Everyone's buying Bitcoin: From shrimps to institutional investors

Last week's events have led to two interesting trends. First, cryptocurrency exchanges have experienced an influx of stablecoins to exchange for Bitcoin and Ethereum. Secondly, cryptocurrency funds saw a record-high inflow of funds in the past 14 weeks.

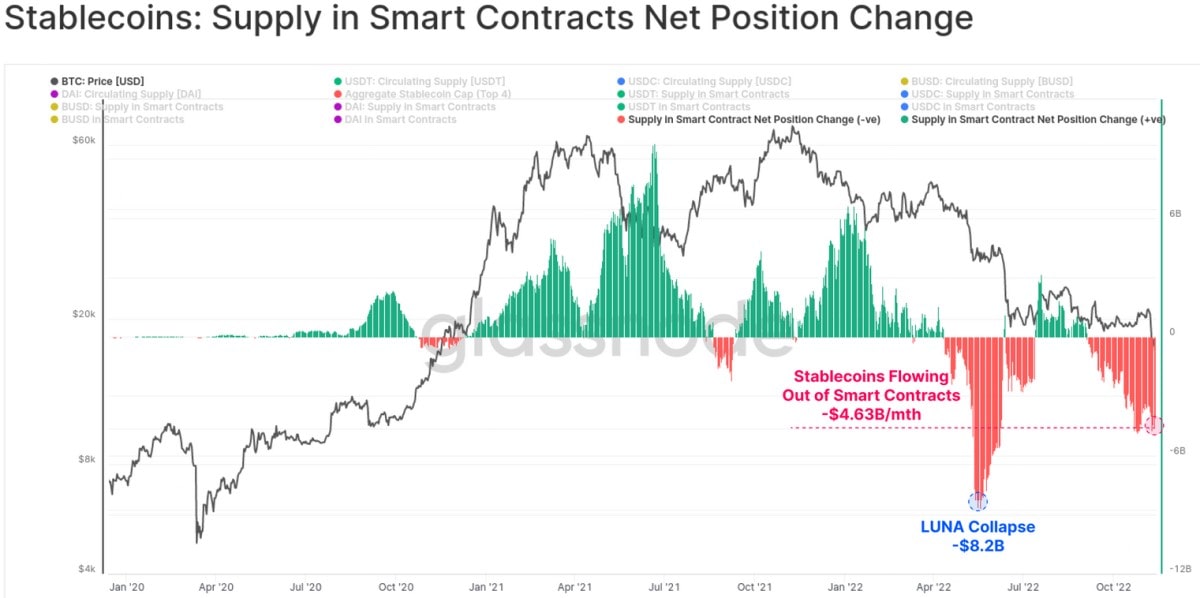

The total volume of stablecoins on crypto exchanges has reached an all-time high of $41 billion. On the one hand, the growth was driven by a sell-off in the DeFi sector. The market shrank from $56 billion on 6 November to the current $44 billion, and Ethereum's smart contracts alone saw the rate of stablecoin withdrawals reach $4.6 billion per month.

On the other hand, most stablecoins are like FTT (the FTX crypto exchange's token), a centralised product whose collateral should be closely examined. Because the community remains suspicious of Tether, USDT's capitalisation has experienced a drop of 5% or $3 billion over the course of the week.

