Fidelity: Bitcoin's average monthly return is seven times higher than the S&P 500's

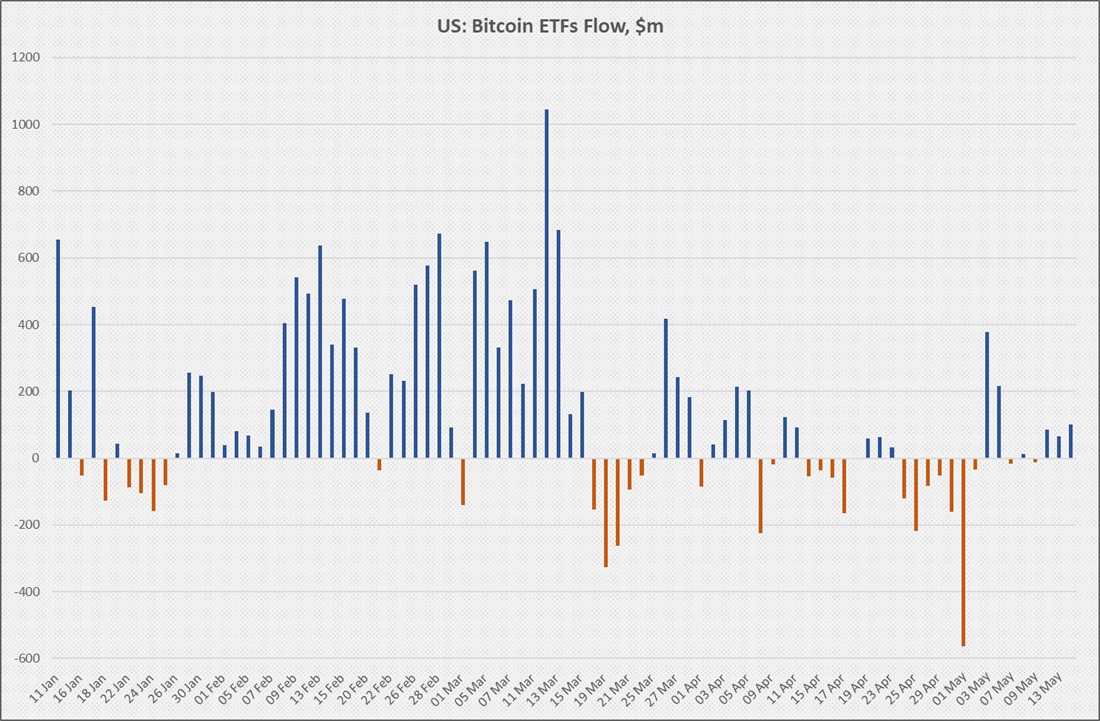

Bitcoin's global acceptance is hampered by two factors: regulatory risks and high volatility. After China's crackdown on cryptocurrencies in 2021, the industry started to see a streak of good luck when El Salvador recognised Bitcoin as an official means of payment. This year, the spot ETFs that have emerged in the United States have taken the baton.

Yesterday, the State of Wisconsin Investment Board was reported to have bought $100 million worth of shares of BlackRock's crypto fund in Q1 2024. The board manages $160 billion in assets, including state trust funds, such as the Wisconsin pension fund. Bloomberg analyst Eric Balchunas said on X that large financial institutions typically wait about a year before investing in a newly created ETF. Such a quick decision indicates increased interest in Bitcoin.

Regulatory risks are gradually receding. Even the SEC, a staunch opponent of cryptocurrencies, recognises Bitcoin as a commodity. However, it has lacked the reduced volatility until recently to attract really large capital inflows.

