US remains the leader in venture capital investments in the crypto industry, even despite tightening crypto regulations and massive legal challenges to market participants. In Q2 2023, US-based investments accounted for 45% of global volume, followed by the UK with 7.7%.

The Fed continues to act as a 'financial hoover', sucking up excess liquidity in its fight against inflation. The key interest rate was raised to 5.5% this week, the highest level since 2001, and it's not expected to go down this year.

In these conditions, startups will continue to experience financial starvation, which, in turn, reduces the chances of an active cryptocurrency market recovery before the Fed begins to reverse course on interest rates.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.