Bitcoin hits new highs

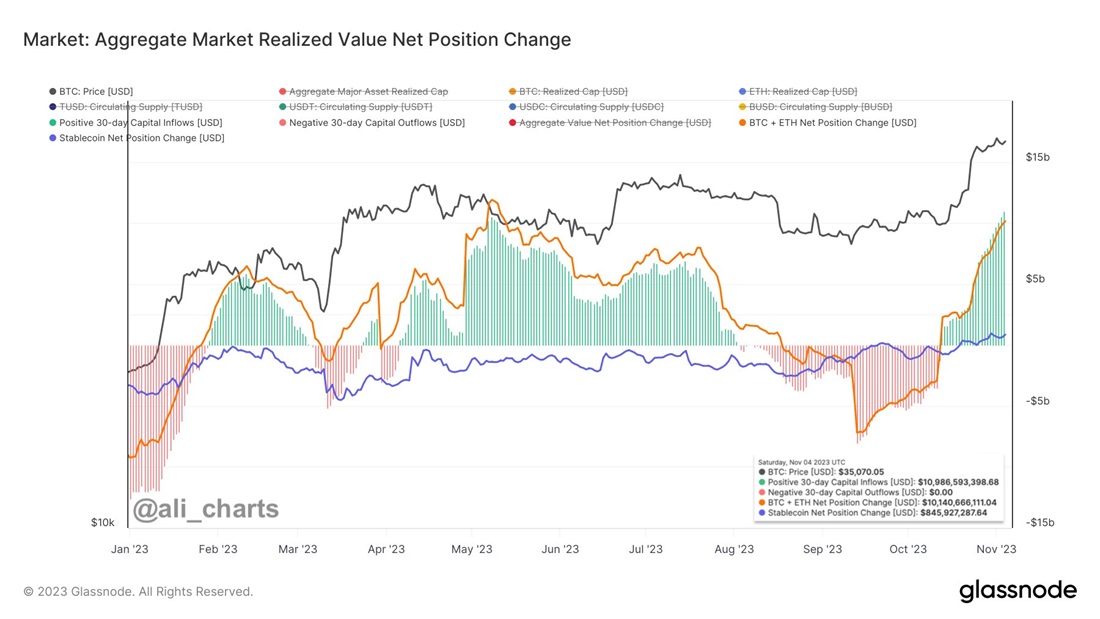

Renewed interest in cryptos led to new one-year and all-time highs. The net inflow of capital into digital assets over the past 30 days reached $11 billion, which is the best result in 2023.

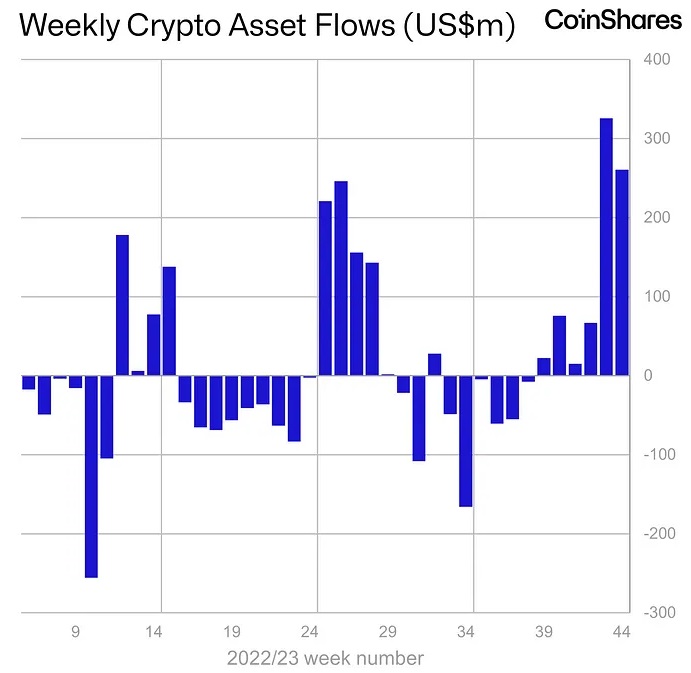

Over the past six weeks, $767 million of institutional capital flowed into crypto funds, exceeding the $736 million seen in all of 2022. This is the best level since the end of 2021 when the bull market went into decline.

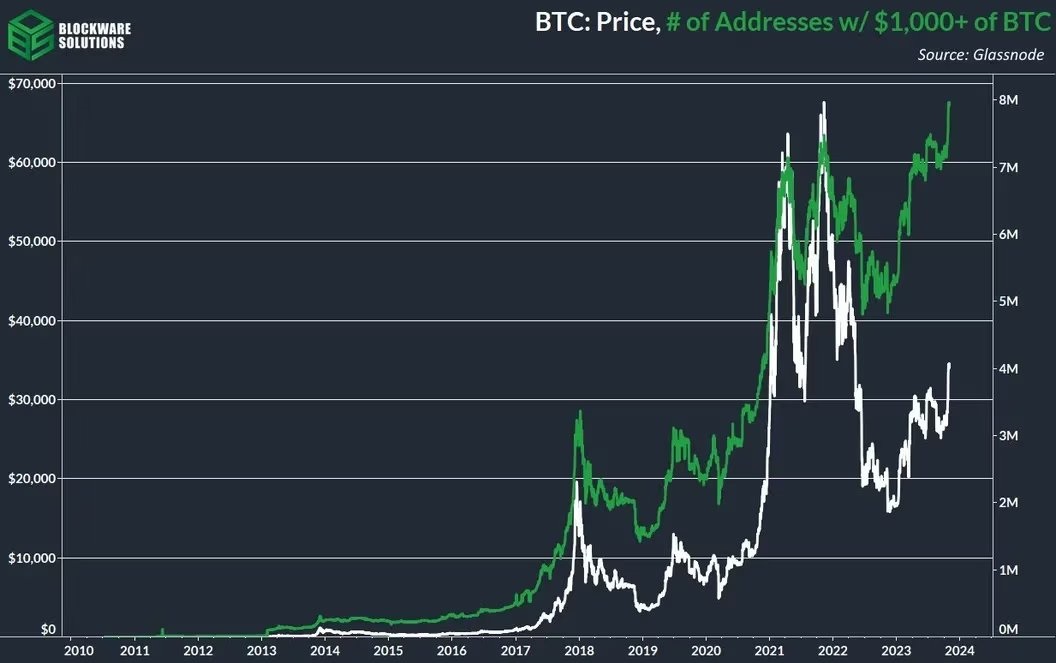

The influx of fresh capital and the reluctance of long-term hodlers to part with their reserves has less to a new high for the number of addresses containing more than $1,000 in BTC. There are now over 8 million such accounts.

CME's open interest in Bitcoin futures on the Chicago Mercantile Exchange is at $3.7 billion, its best level since December 2021. This once again testifies to the increased interest among large capital and the formation of steady demand for the crypto.

The price is at its highest level in 18 months and is currently testing the resistance level at $35,000.

The network hashrate is growing by leaps and bounds. This year, it's increased by 75% to 470 EH/s. By comparison, over the past year, it rose by just 50%. In the absence of a technological revolution, this speaks to an ongoing 'arms race' in the industry and miners bringing additional equipment online.

There are a variety of reasons for interest in the crypto, including the expected appearance of the first spot Bitcoin ETFs in the United States, the upcoming halving event in April 2024, a reduction in the circulating supply, and the Fed potentially reversing its monetary policy.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.