Fed losses will lead to Bitcoin's growth

Distortions in monetary policy are leading to increased uncertainty. US Treasury Secretary Janet Yellen is warning of risks to financial stability, while analysts at Bank of America are calling Bitcoin a potential saviour from inflation.

How everything started

The Federal Reserve is the biggest power in the global financial market, and the US dollar accounts for 59% of the volume of international reserves. The Fed's policy predetermines the actions of other financial regulators and sets the main flows for international capital.

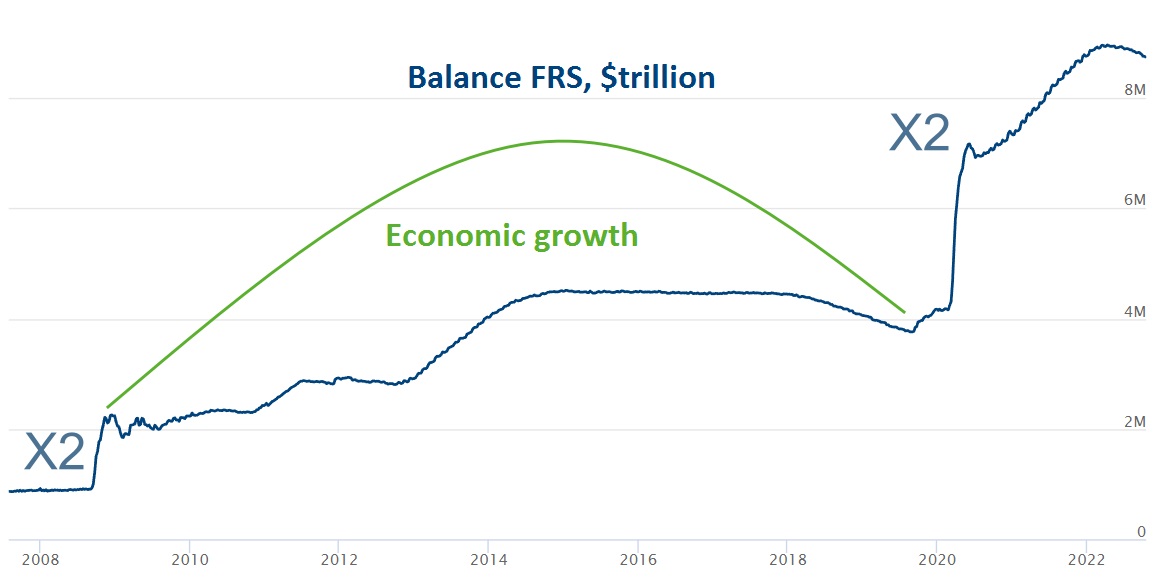

During the 2008 global financial crisis (which began with the US mortgage crisis), the Fed more than doubled its balance to support the economy, buying up assets and injecting money into the economy. During the last growth period between 2010 and 2020, the regulator was supposed to offload this balance but didn't do so.

With the arrival of the COVID-19 pandemic in 2020, the Fed has again more than doubled its balance sheet, and the dollar money supply (M2) has grown by 35% in two and a half years.

