850,000 ETH worth $1.8 billion in line to be unstaked

On 12 April, the Shanghai hardfork allowed validators to withdraw staked funds. Despite a delay to unstake funds by the largest staker (Lido), the total amount ready for withdrawal already exceeds 850,000 ETH, which is worth about $1.8 billion.

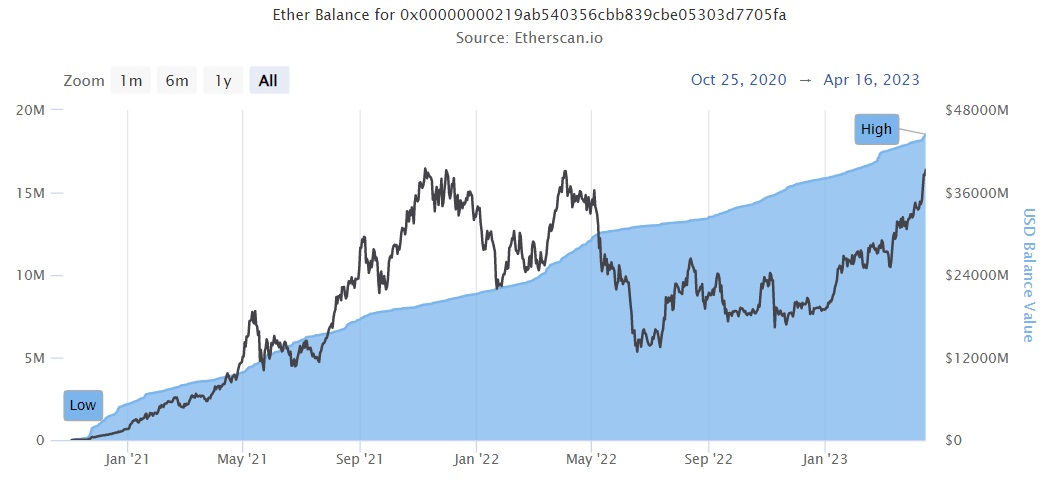

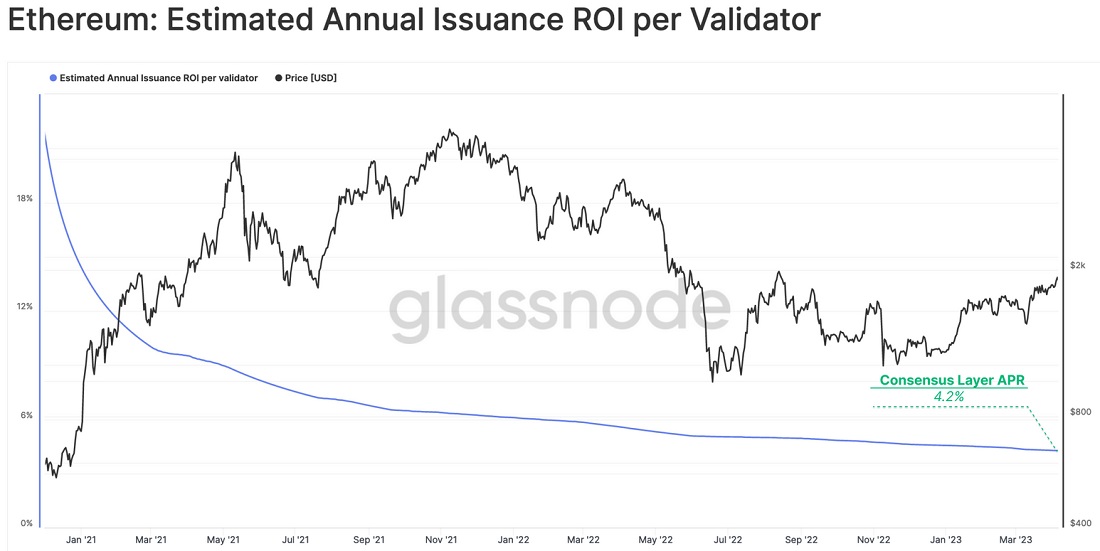

For 2.5 years, validators could participate in the network by depositing ETH under a contract. They couldn't withdraw funds, however, including the income generated from staking. The high annual returns and the growing market of 2021 seemed extremely attractive. But as the number of participants grew, the rate of return declined and is now just over 4%.

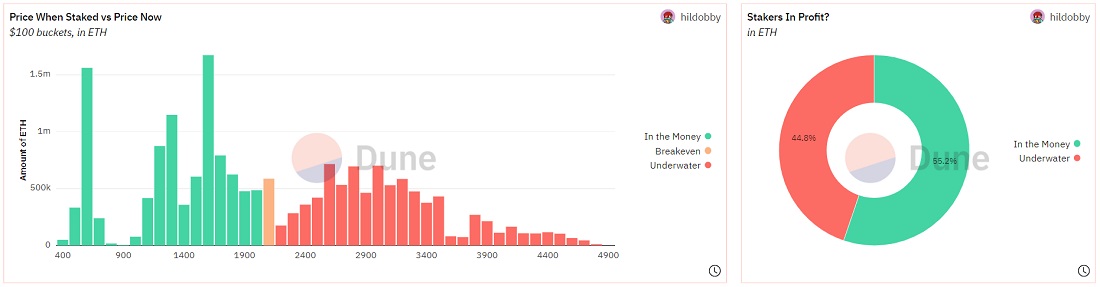

The market decline last year resulted in almost half of investors still incurring unrecorded losses.

