Weekly outflow of Bitcoin to cold wallets exceeded $3 billion

The crash of one of the largest crypto exchanges caused a mad stir in the industry. Leading market players are discussing the loss of trust built up over years, and crypto exchange clients are withdrawing coins to cold wallets en masse.

Last week, FTX joined Terra, Three Arrows Capital, Celsius and Voyager on the list of companies that have filed for bankruptcy. Poor financial management precipitated the crypto exchange's crash: the main asset held by the subsidiary investment company Alameda Research was tokens issued by FTX. The artificially created investment wealth was enhanced by active PR in the press and a long list of sponsorship deals, including the Mercedes F1.

Kraken CEO, Jesse Powell, had strong words for the FTX crash: "This is about recklessness, greed, self-interest, hubris, sociopathic behaviour that causes a person to risk all the hard-won progress this industry has earned over a decade, for their own personal gain…An exchange implosion of this magnitude is a gift to bitcoin haters all over the world".

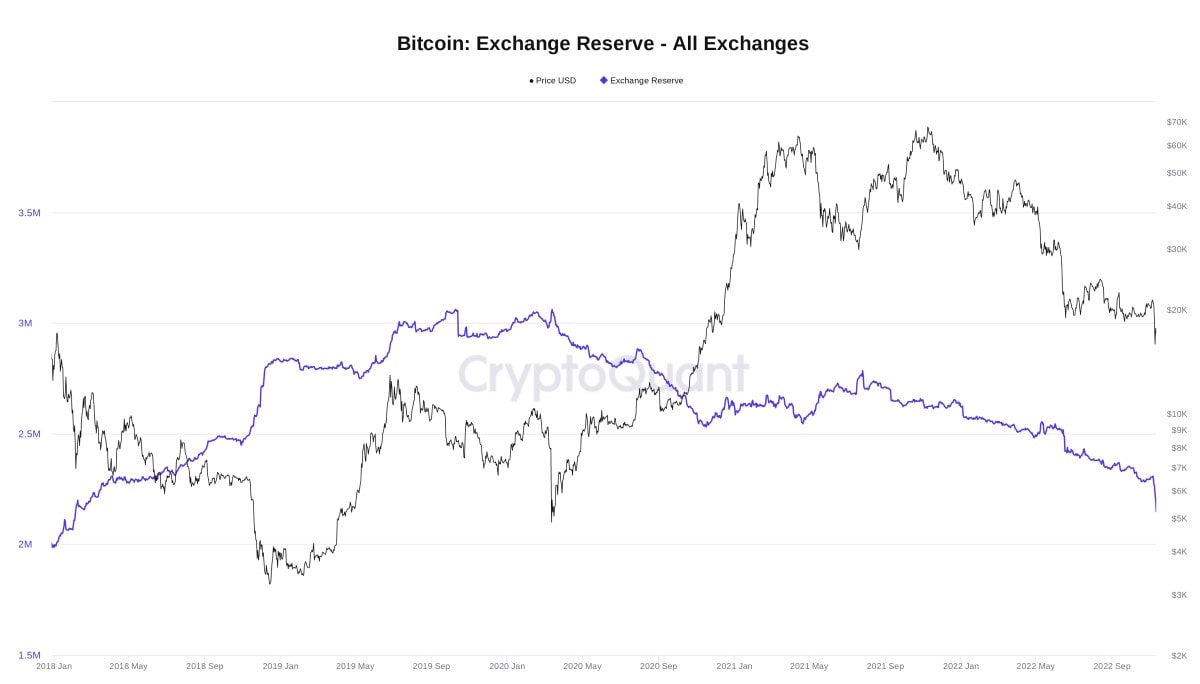

Since the credibility of aggregators has been undermined, the outflow of coins to cold wallets has increased. On November 12 alone, over 70,000 addresses were involved in withdrawing funds from crypto exchanges. Over the past week, customers withdrew a total of over $3 billion in BTC.

The cumulative balances of 38 crypto exchanges tracked by CryptoQuant have shrunk to lows not seen since February 2018.

The heads of Binance and MicroStrategy called on crypto enthusiasts to store the primary part of their coin holdings independently and to turn to intermediaries' services only to conduct trade operations or exchanges. As MicroStrategy CEO Michael Saylor recently said, centralised aggregators are accumulating too much power, and there is a risk of them abusing it.

Meanwhile, the cryptocurrency market is expecting new shockwaves from FTX's collapse. Crypto lender BlockFi announced a freeze on withdrawals last week; Genesis Trading announced that it's at risk of losing the $175 million it had in its FTX account; and Galaxy Digital CEO Mike Novogratz has already mentally said goodbye to the $77 million he had invested. JPMorgan predicts a new cascade of margin calls (the risk of being forced to close positions due to insufficient collateral), which could push Bitcoin to $13,000.

StormGain Analytics Team

(a cryptocurrency, trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.