Crypto funds see outflow of funds for second week in a row

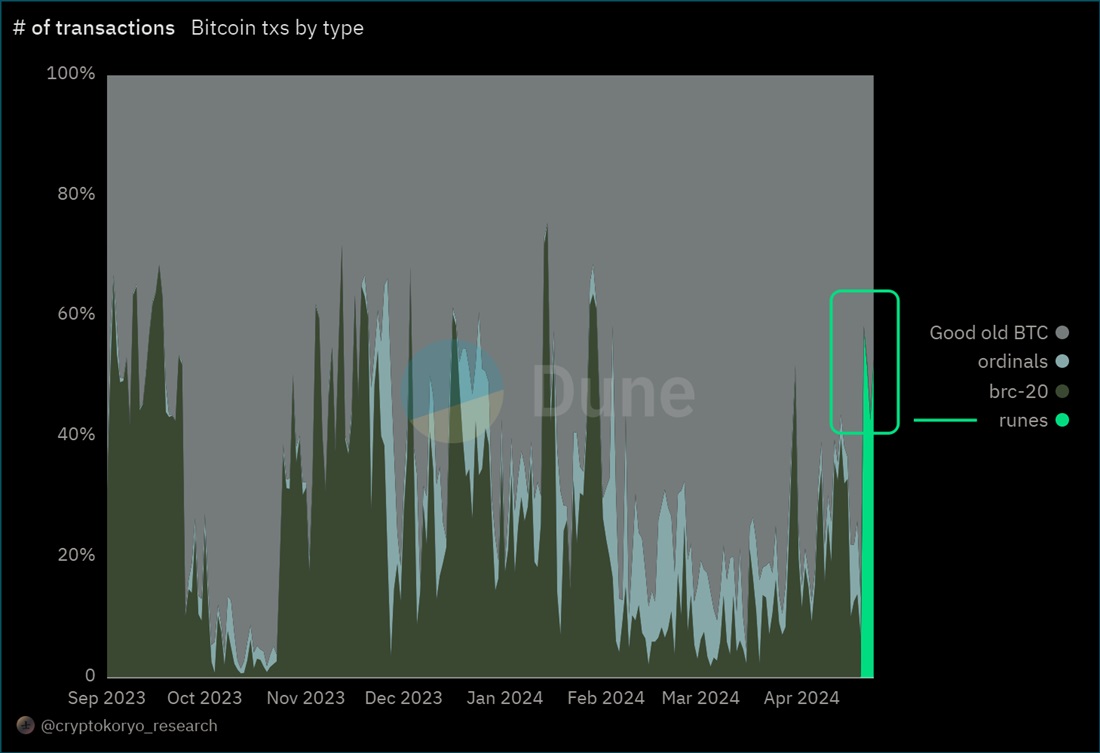

The recent halving event was characterised by explosive growth in commission thanks to the introduction of the Runes protocol in the same block. The new protocol makes it possible to mint a new subtype of meme coins. The speculative frenzy hasn't run out of steam yet. Runes account for about half of all transactions in the block, which is why the commission for sending a simple transaction now exceeds $15.

