Has Bitcoin reached the bottom?

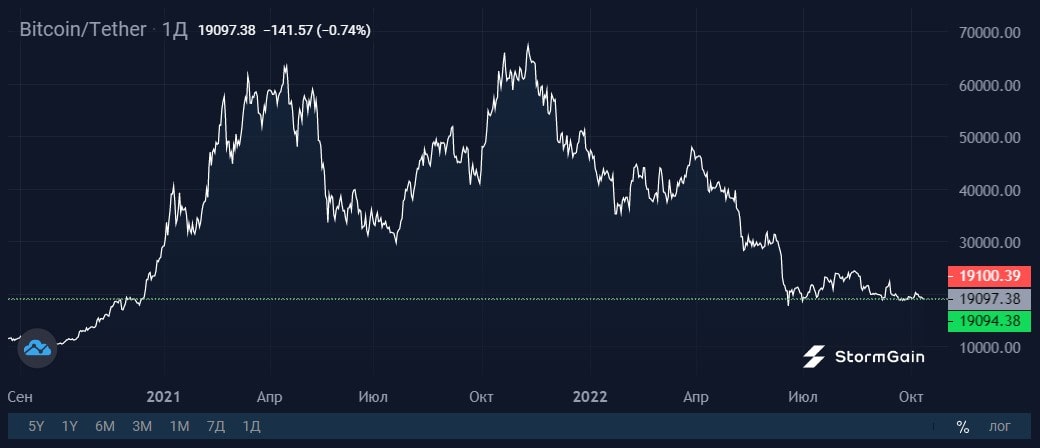

Bitcoin's consolidation around $20,000 has lasted 120 days, suggesting the formation of sustained support or a local bottom. When compared to the bearish market of 2018-2019, Glassnode sees repeating patterns in market participants' behaviour.

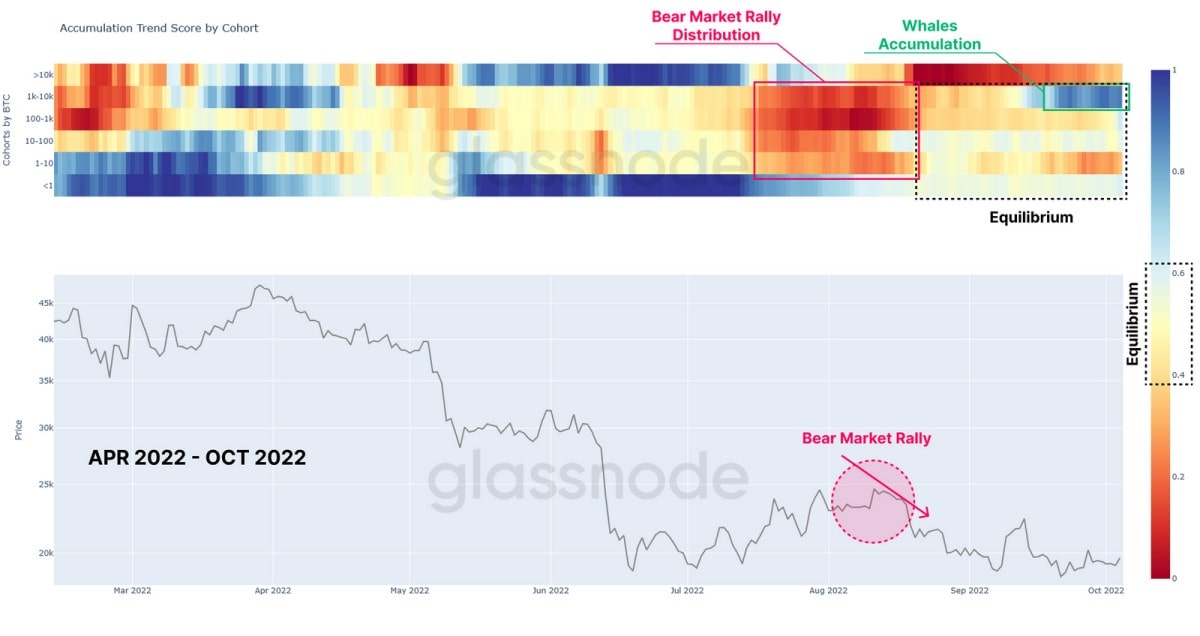

At the conclusion of the bearish trend in late August, after an active distribution of coins, a balancing phase came, And whales with wallets of 1,000 to 10,000 BTC have even switched to accumulation. The same trend in March of 2019 preceded a growth phase.

