BlackRock restores interest in Ethereum

For Ethereum investors, 2023 was a tough year as the SEC boosted efforts to label the cryptocurrency a security. The regulator's efforts led to a host of market participants, including Kraken, ceasing to provide staking services. As a result, the altcoin's value declined by 25% against Bitcoin over the course of the year.

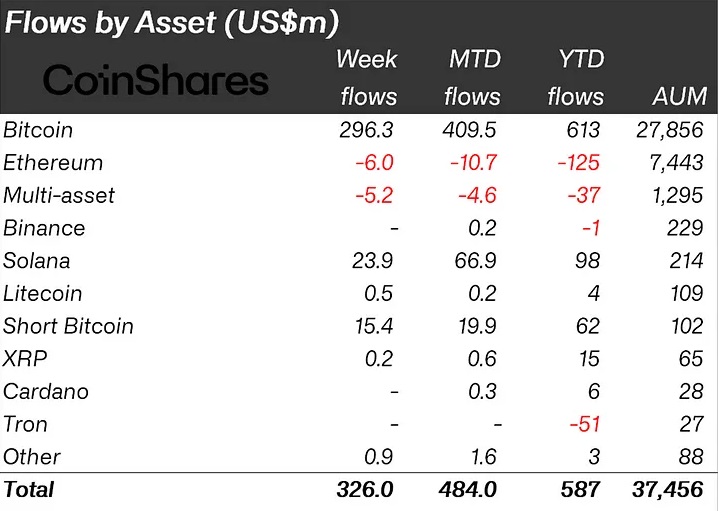

In terms of institutional capital inflow into ETFs, it lost to Solana, XRP, Cardano and Litecoin, showing an annual outflow of $125 million.

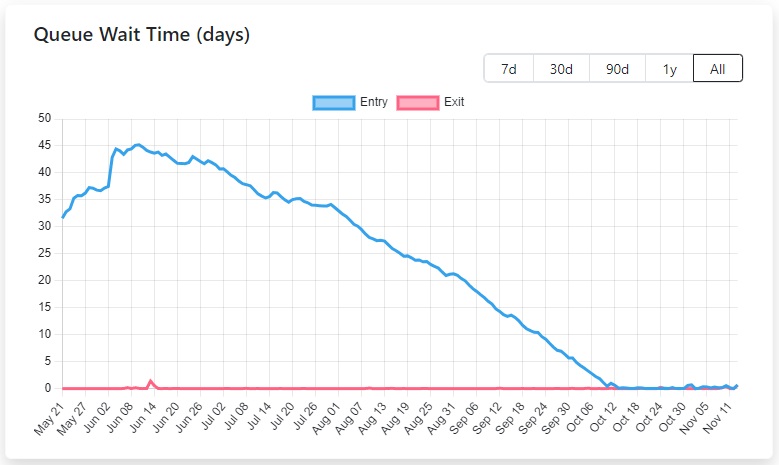

Even the staking boom ended as the 4% yield couldn't cover losses from Ethereum's weak growth. As such, by October, the long queue of people wanting to become validators had already shrunk so much that the waiting time was reduced from forty days to less than one day.

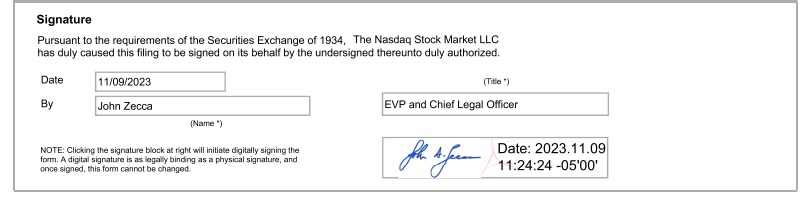

However, the world's largest asset management company, BlackRock, renewed interest in Ethereum by applying through Nasdaq for a spot ETF on 9 November. The price skyrocketed by 8% to $2,050 on the same day.

Some analysts believe that an investment giant applying for an altcoin ETF signals the inevitable adoption of spot Bitcoin ETFs. This will be a huge step for the crypto industry towards institutionalisation.

