Disappointing Ethereum ETF launch

With the emergence of the first Ethereum futures ETFs, many linked hopes for the altcoin rally, keeping in mind a boost in investments when similar Bitcoin funds were launched in 2021. Analysts from K33 Research were actively promoting the accumulation of Ethereum, promising investors a 'hot October'.

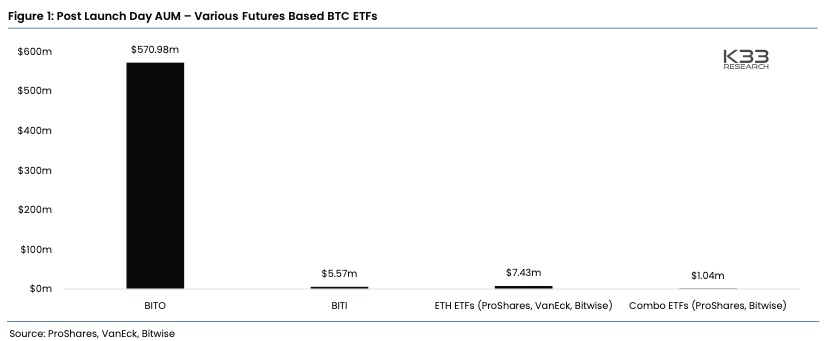

But, the emergence of ETFs caused a moderate reaction even for the bear market. On the first day of Bitcoin ETF (BITO) trading in 2021, it collected $571 million in investments, while Ethereum ETFs only managed to accumulate a total of $7.4 million.

Note: we're talking about ETFs for futures contracts. So far, the US hasn't yet issued authorisation for crypto instruments spot ETFs. BITI is an ETF to sell Bitcoin. Combo ETFs are funds tied to both Bitcoin and Ethereum.

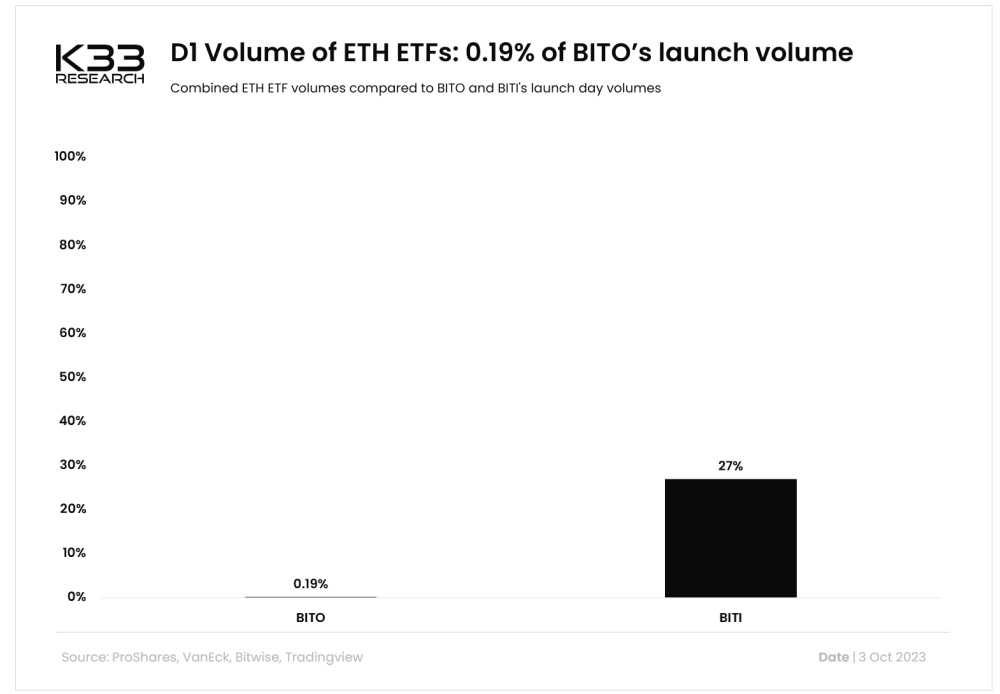

The total trading volume of Ethereum ETFs on the first day was only 0.19% of the BITO, demonstrating a massive difference in investment interest in the two assets.

This forced Vetle Lunde, a senior analyst at K33, to withdraw his forecast that Ethereum would rise and urge investors to focus on Bitcoin.

Lunde opined that he no longer supports excessive ETH risk given the disappointing launch of an ETH futures ETF, the weak movement and the lack of persuasive medium-term forecasts.

In 2023, the altcoin lost 18% to Bitcoin:

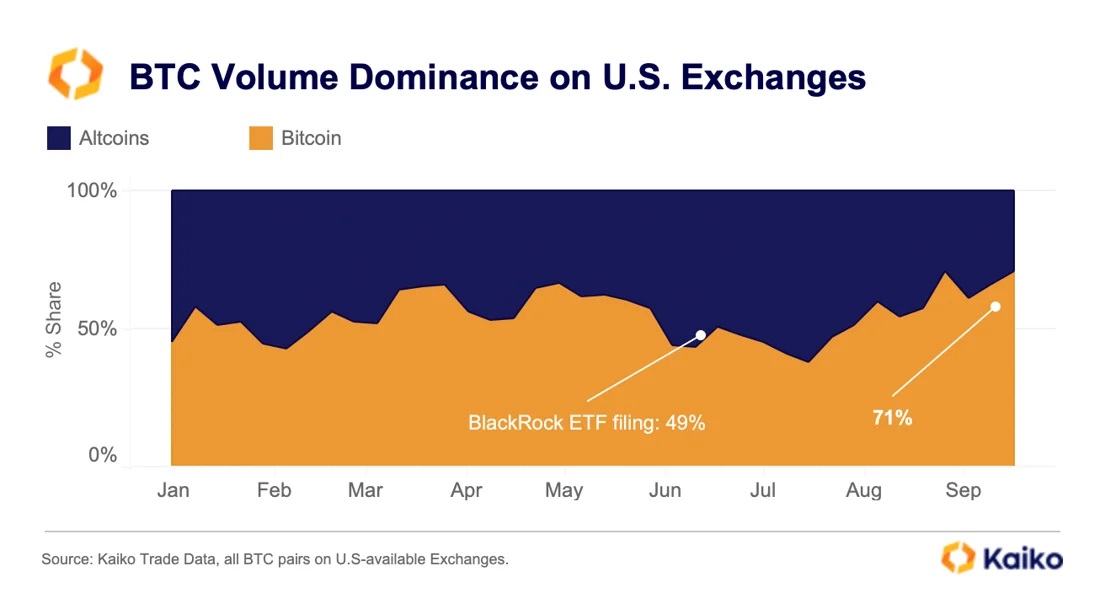

Credit for this primarily goes to the SEC, which is trying to get Ethereum labelled a security and is prosecuting market participants for providing access to staking. The consequences are clearly demonstrated by the share of Bitcoin in the US market, which has grown to 71%. Internationally, Bitcoin accounts for 50% of market share.

On the contrary, Bitcoin is the only cryptocurrency that SEC Chairman Gary Gensler has confidently called a commodity since 2023. The change in rhetoric from labelling it a dubious instrument to a financial asset led to the largest investment companies, including BlackRock, filing applications for a spot Bitcoin ETF. Their approval is expected to come in late 2023 or early 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.