China behind Bitcoin's rise, not ETFs

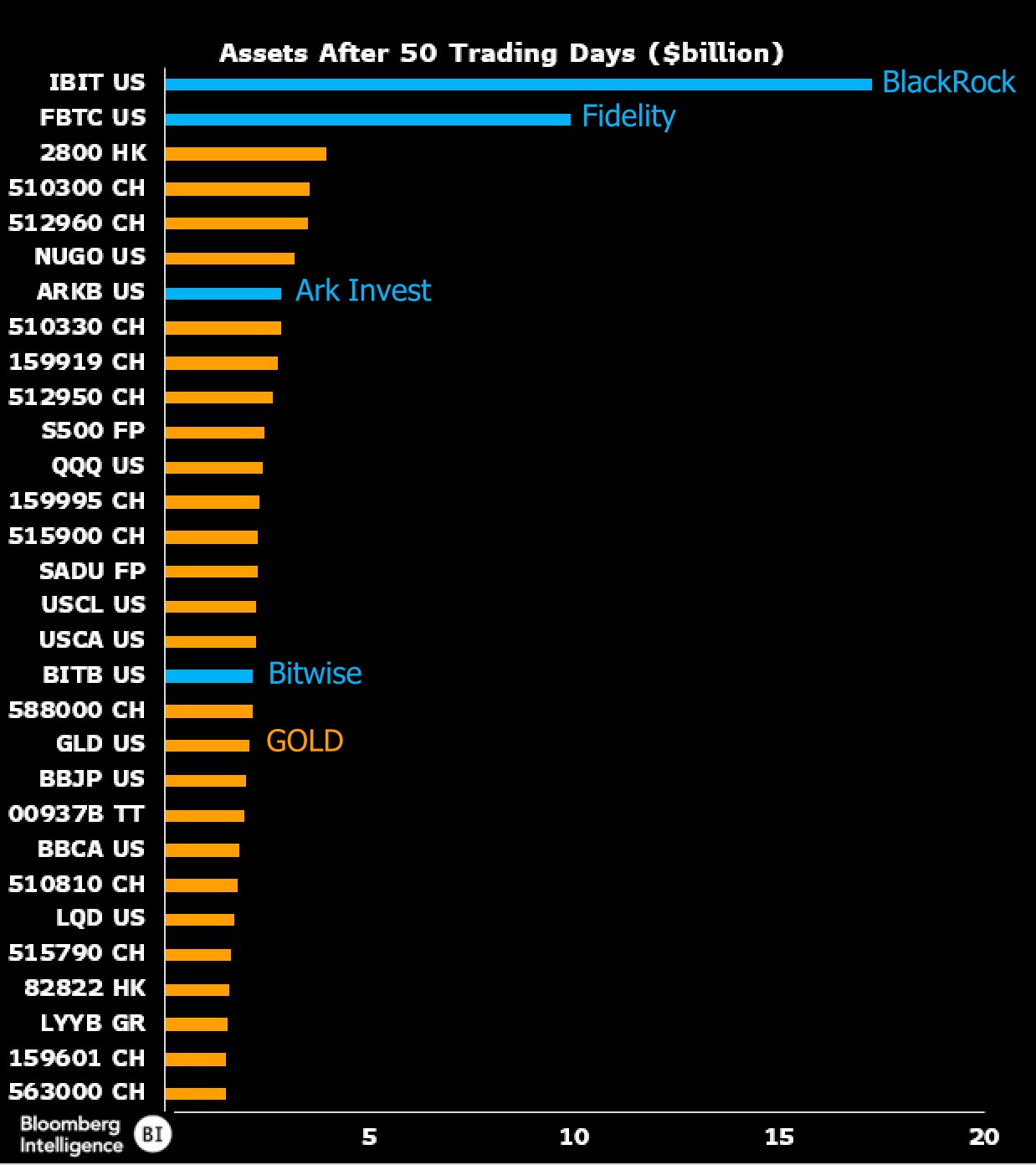

Over the past six months, crypto news publications have primarily focused on the fate of spot ETFs in the US and the subsequent record-high inflows into BlackRock and Fidelity's ETFs. In less than four months of operation, they have become the fastest-growing ETFs in the world, taking in $23.7 billion just across the two of them.

