Crypto funds set a record turnover of $17.5 billion

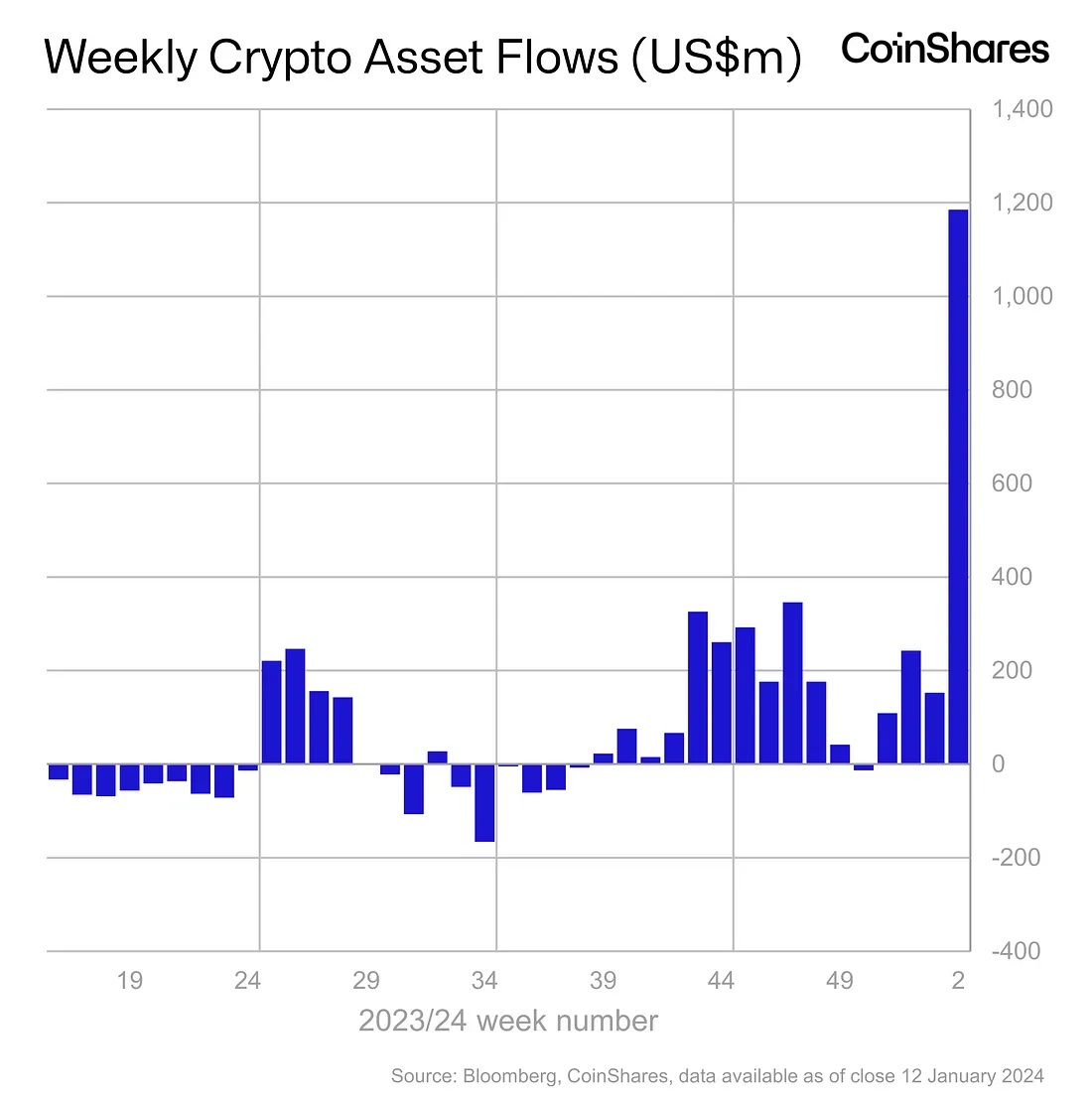

The first financial statistics on Bitcoin ETFs launched last week in the US have been released. New records were set: the total trading volume of new and existing crypto funds for the week reached $17.5 billion, with an average of $2 billion. However, the inflow figure failed to beat the effect of the launch of a futures ETF in the US in 2021, when the numbers were $1.2 billion and $1.5 billion, respectively.

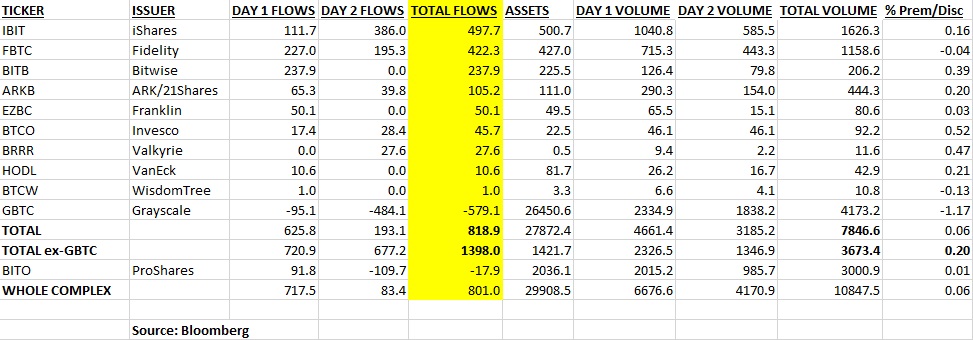

Among the approved ETFs, the one from BlackRock, the world's largest company by assets under management, predictably saw the highest rise. In just two days, it raised $0.5 billion in investments. Grayscale, on the other hand, showed an outflow of $0.6 billion.