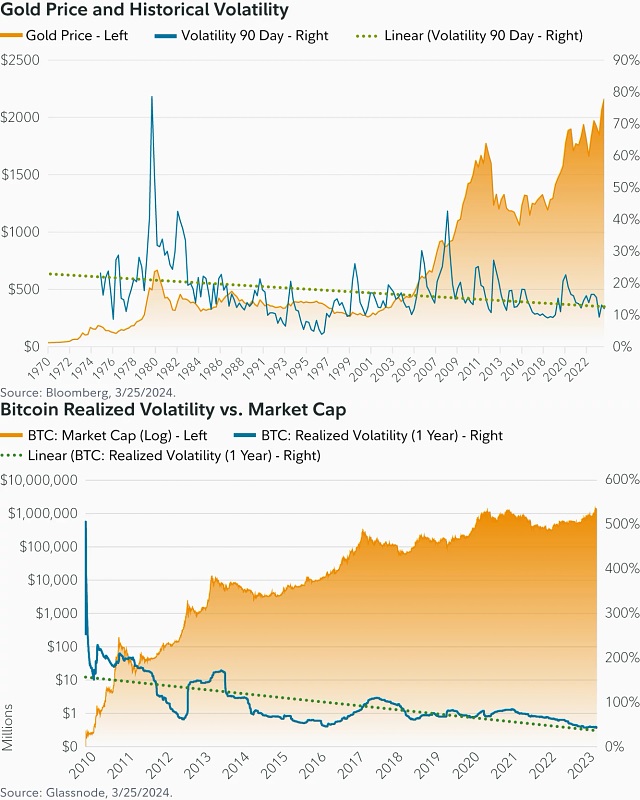

In May, Fidelity released a report analysing Bitcoin's volatility. First, significant fluctuations are inherent in most new markets, which diminish as capital accumulates. For example, the trend seen in Bitcoin resembles that of gold.

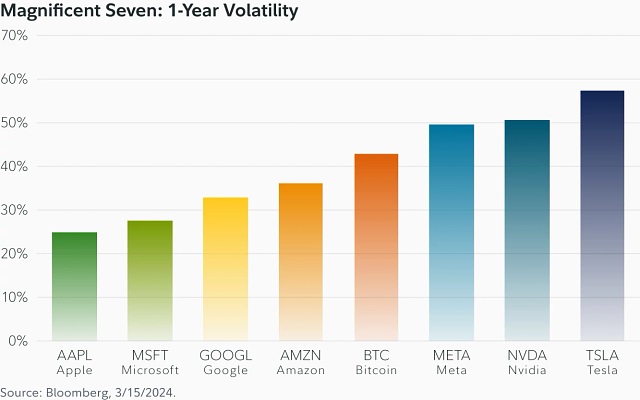

Second, annualised volatility is already at the level of top stocks and, as Fidelity predicts, will continue to decline as more gets invested into the cryptocurrency.

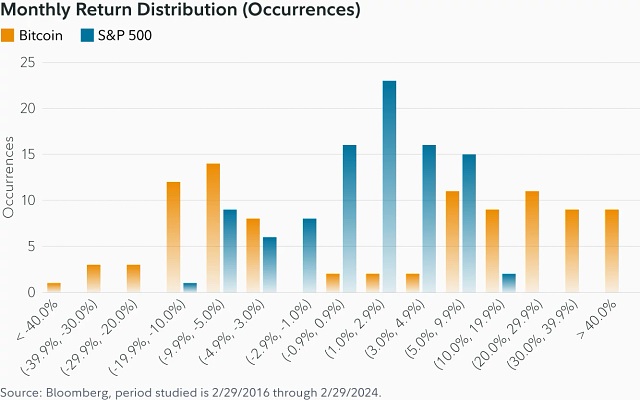

Third, although Bitcoin is significantly outperforming the S&P 500 broad market index in terms of volatility, long-term investors are generously rewarded for the risk they take. This is clearly reflected in Bitcoin's larger average monthly return (7.8%) versus the S&P 500's (1.1%) between 2016 and 2024.

Bitcoin is now on a long-term growth path because the influx of institutional capital will cause a decrease in volatility and make the cryptocurrency even more attractive to large market participants for investment.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.