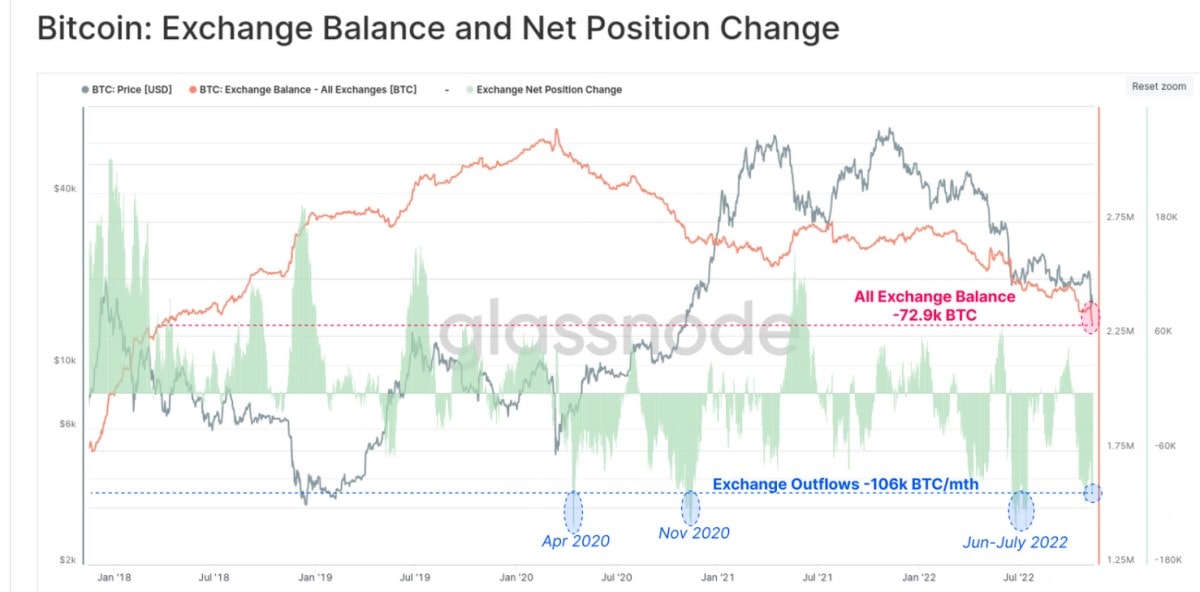

In exchange for stablecoins, users are buying up Ethereum and Bitcoin to withdraw to cold wallets since the viability of decentralised assets doesn't depend on the fate of an individual platform. The rate of coin outflows from cryptocurrency exchanges reached 1.6 million/month for ETH and 106,000/month for BTC. The indicators reflect that a local bottom has been reached.

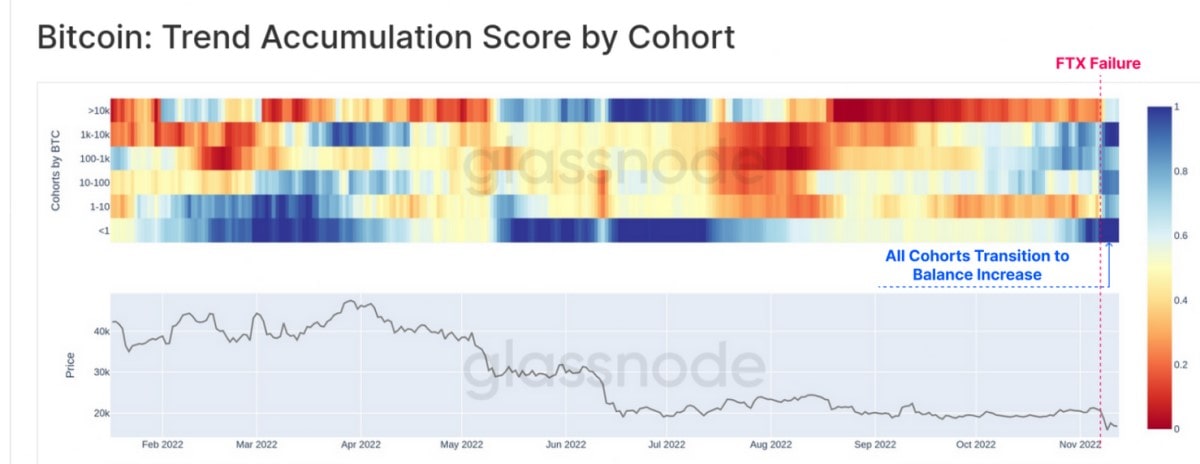

All ranked groups, from whales (>1,000 BTC) to shrimps (<1 BTC), are now accumulating. The latter group is showing activity not seen since 2017, adding 33,700 BTC to their holdings in just one week.