Consequences

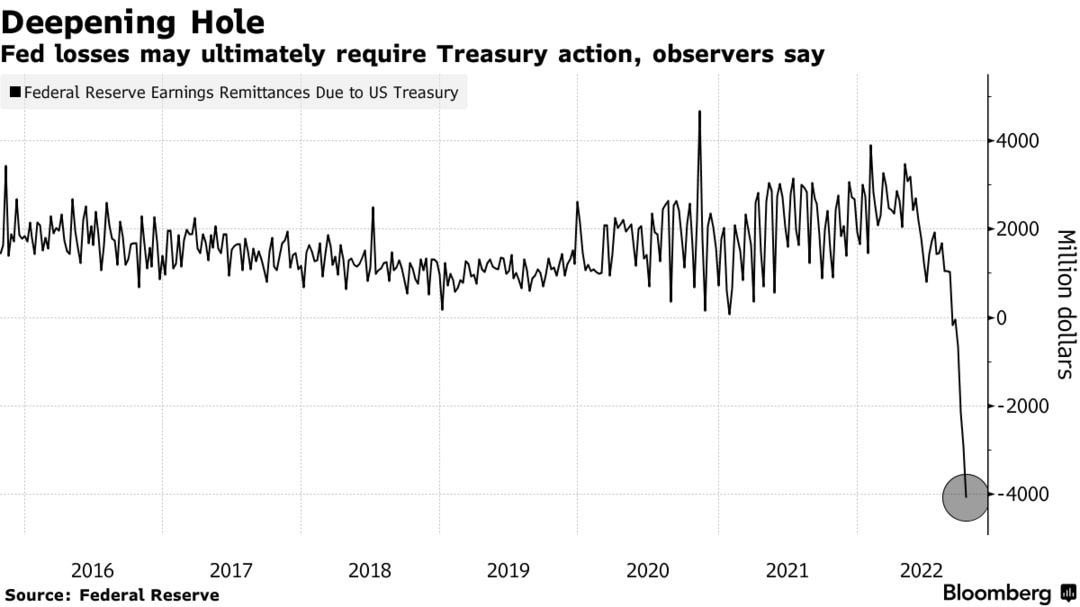

The subsequent inflation was not only a natural phenomenon but an inevitable one, too, given the extreme monetary injections. To stop it, the Fed is raising interest rates, making borrowing money more expensive. As a result, this year, the Fed has accumulated a debt with the US Treasury of $5.3 billion.

The US national debt is $31 trillion, and servicing it is becoming more expensive. In the period from October 2021 through May 2022 alone, interest payments rose by 30% to $311 billion. In the next 10 years, the payments are forecast to reach $8.1 trillion.

A series of analysts justifiably assume the Fed will be forced to loosen its grip ahead of time and eschew further hiking interest rates at the beginning of next year. If by this time, inflation doesn't reach the target zone between 2.0-2.5% (something which is unlikely), the regulator will have a really hard time.

Change in sentiment

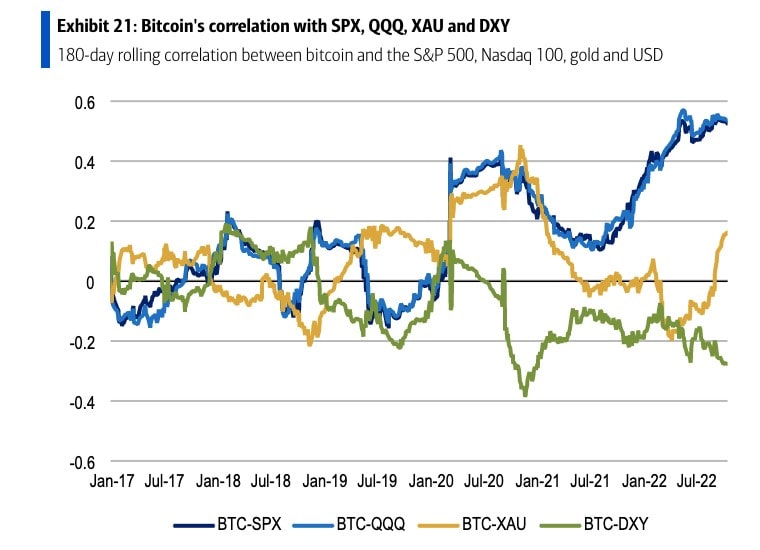

If the above scenario plays out, a number of analysts, including those at Bank of America, expect the dollar to weaken as interest in deflationary assets grows. In this regard, they note Bitcoin's growing correlation with gold:

Bitcoin is a fixed-supply asset that may eventually become an inflation hedge.

The Fed is currently trying to tame inflation by quickly raising its key interest rate. This has already led to an increase in the regulator's losses, which will need to be repaid in the future. The interest rate hike is also leading to increased payments on government debt, an economic slowdown, the decreased competitiveness of American goods in the international market and a number of other negative factors. This could force the Fed to loosen its grip sooner than it wants, but then inflation would strengthen its position and Bitcoin would return to growth.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.