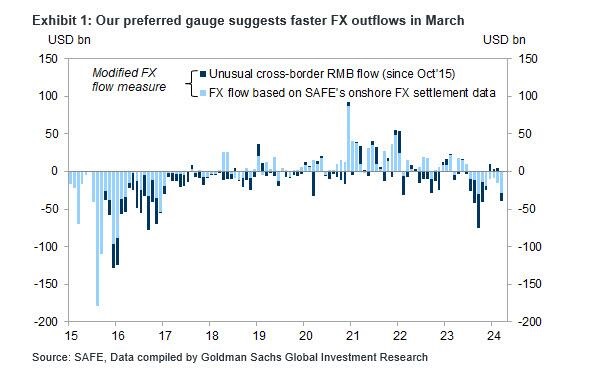

Analysts at Zerohedge believe that the main driver for Bitcoin's price wasn't actually the launch of the ETFs. Instead, it was the outflow of currency from China. In October 2023, it reached its highest level since 2015 at $75 billion. At that time, the cryptocurrency was trading at $27,000 and has grown 2.7-fold in six months.

In March 2024, currency outflows picked up again, reaching $39 billion.

Chinese citizens have strict restrictions on moving money out of the country and using it abroad. For example, a separate permit is required to travel with over $5,000 in cash. Overseas withdrawals from cash machines are capped at ¥100,000 per year (~$13,800). For this reason, cryptocurrency has become a prioritised financial instrument.