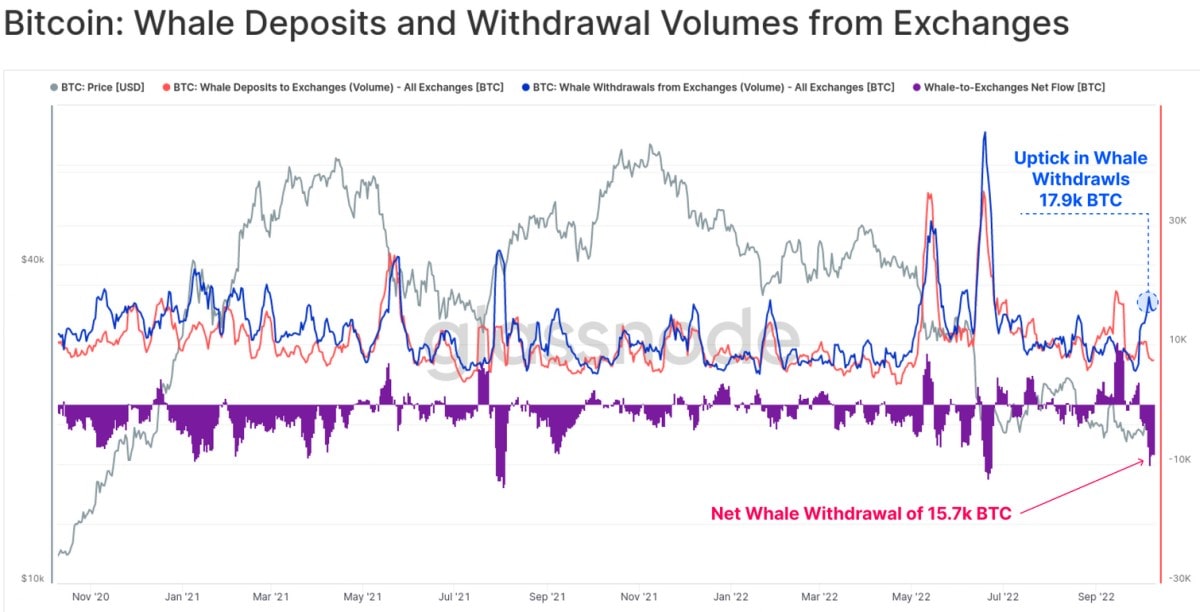

Another positive note is the net outflow from exchanges to the tune of 15,700 BTC initiated by the whales. This is the highest level since June of this year. The increased outflow suggests that the cohort is anticipating the coin's price to rise and is unwilling to sell in the near future.

However, when switching to time metrics, it becomes clear that too little time has passed for a real bottom to form. The Net Unrealised Profit/Loss (NUPL) indicator, the difference between realised profit or loss relative to market capitalisation, spent 301 days in the negative zone in 2014-2015, 134 days in 2018-2019 and only 88 days in the current phase.

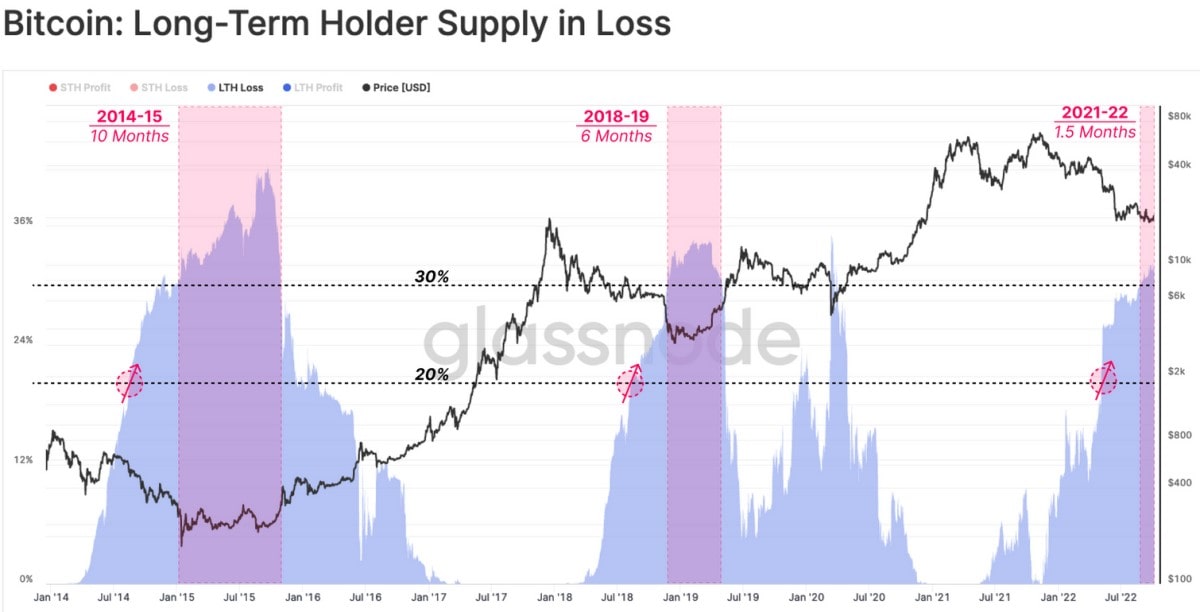

The Long-Term Holder Supply in Loss indicator shows an even larger gap between cycles (periods in which over 30% of LTH supply is at a loss are highlighted separately). In previous cycles, the gap lasted between 6 and 10 months. This time, it was only about a month and a half.

Meanwhile, the macroeconomic environment remains tense. In addition to an outflow of capital caused by tightening monetary policy, another world financial crisis can't be ruled out. As such, the cost of insurance against default for Deutsche Bank and Credit Suisse has approached levels last seen in 2008. The banks are key regional players whose bankruptcy could trigger a chain reaction similar to what Lehman Brothers did.

The intensity of passion in the financial sector is unlikely to bypass Bitcoin, which is trying to gain a foothold around $20,000.

If we speak about the key support level to which Bitcoin could fall, $15,800 is a psychologically significant level. According to Glassnode's analysis, this is the coin's realised price for whales (>1,000 BTC) who have traded since 2017.

StormGain Analytical Group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.