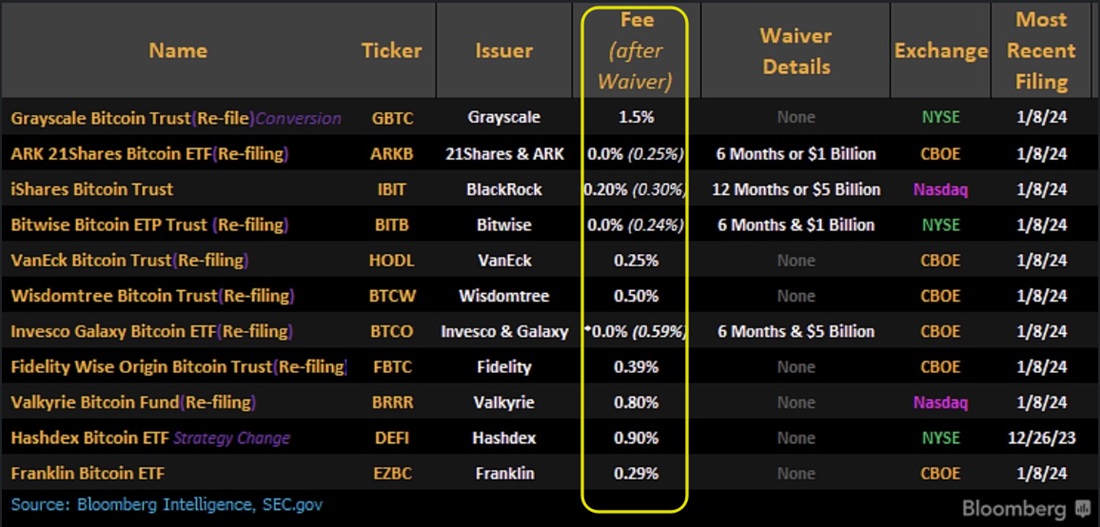

It's worth explaining that Grayscale, unlike other participants, started this stage with 618,000 BTC (~$28 billion) on board due to the transformation of its trust fund into a spot ETF. Such an impressive margin tempted the company to charge the highest commission of 1.5% for management services. Outflows into lower-cost ETFs are likely to continue in the long term.

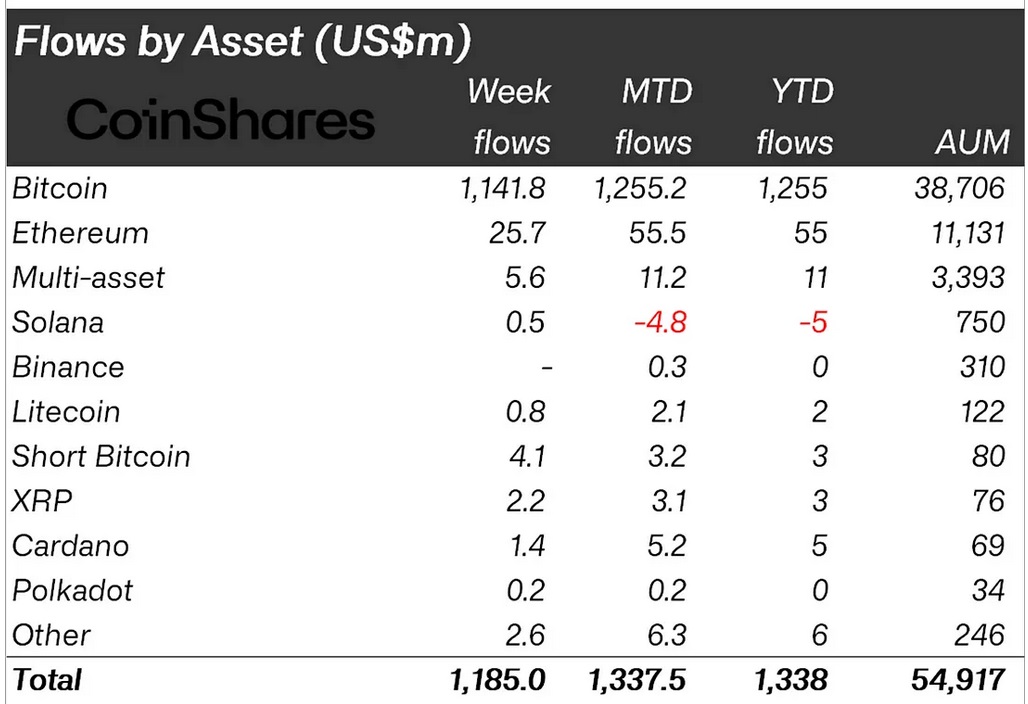

Looking at last week's inflows by asset, $1.1 billion came from Bitcoin, with Ethereum coming in second with $25.7 million.

For 2023, inflows into the altcoin look extremely dim, with $78 million, half the size of Solana ($167 million). The low demand for Ethereum from institutional investors is due to attacks from the SEC, the forced withdrawal of several US cryptocurrency exchanges from staking, and the significant lag in momentum behind Bitcoin.

Last week, BlackRock CEO Larry Fink drew attention to the altcoin by announcing his interest in the emergence of spot Ethereum ETFs.

However, investors should take into account the words of SEC Chairman Gary Gensler. In the accompanying letter to the approval of the ETFs, he noted two important circumstances: the regulator considers Bitcoin to be a commodity only and was forced to launch crypto funds by a peculiar interpretation of the law by the courts (meaning the SEC's loss in Grayscale's appeal).

All of this makes it unlikely that spot ETFs for any altcoin will appear in the US in the near future.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.