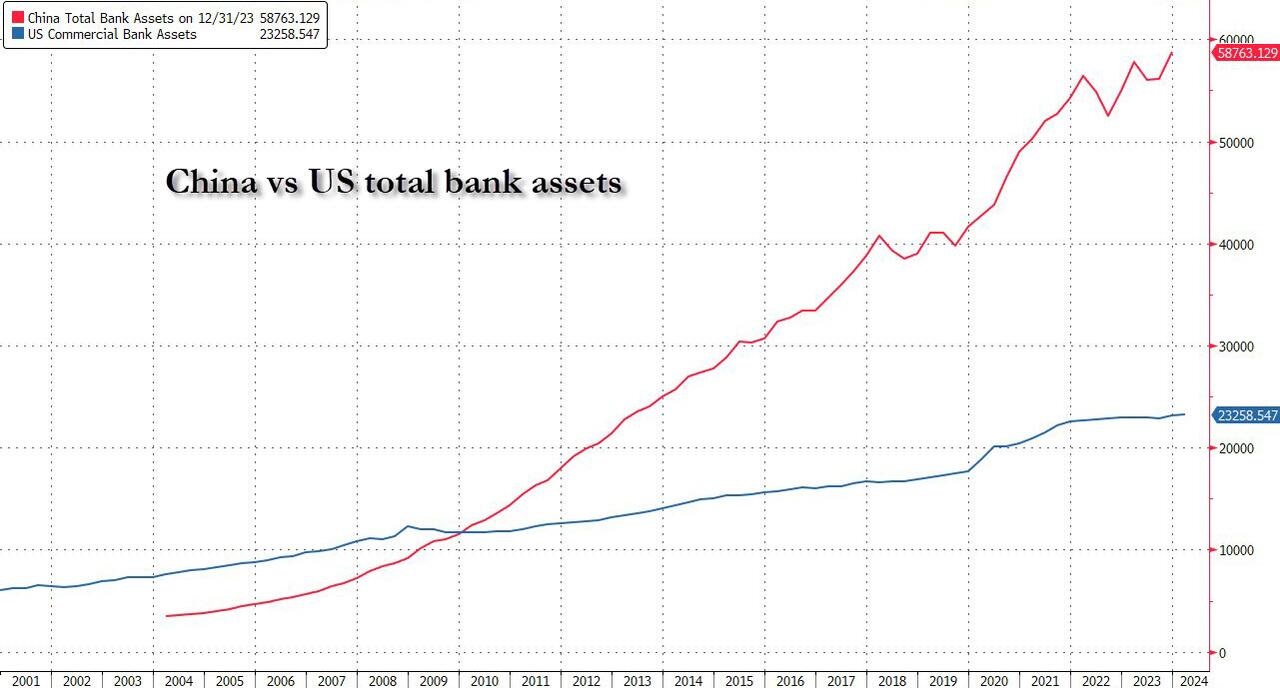

In addition to the desire to go over the limits when travelling, Chinese citizens' interest in Bitcoin has been fuelled by the devaluation of the yuan, the prolonged stock market decline and the real estate market crisis. China's investment potential is hard to overstate since the amount of capital is almost three times as much as that in the US.

The only thing that complicates investment is the ban on conducting cryptocurrency transactions that applies to financial organisations within China. For this reason, investors are forced to find workarounds and turn to the P2P market.

But even with these challenges, Zerohedge believes that Bitcoin's price will double in the next six months if the pace of currency outflows from China continues.

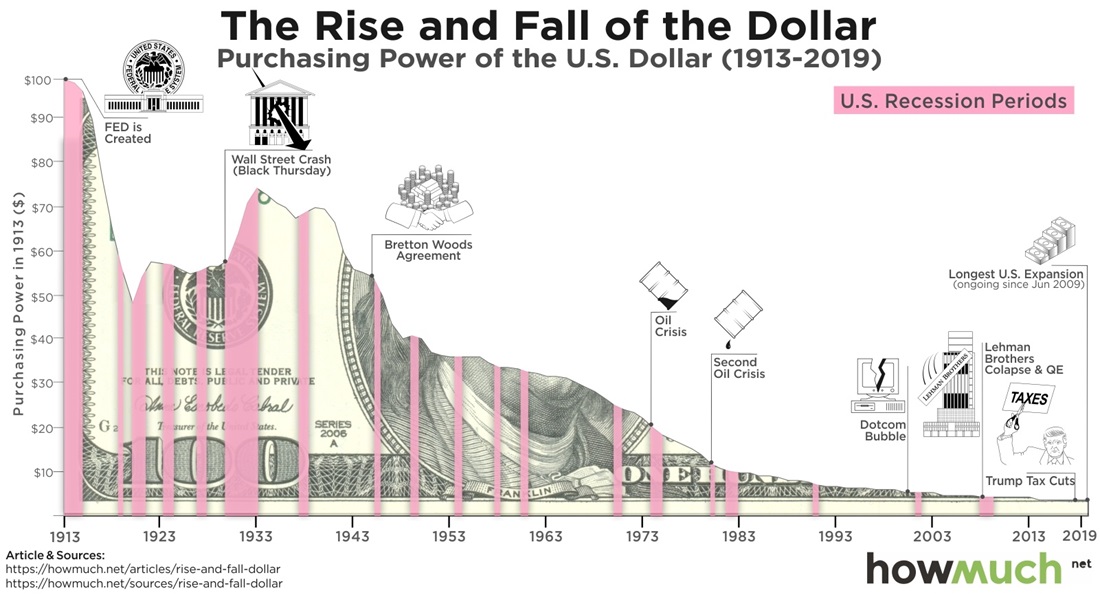

BitMEX co-founder Arthur Hayes argues along the same lines, emphasising the imperfection of the entire modern financial system and the steady devaluation of national currencies:

Fiat will continue to be printed ad infinitum until the system resets.

Hayes specified that the US is stepping up money printing despite the widening gap between revenue and government spending. This year, the imbalance will be widened by spending on foreign policy, defence and the presidential election.

This will inevitably lead to a weakening of the US dollar against 'hard' assets, such as gold or Bitcoin. According to Hayes, the cryptocurrency will reach the $1 million mark in the foreseeable future.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.