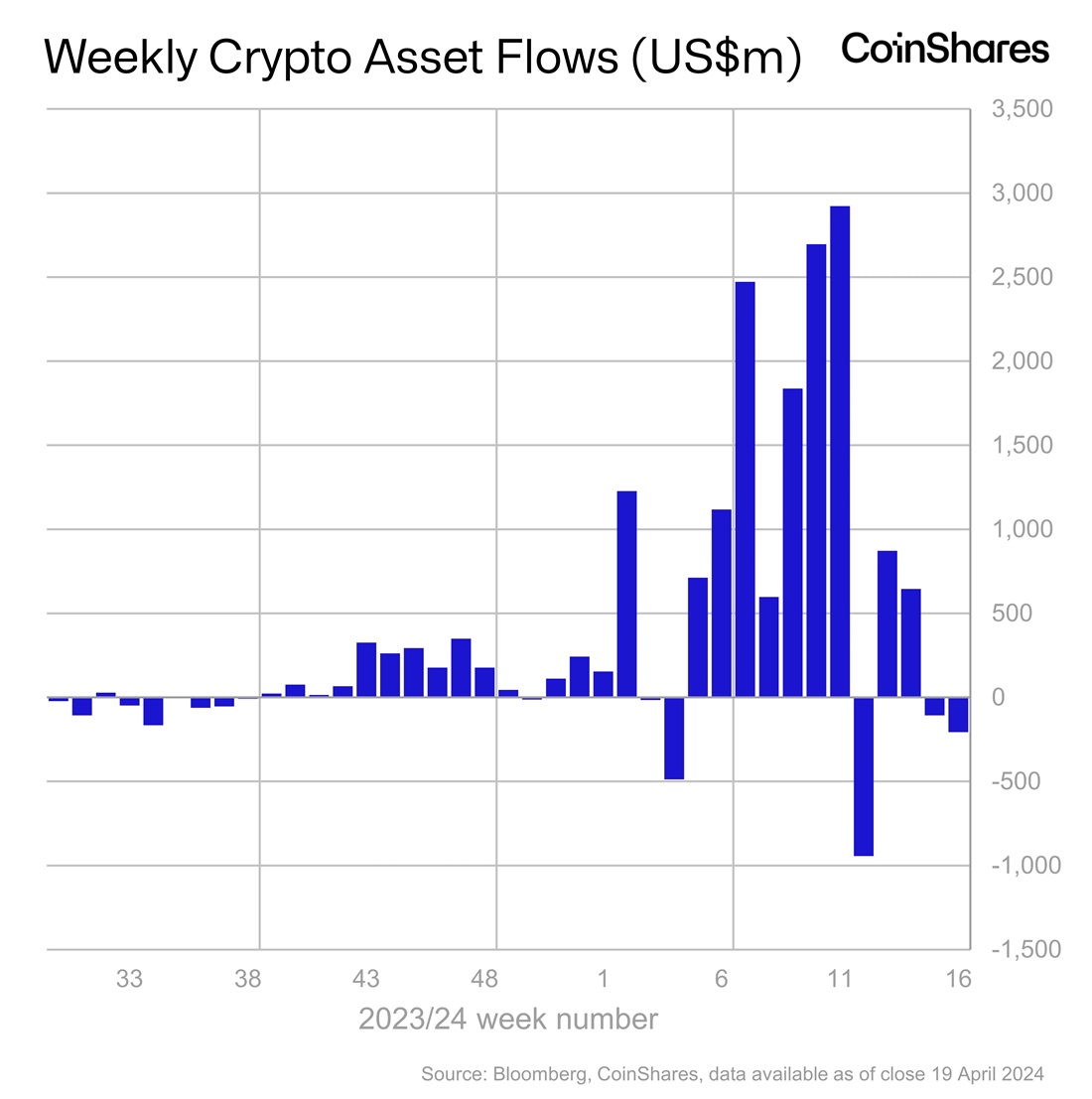

However, investment interest in Bitcoin itself has remained lacklustre over the past two weeks. The crypto funds that drove the cryptocurrency market at the beginning of the year are showing an outflow of funds for the second week in a row. During this time, their total balance sheet decreased by $332 million.

