Hodlers' determination keeps Bitcoin from falling

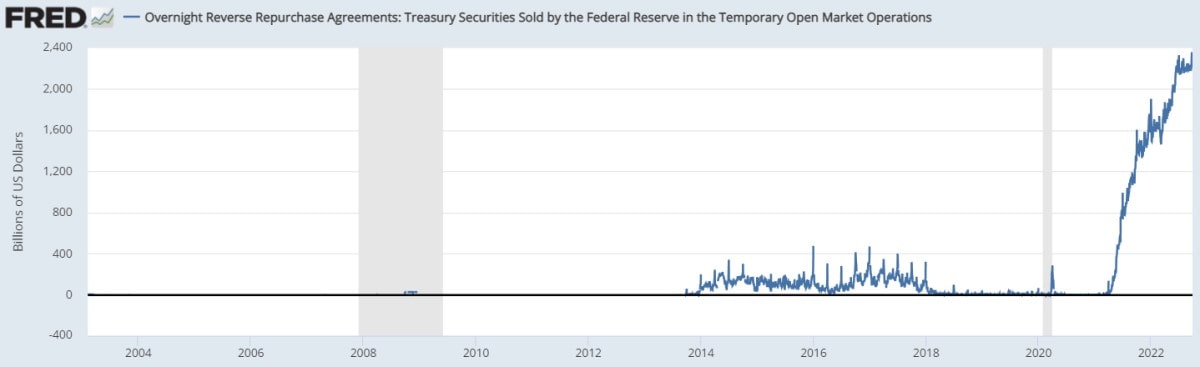

The US Dollar Index broke a 20-year record and continues to rise. At the same time, the risk of a recession in the US is increasing, and the reverse repo market has reached a record high of $2.4 trillion. This all indicates a deterioration in the macroeconomic environment, which is reflected in both ordinary investors and the largest hedge funds moving away from risky assets to cash positions.

The situation is so difficult that the traditional inflation safe-haven asset, gold, has dropped by 21% from its March peak, and the British pound hit a new all-time low against the US dollar.

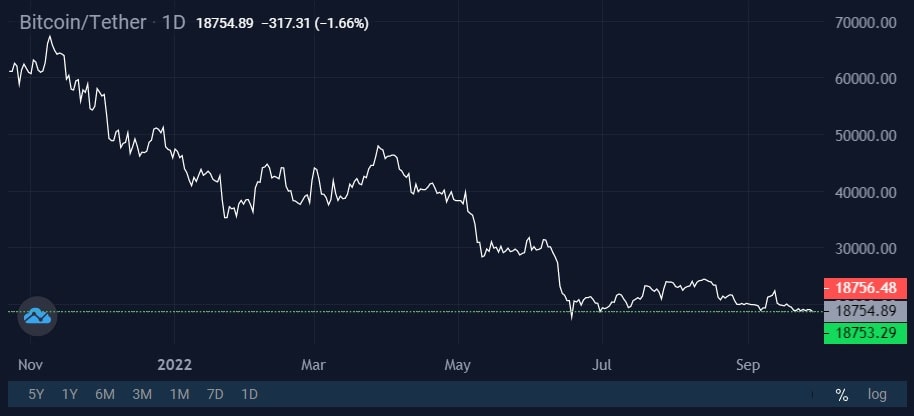

In this environment, Bitcoin's ability to stay around $20,000 for four months is impressive, despite the previous sell-off.

Bitcoin's dramatic fall in 2022 was caused by the cascading bankruptcy of a number of crypto projects that were propped up by mutual lending, as well as the subsequent exodus of speculators who preach margin trading. The market is still being 'cleaned up', but network activity has already rolled back to levels seen in 2014 for a number of indicators, and hodlers are now setting the tone.

