The causes of the new financial crisis, in simple terms

The Fed has caused another financial crisis, just like clockwork. Silicon Valley Bank (SVB), the 16th largest US bank by assets, faced bankruptcy despite a "dull" financial policy that fully followed the Fed's recommendations. However, this didn't save SVB from bankruptcy, and the banking sector could face a domino effect if no immediate support measures are taken.

Easy money, 2020-2021

To support the US economy with the onset of COVID-19, the government adopted a series of costly measures, including paying unemployment benefits above the national average wage ($987 versus $957 weekly, respectively). At the same time, the Fed dropped its key interest rate to zero, making credit and other borrowing super-cheap. It also inflated its own balance sheet by buying bonds and securities, doubling it to $9 trillion.

Simply put, the regulator has printed trillions of dollars to hand out money to the public and businesses. This was reflected in the record growth rate of property prices and the stock market boom and has led to a natural increase in inflation.

Safe-haven assets

On the other hand, safe-haven assets, such as US Treasury bonds, have lost yields, and demand has been low during this period. This is an important point to understand, as it's SVB's conservative policy that will result in unplanned losses.

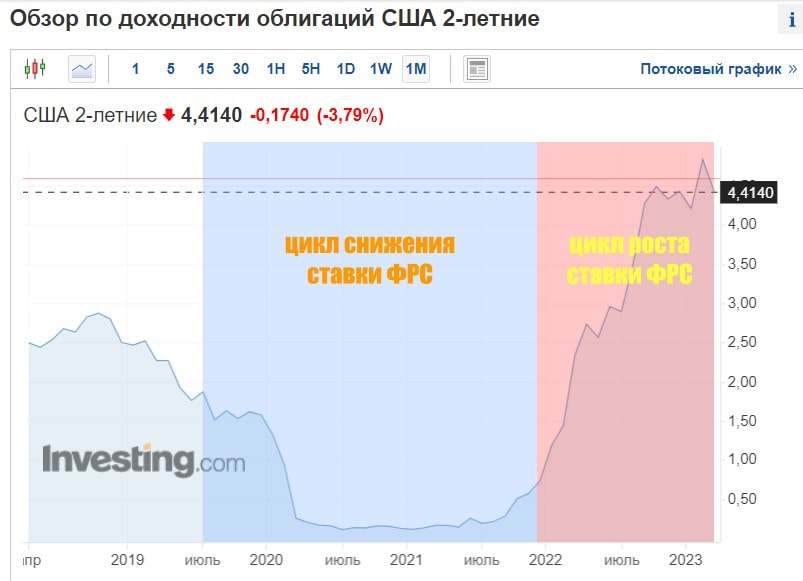

In simple terms, when the Fed lowers its interest rate, bond yields fall. When it raises the rate, yields rise, too. When the rate is high enough, investors prefer not to risk investing in stocks, cryptocurrencies and other high-risk instruments. Instead, they turn to bonds for guaranteed returns.

Silicon Valley Bank

SVB is a role model for banks in this sector. When it faced a high capital inflow during the easy money period, some of the funds were invested in bonds to mitigate risks. The problem is that securities bought with yields below 1% have become much cheaper as the interest rate has risen. Specifically, the bank sold $21 billion worth of bonds last week for deposit repayments at a loss of $1.8 billion. To compensate for the losses, bank management announced an additional issue of shares worth $2.3 billion, leading to a panic among clients.

Simply put, the bank lost 9% on bond transactions alone because of the regulator's actions, even though the purchases were made to insure clients' funds against financial risks. The bank currently holds over $70 billion in long-term Treasury bonds.

How much blame is the Fed's? It's enough to recall Jerome Powell saying that inflation was "transitory" in 2021, refusing even verbally to move into a rate hike cycle any time soon. The following year, the speed of rate hikes was the highest in 40 years.

Accompanying challenges

Nowadays, news travels fast, and online banking makes it possible to withdraw deposits without visiting a bank branch. Following the sale of bonds and the announcement of additional capital raising, SVB faced a total withdrawal request of $42 billion as early as 9 March. On 10 March, all bank operations were blocked by the Federal Deposit Insurance Corporation (FDIC).