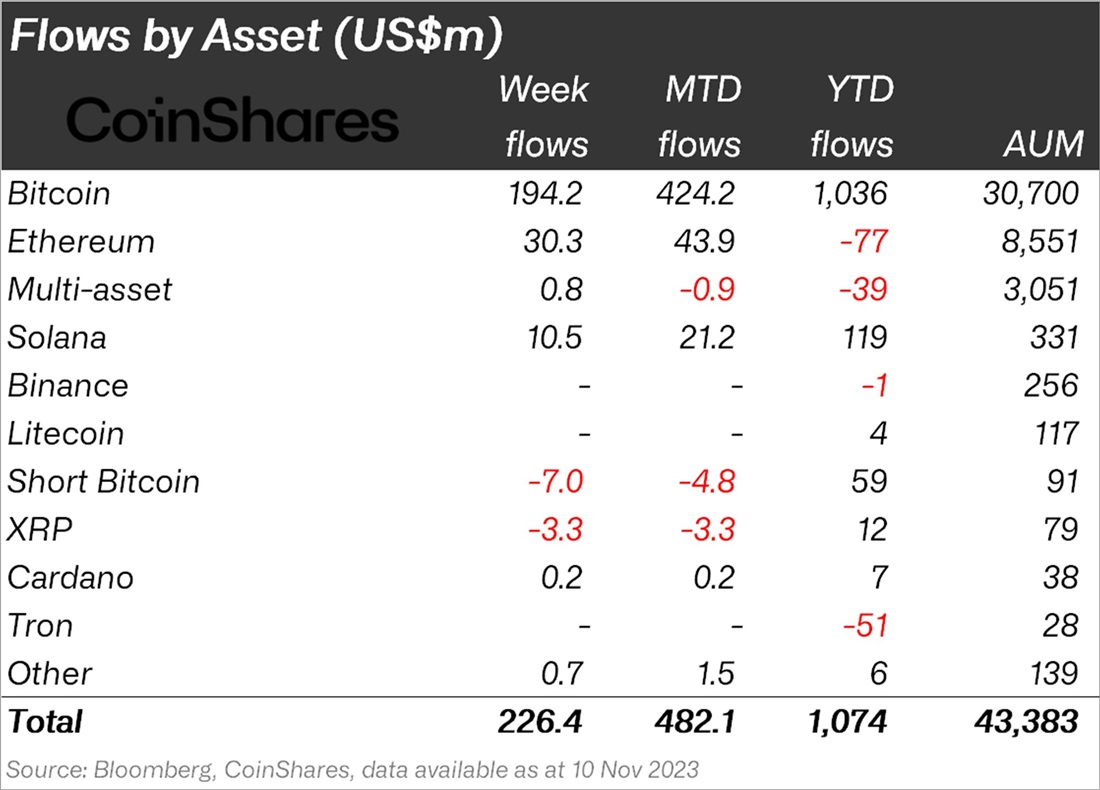

On 10 November, Coinshares' Head of Research, James Butterfill, reported that annual institutional capital inflows into Bitcoin reached $1 billion last week, with $424 million of that invested over the past 30 days. For Ethereum, the outflow of funds turned into an inflow.

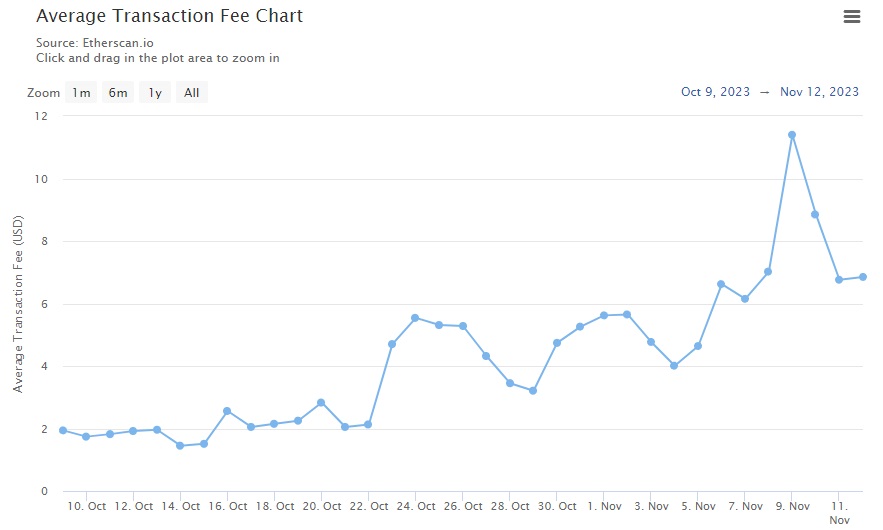

Due to the jump in interest in Ethereum, the average fee shot to $11 on 9 November, even though it didn't exceed $2 a month ago.

BlackRock's interest in Ethereum gives hope that the altcoin's positions will be restored. Coupled with increased profitability due to higher fees, it'll attract new investors.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.