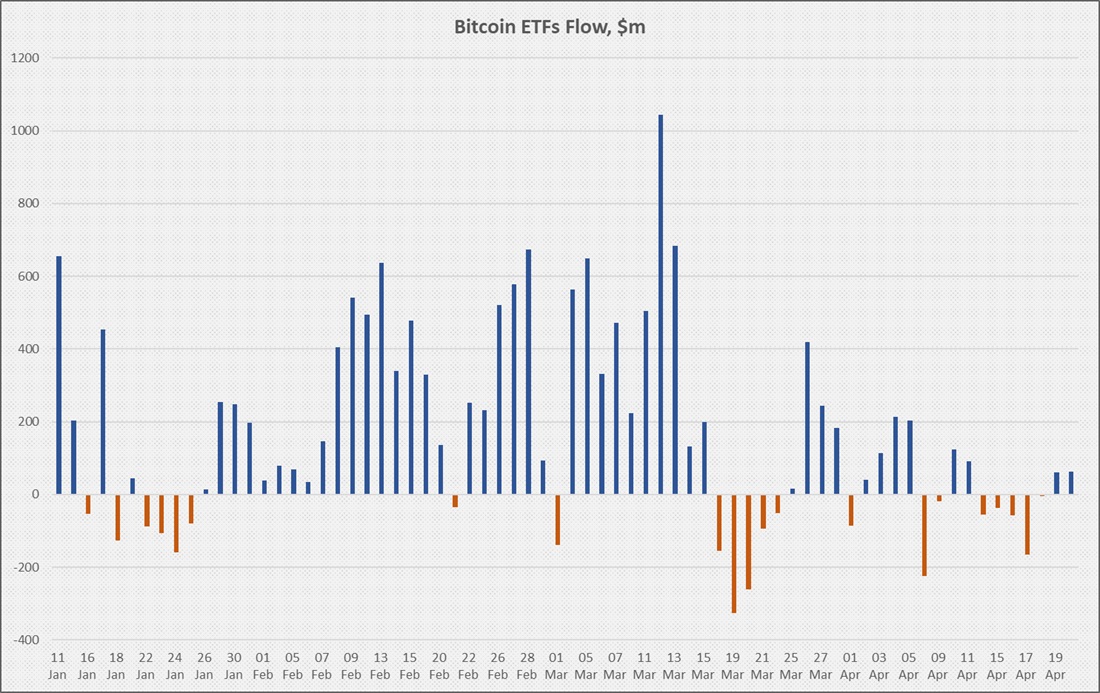

On the first business day after the halving, inflows into spot ETFs were only a modest $62.2 million.

Investors' caution is related to Bitcoin setting a new record-high before the halving event (for the first time in history) and the forecast by several analysts, with JPMorgan leading the charge, that BTC's price would inevitably correct to $50,000 due to inflated expectations.