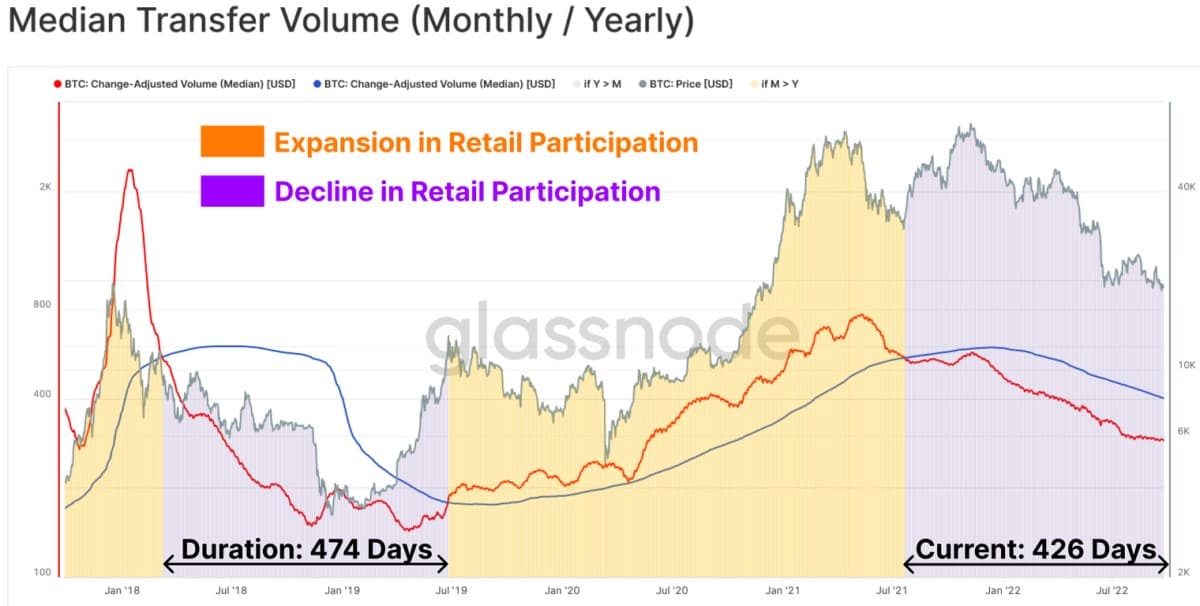

After China prohibited financial institutions from conducting cryptocurrency transactions, retail traders began to exit the cryptocurrency market. In the last bearish cycle, this took 474 days. Now, the monthly average is 426 days behind the annual average.

In addition to the drop in network activity, the market is also seeing a decrease in interest among short-term holders, most of whom locked in losses and left the market. At the same time, however, hodlers are demonstrating an unprecedented commitment to Bitcoin.

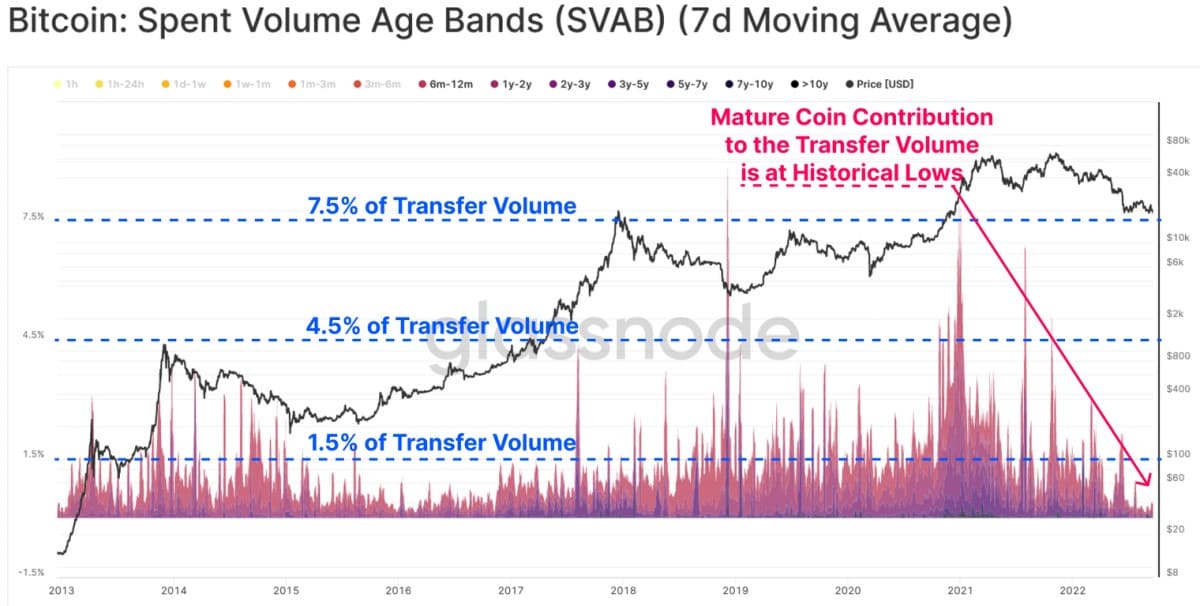

Coins that saw no movement for over six months were actively spent during the 2021 rally (on some days, their share reached 8% of total volume). Now, this group's activity is at a historical low (only 0.4% of total volume).

Hodlers remain resilient and are ignoring the deteriorating macroeconomic environment. Short-term holders and speculators trying to find the bottom and buy Bitcoin at the lowest prices are responsible for most activity now. However, the lack of faith in Bitcoin is leading them to get rid of the asset either after they achieve a small profit or after the price drops to the level they bought at. This is increasing volatility and preventing Bitcoin from rising against the market.

StormGain analytics team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.