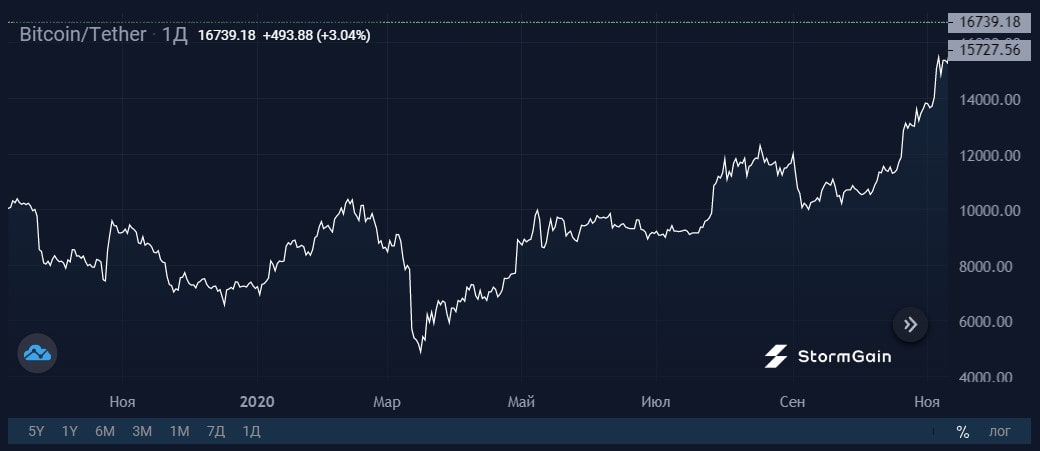

Edward Snowden, a former NSA employee and a participant in the Zcash launch ceremony, has talked about his investment itch on social media. He last stated his desire to buy Bitcoin in March 2020, when it was trading at $5,000.

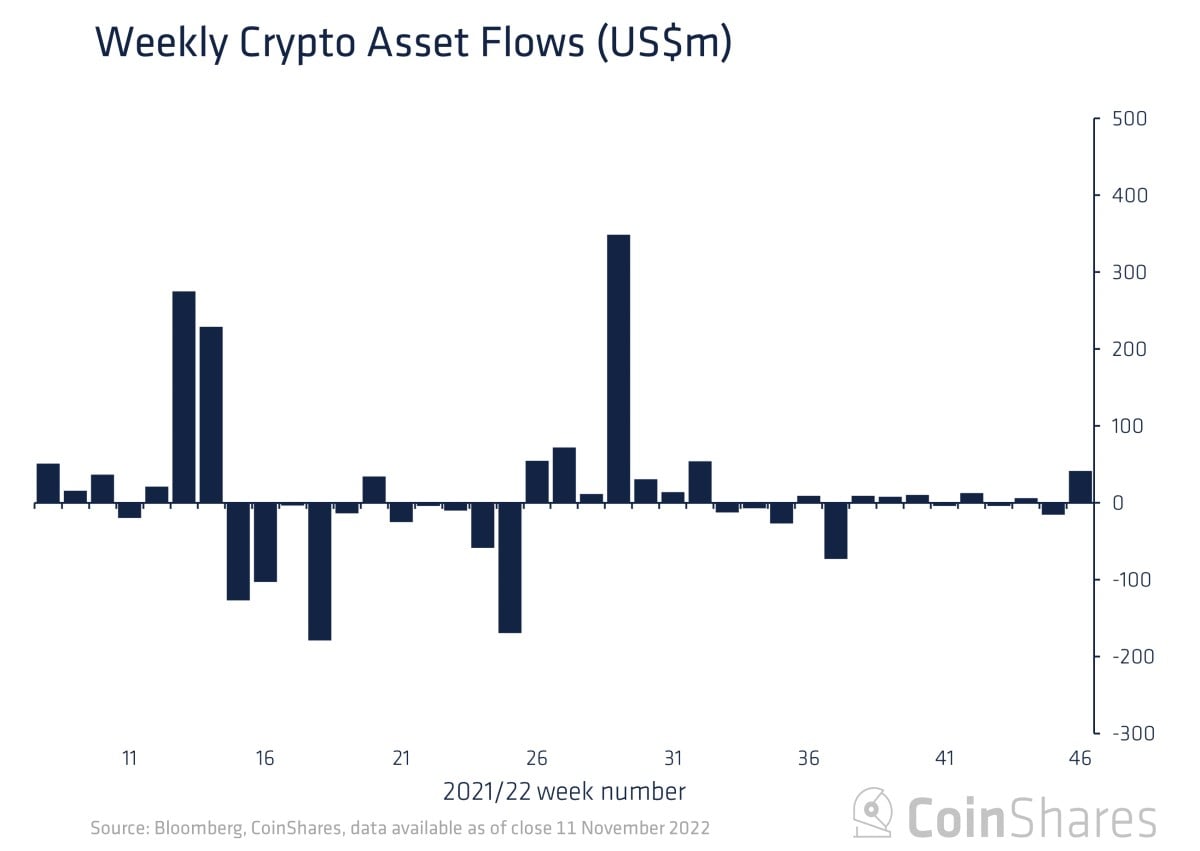

Even the most cautious, Fed-sensitive institutional investors have boosted investments in cryptocurrency funds. Excluding short positions (when the fund profits off of Bitcoin dropping), the weekly inflow was $29.7 million.

Rising hodl sentiment suggests that Bitcoin is oversold in the valuations of the cryptocurrency community and investors, but they alone don't guarantee further growth of the cryptocurrency. FTX's bankruptcy could lead to the liquidation of several smaller crypto projects, each of which would sell coins to cover losses.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.