Bitcoin: who's selling and who's buying at the moment

The collapse of a number of projects has led to a full-scale cryptocurrency sell-off, wiping almost 70% off the market's value. Among groups of investors, the largest outflows have been recorded among institutional investors (companies with investments of $1 million or more), public miners (who expanded production on credit), and speculators. However, there are also those who have accumulated historic levels of coins.

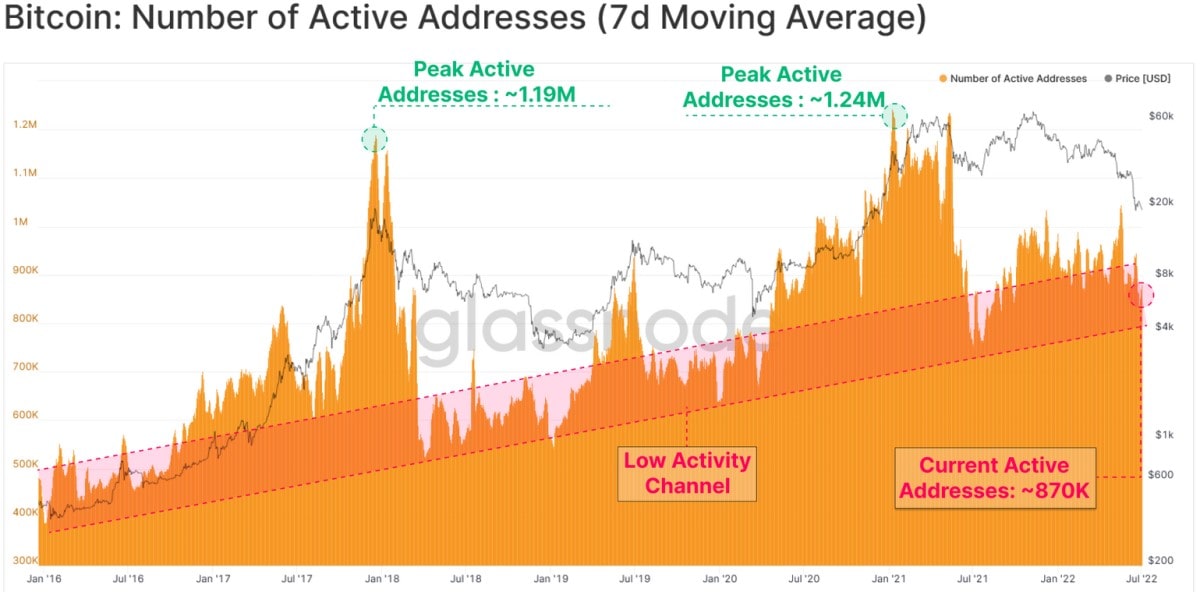

The crisis in the cryptocurrency market has led to a decline in the number of active addresses in the Bitcoin network from a peak of 1.2 million in May 2021 to the current level of 0.9 million. The rate at which participants are entering the space has decreased to historic lows unseen since 2018-19, with no more than 7,000 new users registering each day.

