A hit on decentralisation: USDC loses ground

Financial regulators are increasing pressure on decentralisation, a key advantage of the cryptocurrency market. In August, the US Department of Treasury sanctioned Tornado Cash, which set a striking precedent in a move that market participants considered to be unconstitutional. Meanwhile, some crypto projects, including Circle (USDC), have shown their loyalty to the US Treasury.

Decentralisation is independence from various authorities and financial institutions. Bitcoin can't be banned because no single centre can be sanctioned, and the transactions and user funds are only an entry in a shared distributed registry.

Bitcoin and Ethereum are public blockchains with an open history and record of the entire path of the minted coin. Because publicity conflicts with the right to privacy and confidentiality, some users prefer anonymous coins or use mixers.

Tornado Cash is a mixer that breaks the connection between the sender and receiver in the Ethereum network. It's a decentralised, open-source protocol built on smart contracts. Simply put, the tool is autonomous from the creator and any organisation. Any user can employ the mixer to break the connection between the sender and receiver.

The desire to hide the transfer history doesn't mean that the funds are being used for criminal purposes. However, this argument proved insufficient. In early August, the US Treasury Department's Office of Foreign Assets Control (OFAC) division included the software code in the list of blocked persons for the first time ever. As a result, all companies subject to US jurisdiction began blocking users and accounts where at least one transfer was received using Tornado Cash (TC).

The Coin Center advocacy group is preparing a lawsuit against OFAC because the regulator "exceeded its authority" and "violated the constitutional rights of US citizens". Congressman Tom Emmer joined OFAC's criticism by writing directly to Treasury Secretary Janet Yellen. Emmer raises the following questions:

- How does the regulator see the implementation of contract control?

- What is the status of citizen-owned funds after the mixer?

- How can law-abiding citizens get their frozen funds back?

- How can impersonal smart contracts appeal an OFAC decision?

Following TC's inclusion on the sanctions list, organisations loyal to the Treasury Department began blocking users who received the involved transfers. Since a transfer can't be declined, any participant could be compromised. Justin Sun (head of TRON) was blocked on the DeFi sector's Aave platform after receiving 0.1ETH from an unknown person.

Circle (issuer of USDC) also took up the challenge, freezing 75,000 USDC in TC-related transfers. Circle could freeze the transfer of stablecoins to and from TC at the Ethereum smart contract level.

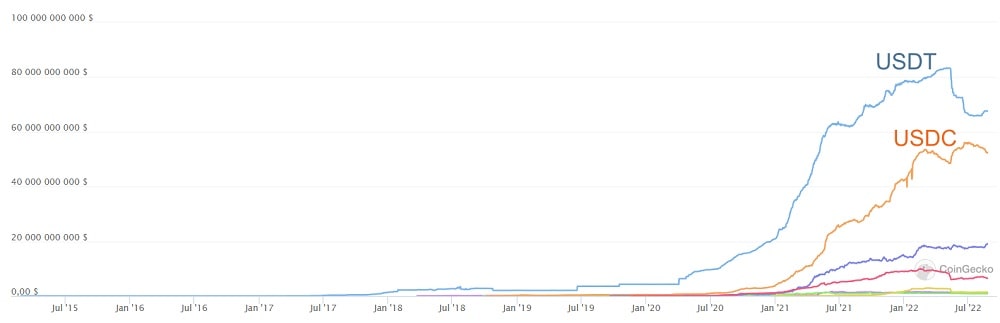

As a result, users and whales began to give up on USDC. Over the past two weeks, deposit volume on the exchanges has reached a low of March 2021, and the whales (top 1% of addresses) have dropped to a low of August 2020. The stablecoin's capitalisation fell by 3.5% to $52.3 billion over the period.

For the cryptocurrency community, blocking TC is an extremely unpleasant precedent because users are penalised not for the offence but for using a privacy tool. If US citizens use TC after the mixer's sanctioning, the penalty can result in a fine of up to $300,000 or up to 30 years of imprisonment.

StormGain analytics team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.