Good and bad news for Ethereum

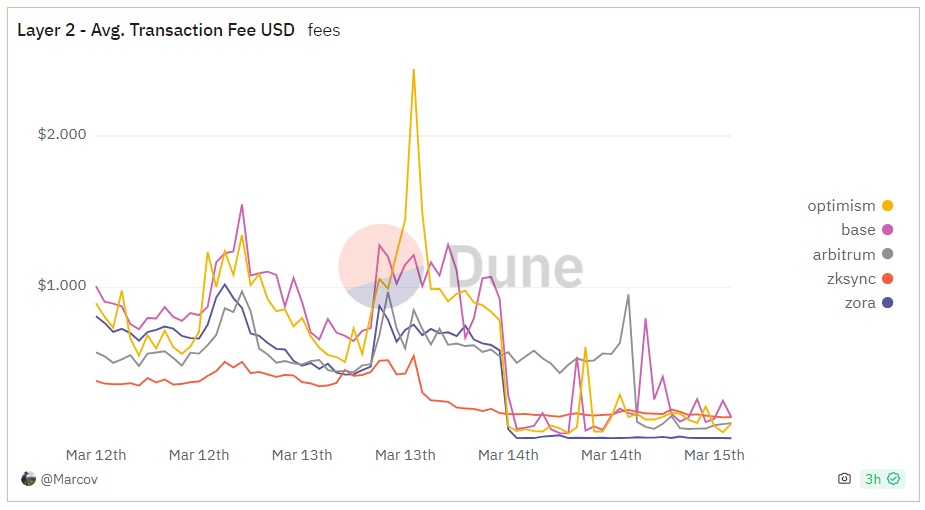

On 13 March, Ethereum carried out the most complex hard fork since the transition to PoS, Dencun, with proto-danksharding taking centre stage. This enhancement allows additional data to be stored in objects called blobs. To validate a bundle of transactions from a layer-2 (L2) network, only the blob needs to be validated instead of each individual transaction. This results in a significant reduction in commissions on the L2 network.

The hard fork has reduced L2 costs nearly tenfold. For example, on average, the costs on Base (Coinbase network) decreased from $1.10 to $0.14 and from $0.70 to $0.08 on Arbitrum.

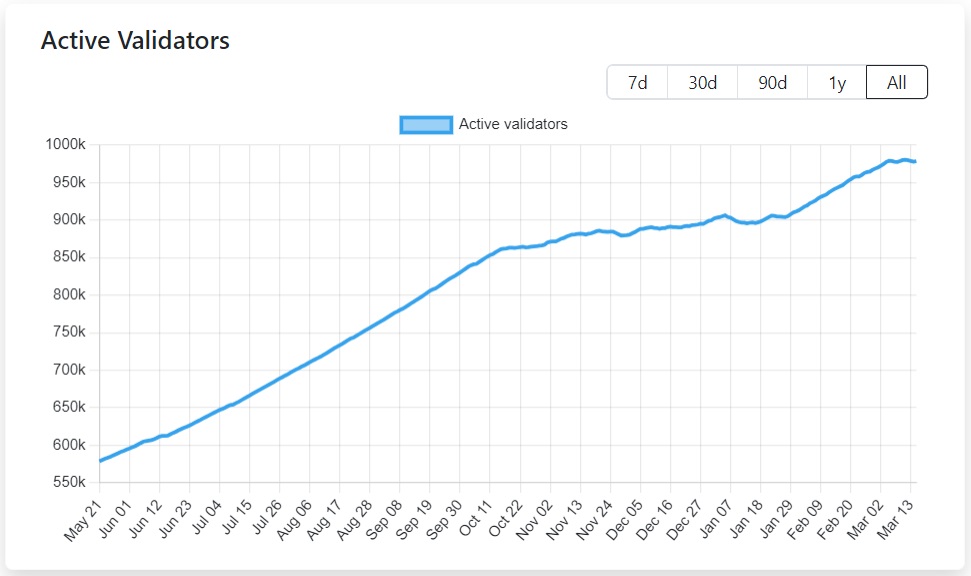

For Ethereum, which L2 networks use as a security guarantor, lowering fees is a great reason to increase scalability. Projects that can't use blockchain directly due to high user costs will host services on L2. That said, Ethereum still provides the final layer of security at the end of the day with its army of millions of active validators.

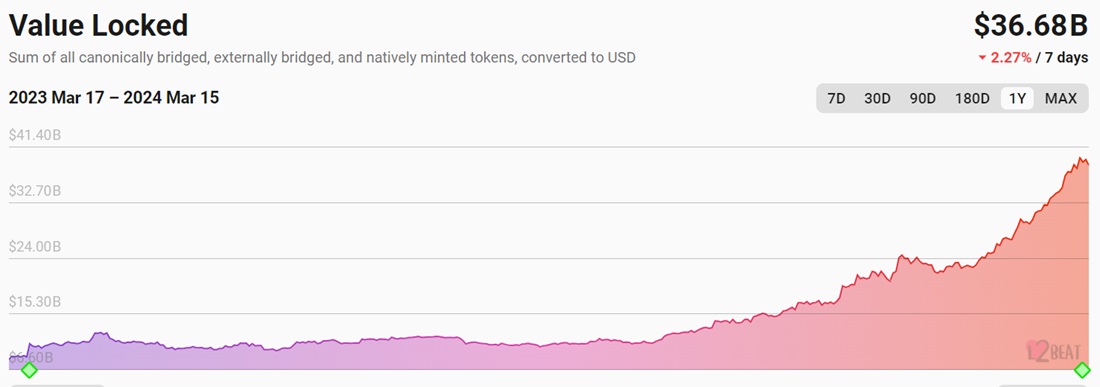

This year alone, funds staked in L2 have increased by 76% to $36.7 billion. Arbitrum ranks first among them, with a market share of 41%.

The bad news for Ethereum, however, is a letter from two US senators to SEC Chairman Gary Gensler, calling for the agency to refuse to authorise any further crypto ETFs and to probe managers, brokers and advisors who call these products "exchange-traded funds".

Note: Strictly speaking, the SEC has approved ETPs (exchange-traded products), which could include ETFs (exchange-traded funds). There are differences in the tax treatment and a number of other areas, most of which are set by the SEC when approving each ETP or ETF. In the letter, the senators demand that the regulator penalise financial advisers if they say "ETF" instead of "ETP", which, they allege, misleads investors. The vast majority of the press and crypto community, however, use "ETF" since it's a more familiar name.

The letter could serve as a basis for Gensler to refuse to authorise spot Ethereum ETFs, which has a deadline coming up in May. Bloomberg's Eric Balchunas, for example, has already revised the likelihood of these ETPs being approved from 70% to 35%. If the pessimism is justified, it would be a blow to Ethereum's investment appeal.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.