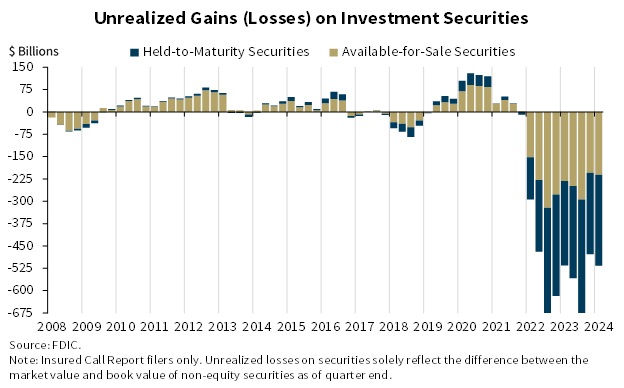

FDIC: US banks' unrealised losses rose to $517 billion

The US banking sector remains depressed after monetary tightening in 2022. This is clearly evident in the significant increase in unrealised losses, which stood at $517 billion in Q1 2024.

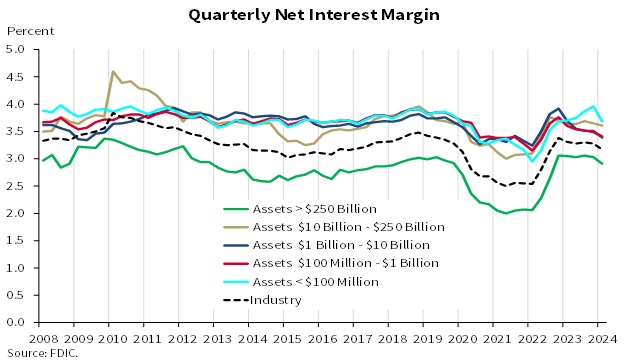

Due to tighter credit conditions and lower yields on a number of assets, the net interest margin fell to 3.17%, down from a pre-crisis average of 3.25%.

A prime example of the impact of a high key rate was the bankruptcy of Silicon Valley Bank (SVB) last year. Treasury bonds on the balance sheet (about $100 billion at the time) lost a lot of value after the regulator's action. The need to sell to settle deposits resulted in significant losses, news of which increased panic and deposit outflows.