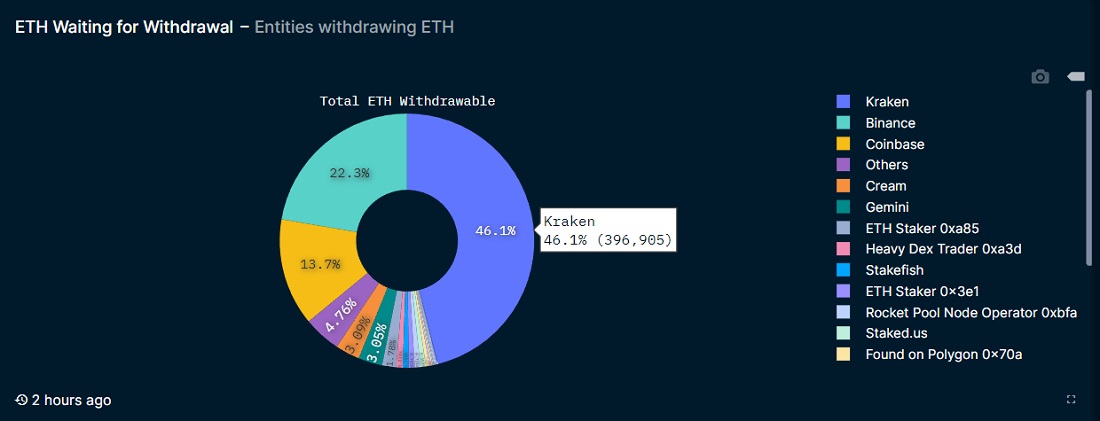

Some investors may have become disappointed by the price movements, while others grew concerned by stricter regulation on PoS coins. The SEC and NYFDS proclaimed Ethereum to be a security in their legal claims against a range of companies. That's the reason why Kraken agreed to stop providing staking services. However, Coinbase intends to appeal the regulator's claims in court (although a settlement similar to Kraken's is still a viable option).

Kraken has a 46% share in the queue ready for withdrawal due to the forced winding down of staking. Lido, the market leader, isn't on the list. Its funds will only become unstaked in May.

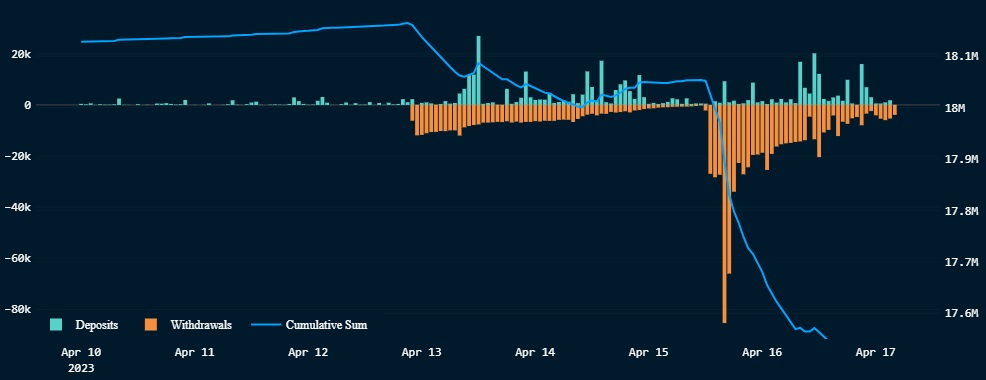

There is a total of 850,654 ETH from 26,328 validators in queue for unstaking. That means that around 5% of staking participants are exiting the programme. In the last 24 hours alone, the net outflow has exceeded 100,000 ETH (including the withdrawal of staking rewards).

The exit of validators has a delayed negative nature. First, the outflow rate is technically limited by the formula: Churn Limit = Active Validators/65536. In other words, there's a limit of 1,800 withdrawals of 32 ETH or 75,600 ETH per day (not including staking rewards). Second, clients of Lido, which has a 31% share in staking, haven't even queued up yet. Third, the desire to withdraw ETH from staking doesn't imply an intention to sell them immediately.

The hardfork event is overall a positive one, as it makes the network more investor-friendly and paves the way for further improvements. This was reflected in Ethereum's price growth over the past six days. The altcoin still lags behind Bitcoin in 2023, and the delayed negative nature of the unstaking may prevent further consolidation.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.