ETF approval to cause drop in Bitcoin price

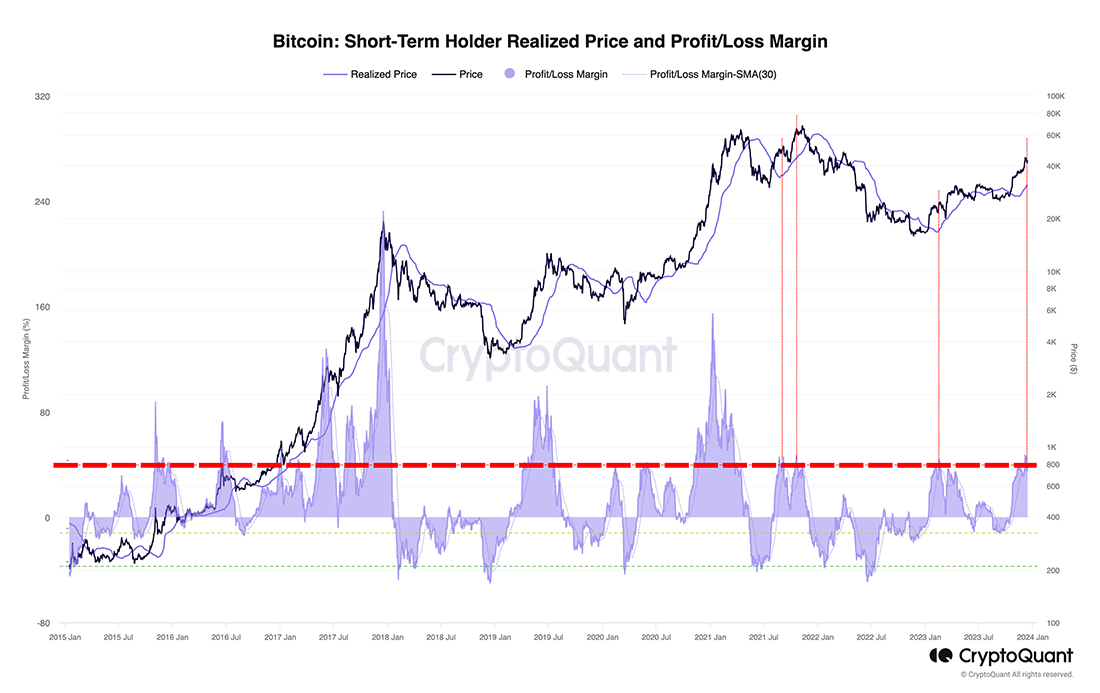

Most market participants are expecting the launch of spot Bitcoin ETFs in the US to lead to a rally, but a number of experts have warned that Bitcoin's value could drop substantially. The CryptoQuant analysis agency notes that short-term holders are sitting on a high rate of unrealised profit, which historically has been followed by a significant correction.

The approval of ETFs will trigger a "buy the rumour, sell the news" scenario, and the start of the correction will lead to a cascade of liquidations of margin positions, pushing the price even lower.

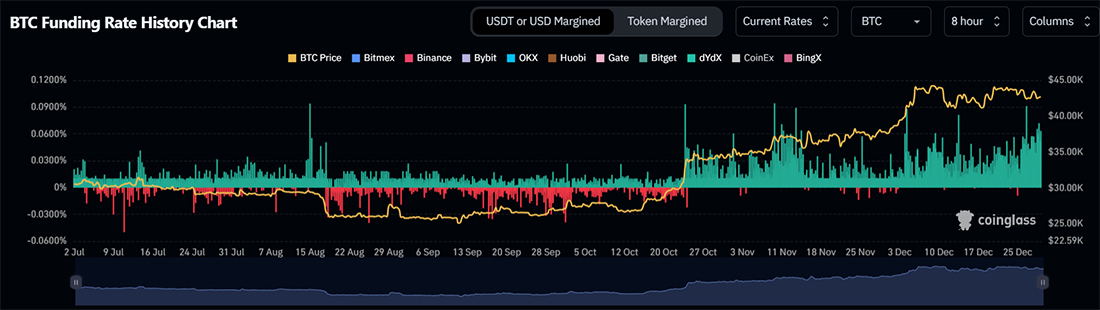

The funding rate has been far into the green since late October, indicating a heavy predominance of bulls in perpetual futures contracts.

CryptoQuant estimates that the launch of ETFs on 10 January will lead Bitcoin to correct to $32,000 by the end of the month.

Cathie Wood of Ark Invest offered a similar assessment:

Those who have been moving in and enjoying some nice profits will probably sell on the news.

BitMEX co-founder Arthur Hayes sketched out a more negative scenario for Bitcoin when the new investment products appear. He believes that a major success could ultimately leave exchange-traded funds holding all the coins, with investors simply transferring money from one account to another. That would kill Bitcoin because transactions would dry up and miners would cease to service the network.

John Reed Stark, a former department head at the SEC, commented sarcastically about the future ETFs:

The very idea of a bitcoin spot ETF remains a laughable concept...because a bitcoin spot ETF is perhaps the most 'centralized' crypto contraption conceivable.

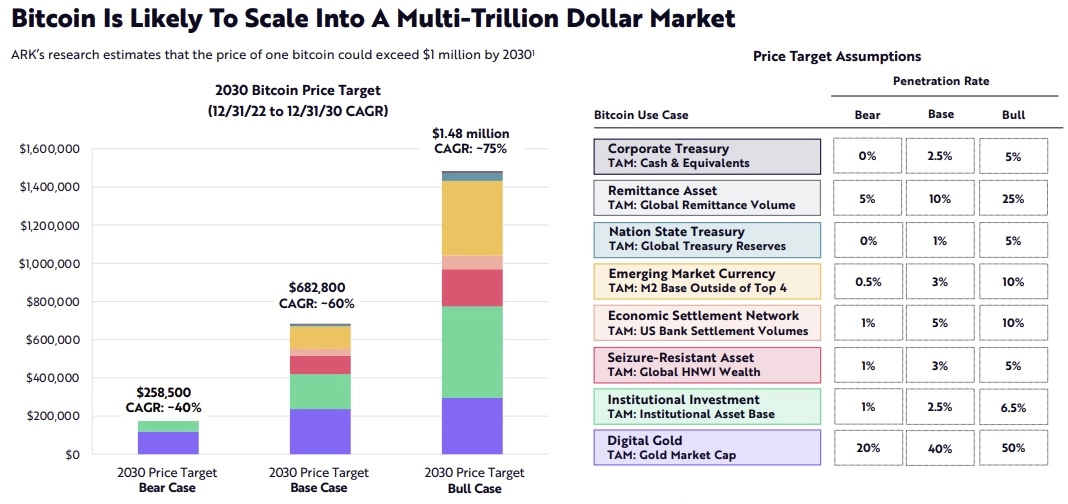

But, despite the potential for a selloff in January, both CryptoQuant and Ark Invest remain bullish for the longer term. Ark Invest forecasts that Bitcoin's price will be between $260,000 and $1.5 million by 2030.

For Bitcoin, which saw extremely low relative drawdown rates in 2023, a possible 25% correction in January would be nothing out of the ordinary. But even that is improbable due to the substantial flow of investments that is expected to coincide with the launch of ETFs. The market's low depth since the FTX's collapse, on the other hand, means a considerable rise in volatility is expected.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.