The liquidity crisis is systemic since the US's fractional reserve banking requirement is only 10%. Simply put, out of every $100 deposited, the bank must keep only $10 on hand. The remaining 90% can be invested in funds, bonds and other financial instruments. Some economists consider the 'reserve requirement ratio of 10%' rule to be a key systemic problem in today's financial system. First, in the event of a sudden demand for withdrawals, the bank is unable to meet the request promptly. Second, the mutual indebtedness of financial institutions leads to a domino effect when one of them falls.

The domino effect and the fall of the US dollar

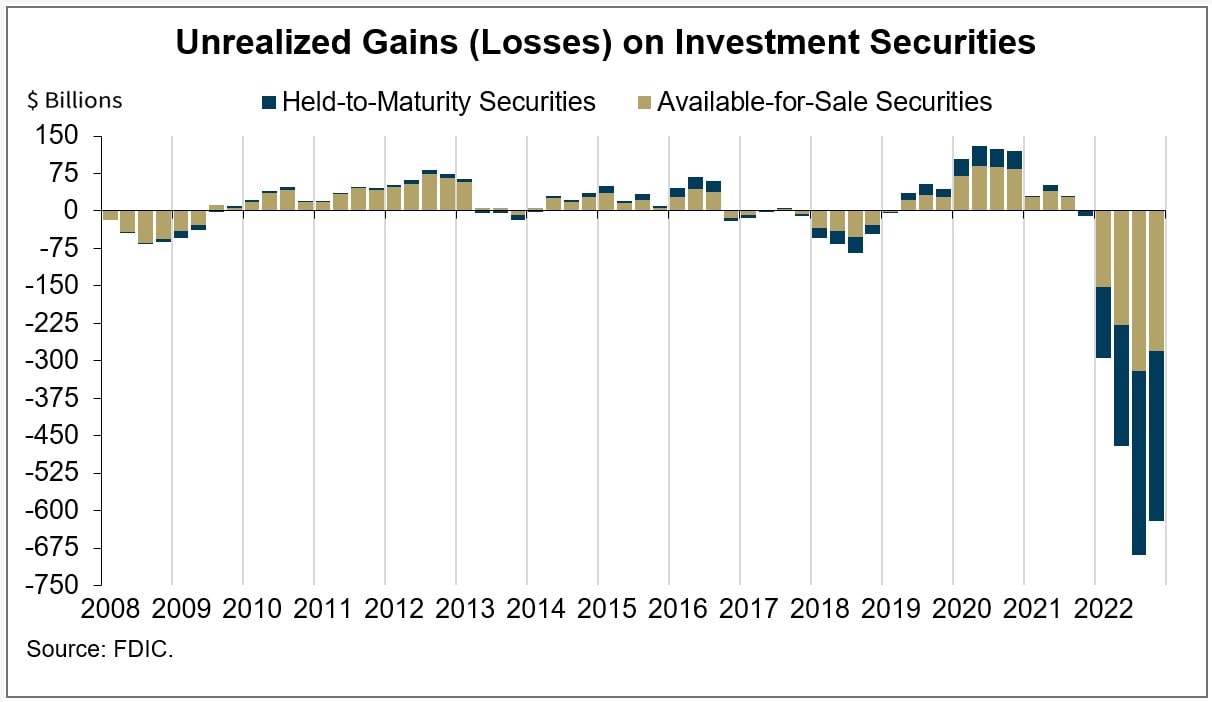

US banks now have $65 billion in unrealised losses, compared to just $3 billion a year ago.

Against the scale of the problem, the Fed's announcement of a $25 billion additional fund to support the banking sector looks pathetic. SVB alone was servicing deposits totalling $175 billion at the end of 2022, 85% of which were uninsured by the FDIC. If immediate action isn't taken, many of SVB's customers will simply go bankrupt, and some other banks will face a lack of liquidity.

The US dollar is losing ground on all fronts as the Fed's actions have led to a crisis in the banking sector. Despite earlier statements about the need for a more serious rate hike, the regulator is likely to take a break in March. The emergence of new support funds isn't good for the dollar, as it'll ultimately come at the expense of additional printing.

As an epilogue, we'd like to quote Bitcoin creator Satoshi Nakamoto:

The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.