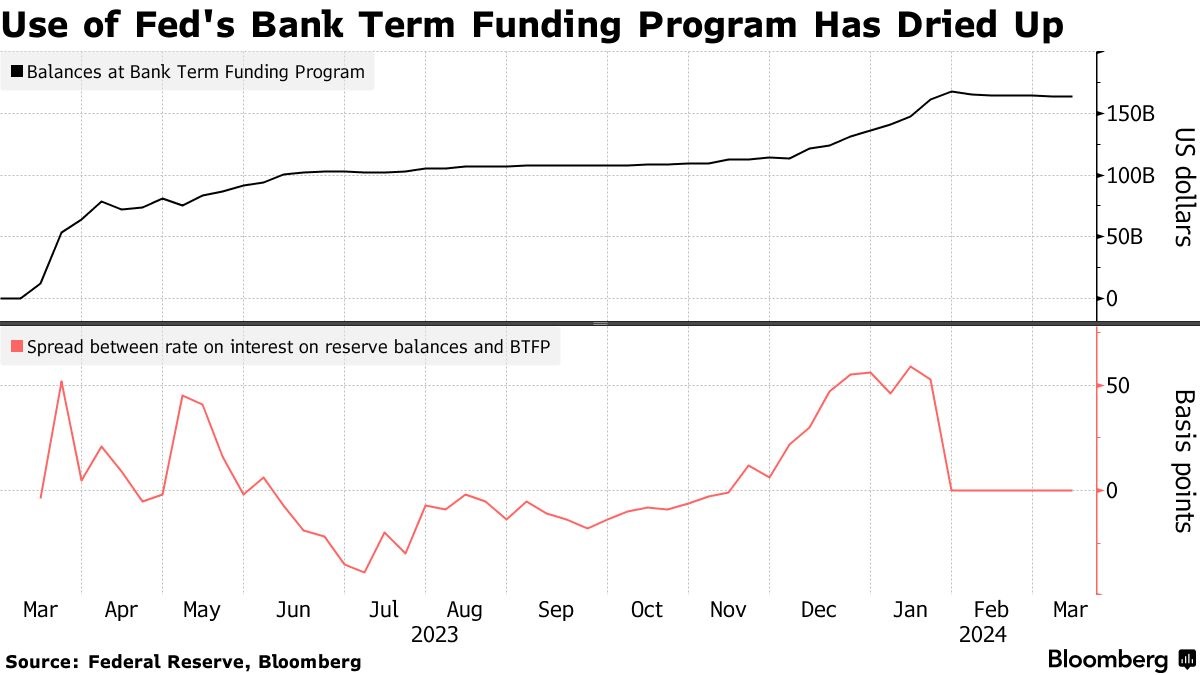

SVB failed and filed for bankruptcy. In response, the Fed announced special terms for banks, allowing them to sell bonds to the regulator at the purchase price rather than the market price. The regulator has also launched an emergency credit line for the sector. Total loans disbursed for the year exceeded $150 billion. The programme was wound down on 11 March.

When three banks in a row failed last spring, and First Republic had to be rescued by government intervention and a consortium of banks (it still went bust a year later), Bitcoin experienced a significant influx of investment. Its independence from financial institutions and decentralisation were once again in demand.

The situation may repeat itself in the near future as the banking sector continues to struggle. According to the Federal Deposit Insurance Corporation (FDIC), the number of troubled banks rose from 52 to 63 in the last quarter and their total assets increased by $15.8 billion to $82.1 billion.

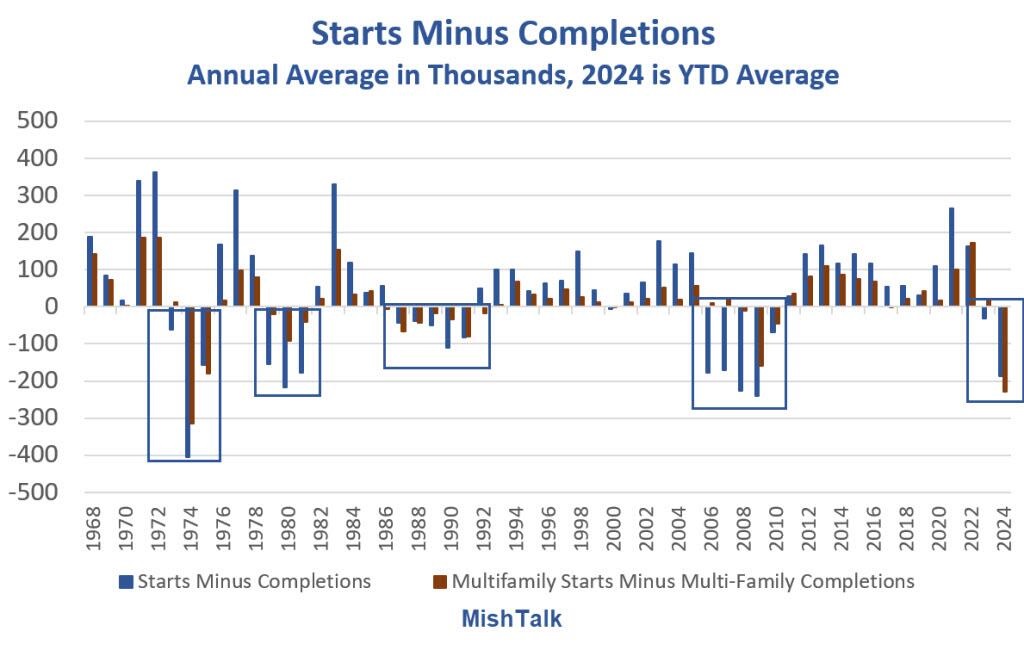

Lending, which is one of the main sources of income, is showing a slowdown. Meanwhile, the real estate sector, which is the leading sector for the banking industry, is signalling an impending crisis. In particular, a significant decline in the number of new housing starts compared to completions is being seen. The last time this happened was before a large-scale recession.

All of this will lead to a drop in banks' operating profit in the near future. With a high key interest rate, new shocks and a string of bankruptcies are likely to occur.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.