Ethereum may be recognised as a commodity like Bitcoin

US authorities may make an exception for the digital currency Ethereum in order to protect investors' interests and classify it as a commodity rather than a security, experts at US investment bank JPMorgan believe.

They reached these conclusions after the litigation between the SEC and Ripple, a case that started back in 2020, resulted in the release of the "Hinman documents".

They reveal the position of William Hinman, the former head of the SEC's Division of Corporation Finance, that he shared in 2018. At the time, he said that neither Bitcoin nor Ethereum could be considered securities.

This thesis has led experts at JPMorgan to believe that the regulator will make an exception for Ethereum and not include it in the list of assets that qualify as securities. In this way, the asset would avoid the strict regulation it would be subject to under US law.

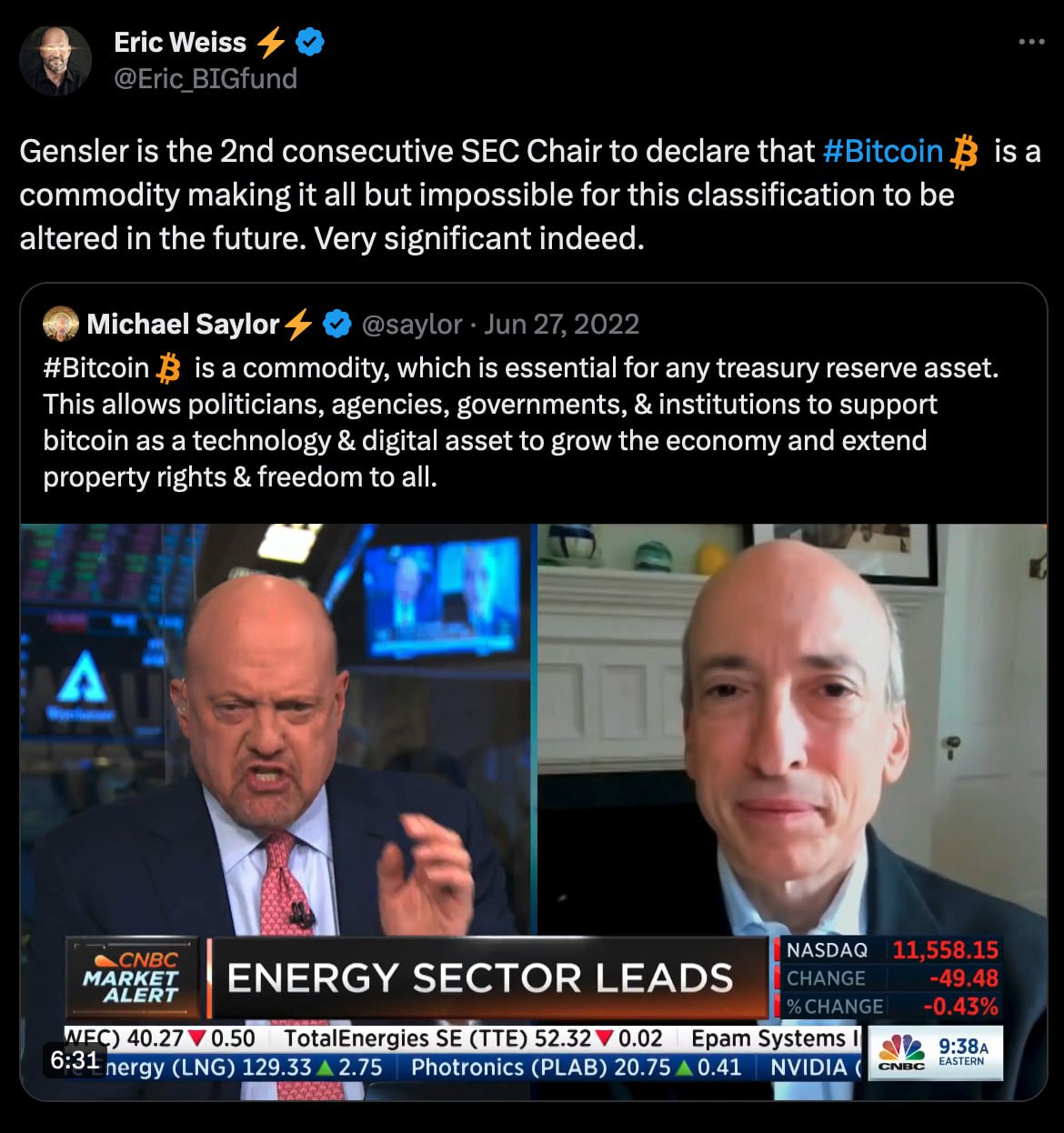

However, in early 2023, current SEC chief Gary Gensler classified only Bitcoin as a commodity and once again reiterated his position on the issue in June. In doing so, he declined to answer a question about Ethereum's status.

ETH is currently valued at just over $1,840 on the market and is the second-largest cryptocurrency by market capitalisation among all digital assets in the world at over $200 billion.

Of course, the possibility of Ethereum joining Bitcoin and avoiding the risk of being recognised as a security opens up very good prospects for this digital asset. As investor interest in the token increases, it could rise to the psychological $2,000 mark and subsequently even higher than that.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.