CBDCs will save us from inflation but lead to dystopia and Bitcoin's disappearance

Central Bank Digital Currencies, also known as CBDCs, are digital state currencies created using distributed ledger technology (DLT). CBDCs differ from current digital currencies that are essentially issued by commercial banks as loan obligations. And, if, at first glance, they seem like the same thing, pay closer attention because the devil is in the details. In the article Pure Evil, former BitMEX CEO Arthur Hayes reveals the reasons for the pessimism about financial regulators' plans.

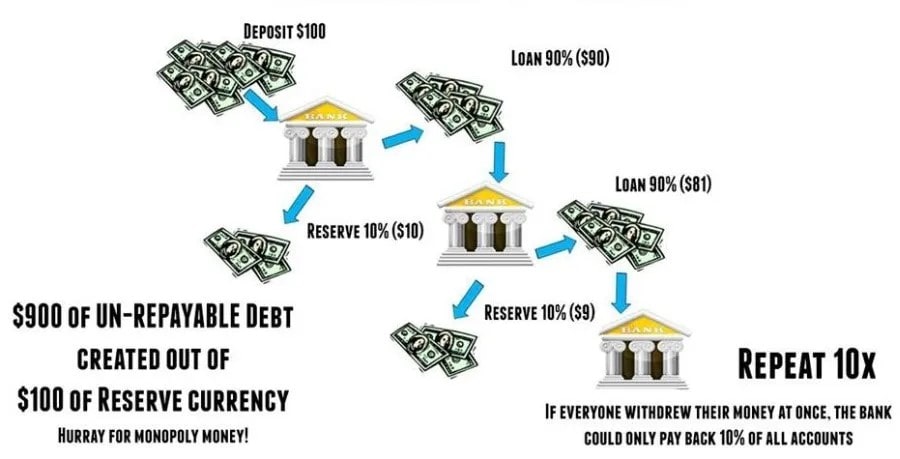

The digital money currently circulating was created by commercial banks, as has historically been the case. When a consumer or organisation takes out a loan, a corresponding amount is reflected in their account. In this case, the bank's assets may be less than 10% of the issued liabilities, which is called the fractional reserve ratio. As a result of the financial cycle, the actual $100 creates a liability of $900.

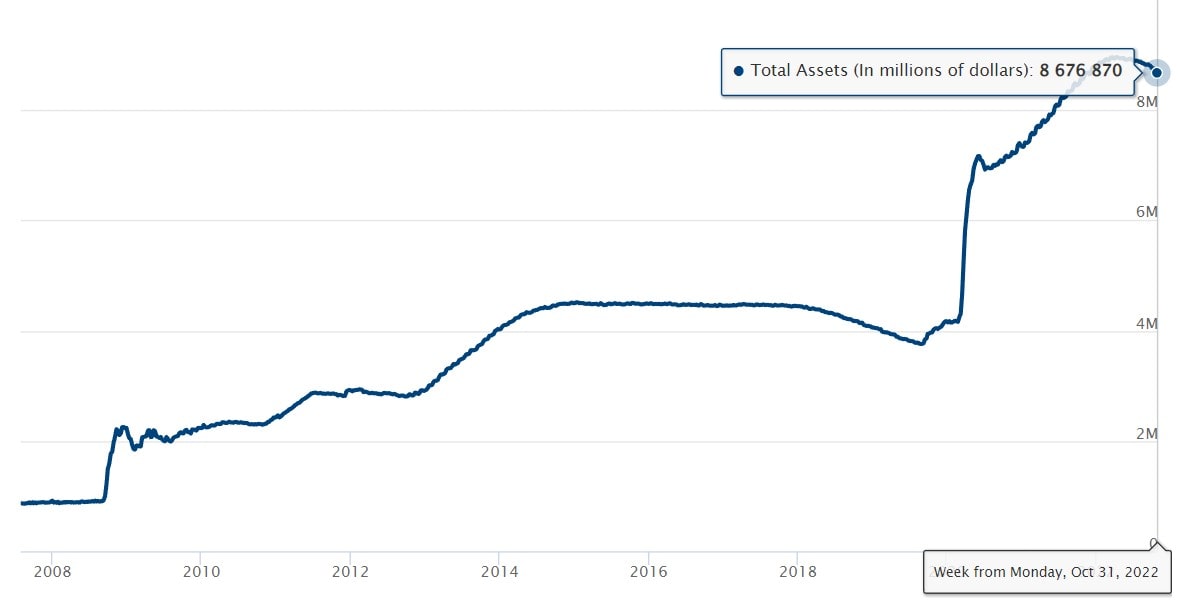

This and other rules have led to the ability to pump up the global economy with money from thin air. The US Federal Reserve, whose balance as of today is $8.7 trillion, plays the largest role in this process. Now the time has come to pay up in the form of increased inflation that can't be dealt with even by a shock rise of the key interest rate with the risk of falling into a recession. Unprotected segments of the population have once again come under attack.

On the one hand, the government needs to support citizens and print more money. On the other hand, inflation prevents this cycle from taking place again. Hayes notes that the adoption of CBDCs will be the logical outcome of resolving the dilemma.

If adopted by the central bank model, CBDCs will be produced and controlled exclusively by central banks. At the same time, DLT allows the entire path money takes as it changes hands to be tracked and establishes rules for the end use of money and its lifetime.

By doing so, the government can provide targeted assistance to those in need while limiting their spending to food and essential goods. However, in the same way, this tool can be used against dissenters. If a person is seen at a rally, sends funds to an objectionable person, or writes a critical post on social media, that person's funds could be blocked. To prevent social indignation, the CBDC can still be allowed to be used to purchase consumer goods and pay utility bills.

Since the circulation of cash will soon be significantly limited (the technology allows CBDC funds to be calculated even without an internet connection), blocking digital money will lead to a decrease in the social activity of opposition-minded citizens. Dystopia lurks around the corner.

Here, we can come back to Bitcoin, which uses a blockchain (a subtype of DLT) and is designed to resist pressure from regulators. However, buying it for cold storage will be extremely difficult since all entrances and exits to/from fiat are controlled by regulators.

Hayes notes a reason for optimism, namely, the hope that CBDCs will be launched in a more benign form, with some powers remaining with commercial banks. However, the best time to buy Bitcoin was yesterday, as the opportunities to acquire are becoming fewer and fewer.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.