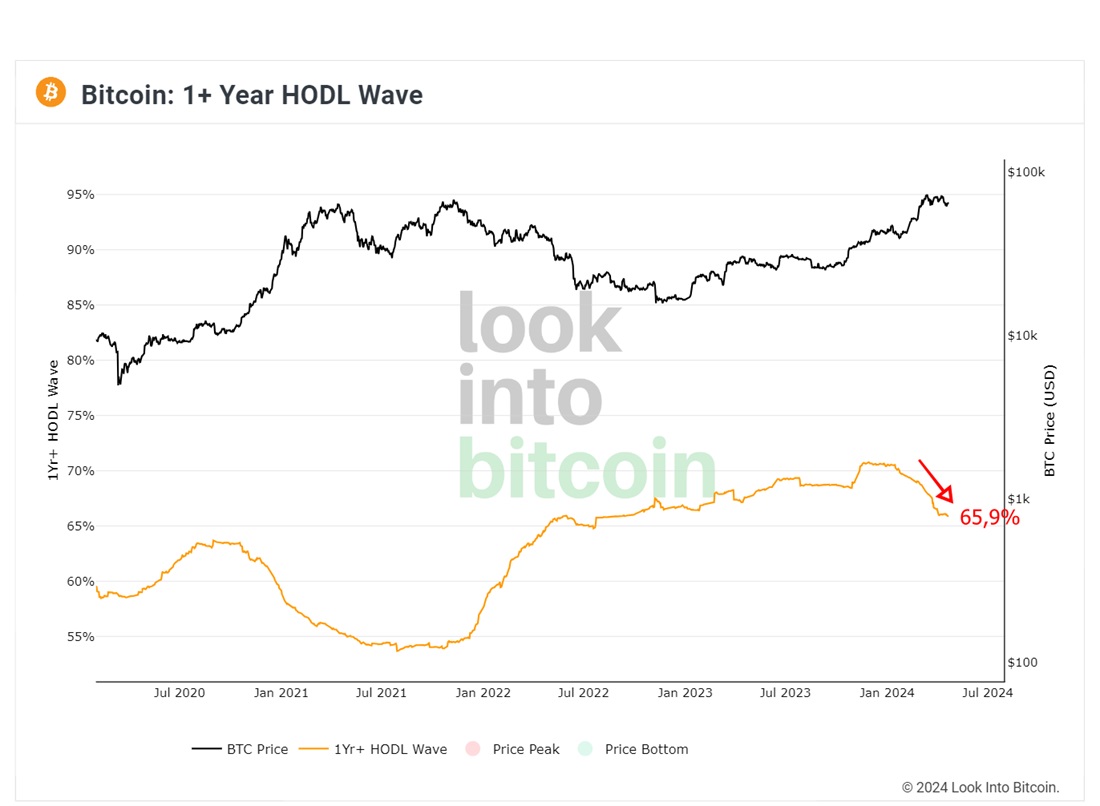

Several network metrics confirm the negative sentiment. The rate at which new addresses are appearing has decreased to lows last seen in 2021, while the share of long-term holders has decreased, too. The percentage of coins that have remained idle for over a year has decreased from 70.5% in mid-January to the current 65.9%.

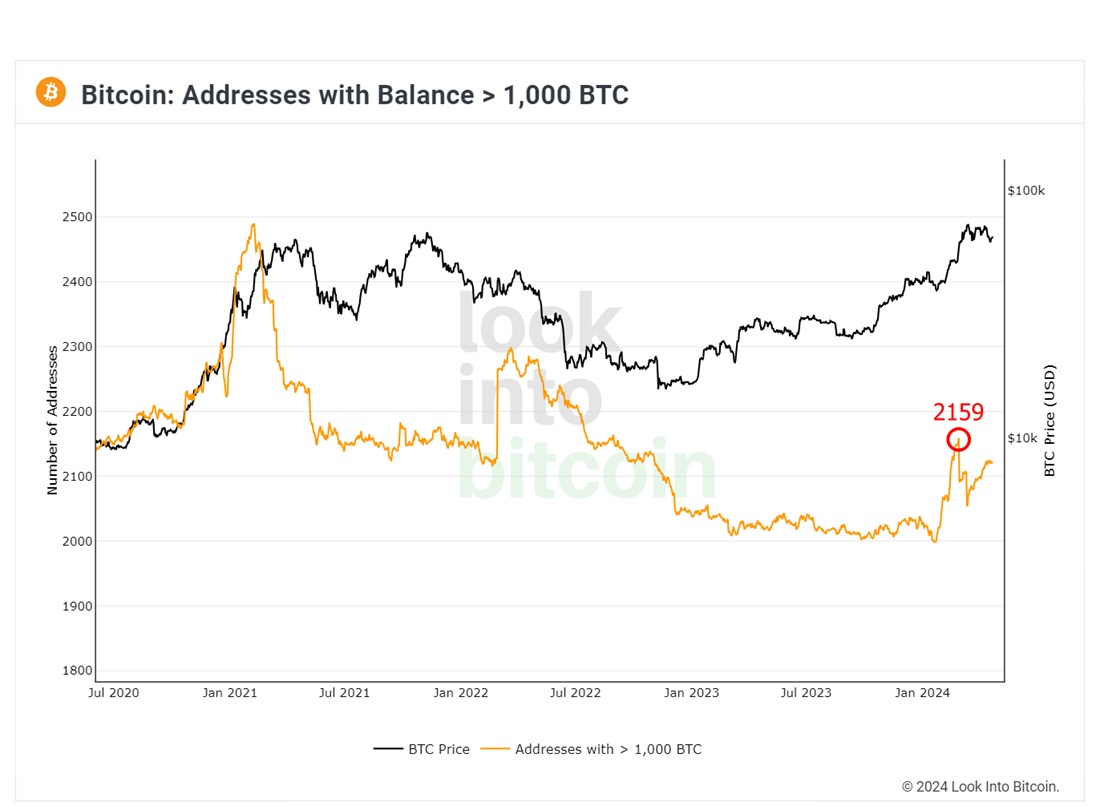

The number of whales (>1,000 BTC) has risen since mid-March but hasn't reached this year's high of 2159 addresses.

Long-term hodlers are locking in profit, and interest in Bitcoin among new investors has significantly slowed. If the trends continue, the cryptocurrency will face a long-term consolidation with the threat of a breakdown into a full-fledged correction. In the current bull cycle, that consolidation is still extremely soft, reaching just 22% in January. Previous rallies saw average drops of 40%.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.