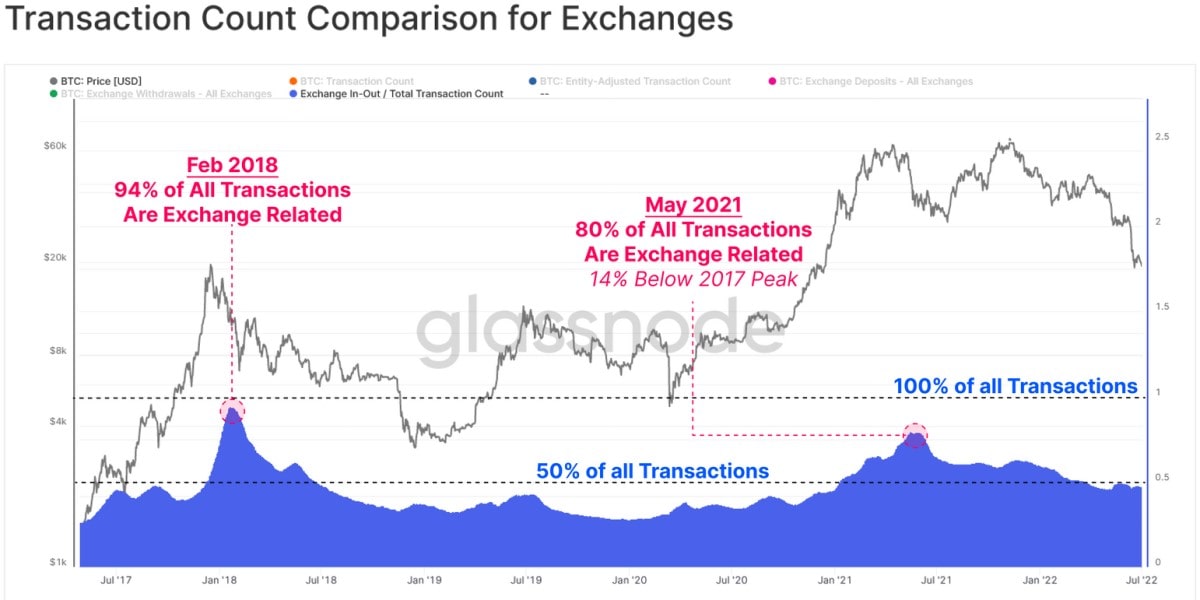

The reduction in the share of exchange transactions as a proportion of total transaction volumes is a sign that speculators and casual players are exiting the market. In periods of crisis following a rally, the share of exchange transactions was as high as 94% in February 2018 and 80% in May 2021. Now the figure is back below 50%.

In addition to speculators, public mining companies and institutional investors exerted serious pressure on the price over the past two months. Thus, in May, public miners sold more coins than they mined in a month to cover operating expenses and pay interest on loans. And in June, institutional investors withdrew a record $188 million from crypto funds due to the Fed's tighter monetary policy and the growing risk of recession.

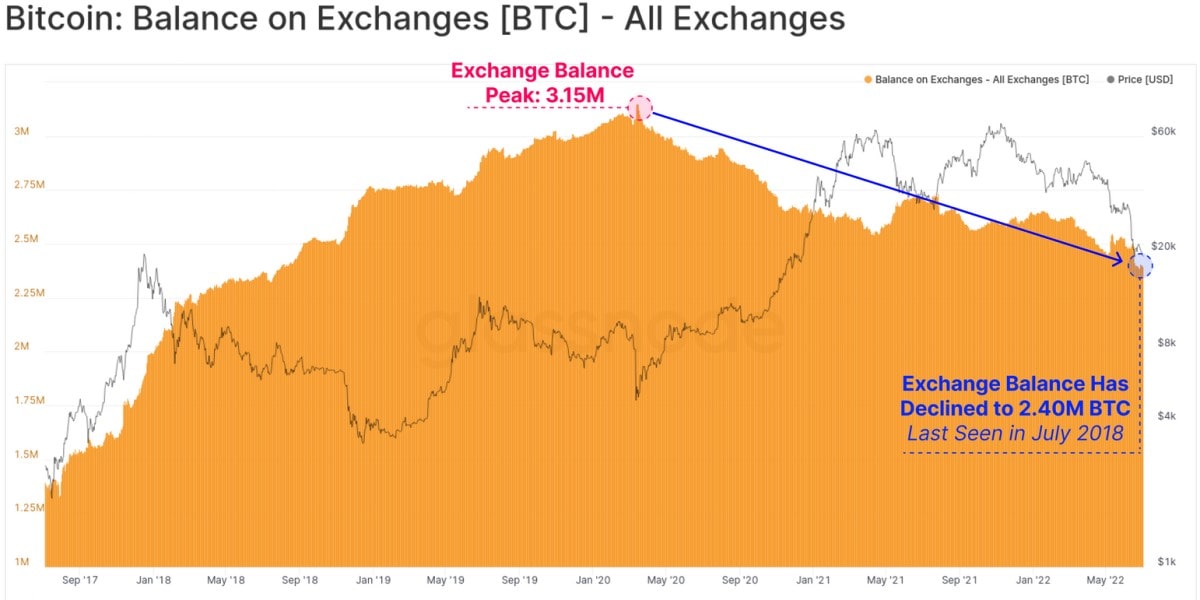

The fall in prices led to a liquidity crisis and the collapse of a number of crypto projects. Fear of further routs led to increased withdrawals of Bitcoin to cold wallets. Over the past three months, 143,000 coins have left the market. As a result, the total balance held by operators decreased to 2.4 million BTC.

The best accumulation figures can be seen among whales (>10 thousand. BTC) and shrimp (<1 BTC), with shrimps' appetites reaching an all-time high of 60,000 BTC a month. The wallet replenishment rate exceeds the previous record set in December 2017. Whales have reached an absorption rate of 140,000 BTC per month, but the figure has not yet exceeded the bull run high of 2021.

A Bitcoin price of $20,000 is seen by Whales and Shrimp as a very significant level. If public miners didn't have an urgent need for cash, they would just as likely abandon selling in favour of hoarding. However, it is worth bearing in mind that the macroeconomic environment remains negative and the Fed will continue to tighten monetary policy during the course of the year.

StormGain Analysis Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.