Fed strikes markets: US stocks lose $1.3 trillion as crypto drops $0.1 trillion

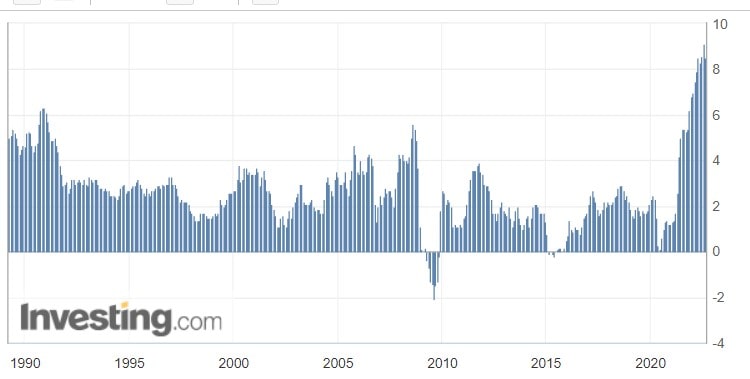

After US inflation fell from 9.1% in June to 8.5% in July, many investors became hopeful that the regulator would soften its stance and hold off on another rate hike until the end of the year. However, Fed chair Jerome Powell and his colleagues have preserved their hawkish sentiment, naming the fight against rising prices their number one priority.

Interest rates are one of central banks' key monetary policy tools. Simply put, as interest rates rise, credit becomes more expensive for businesses and ordinary people, which leads to an economic slowdown. Then, as the economy cools down, inflation slows.

The flip side of this economic slowdown is rising unemployment and social tensions. This requires regulators to ensure that their monetary policy decisions are balanced. Unemployment was a leading theme in Powell's speeches last year, while inflation was deemed "transitory".

On 26 August, at the Jackson Hole Economic Symposium, Powell gave a clear sign that bringing inflation under control was now of primary importance. He is prepared to allow a certain degree of unemployment and financial turmoil since "a failure to restore price stability would mean far greater pain". In other words, the Fed will continue to raise rates until it begins to see results.

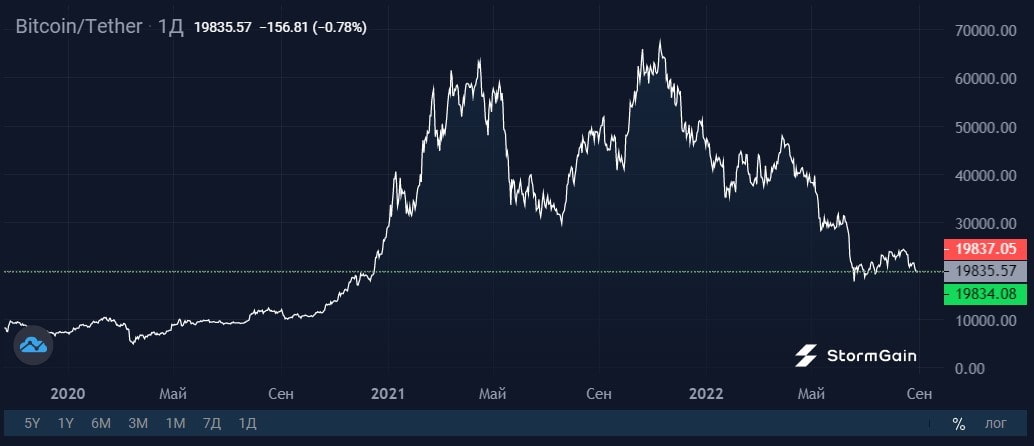

These hawkish comments from Powell – a man who is typically known for his soft policy and penchant for ambiguity – led to a slight panic in markets. As a result, the US stock market had $1.25 trillion wiped in a single session, with crypto losing $0.1 trillion over the course of the same day. Bitcoin has been in a downtrend since Friday and has fallen 8%.

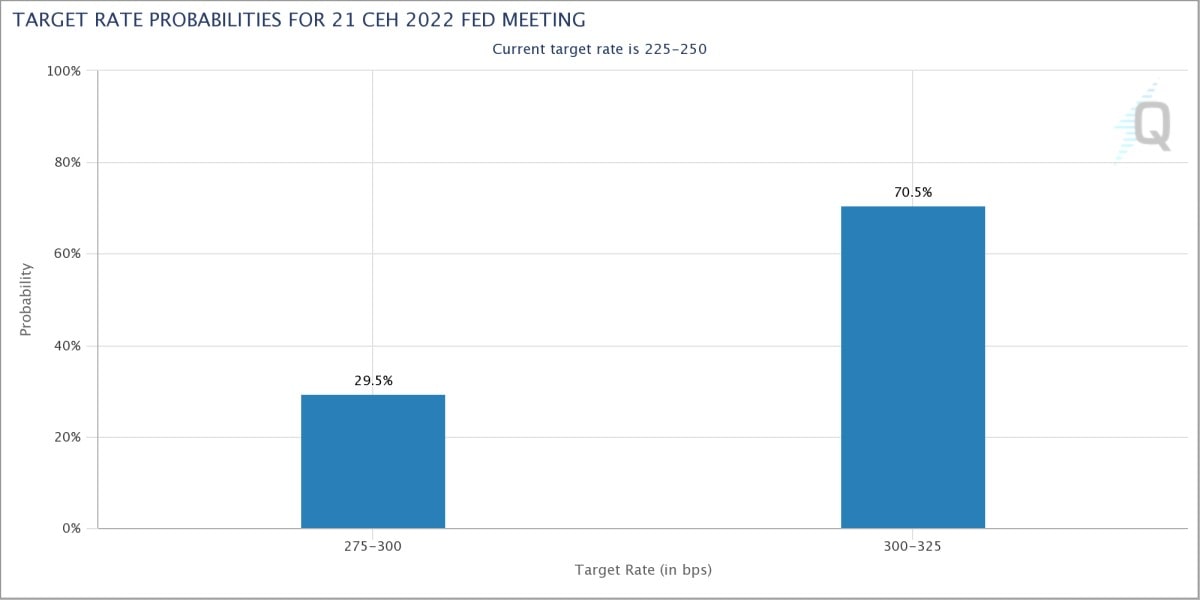

July's inflation numbers will be released on 13 September, while 21 September marks the date of the Fed's next rates meeting. There is currently a 71% probability consensus for a 0.75% increase. This is quite a significant move, especially given that in more prosperous times, the regulator would take more gradual steps of 0.25%.

Rate hikes this year have already led to a sell-off in a wide range of risk assets, with the US Dollar Index close to a 20-year high. Should this forecast prove correct, we are likely to see Bitcoin cement below $20,000.

StormGain Analytics Team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.