Hong Kong won't help. Bitcoin's correction picks up pace

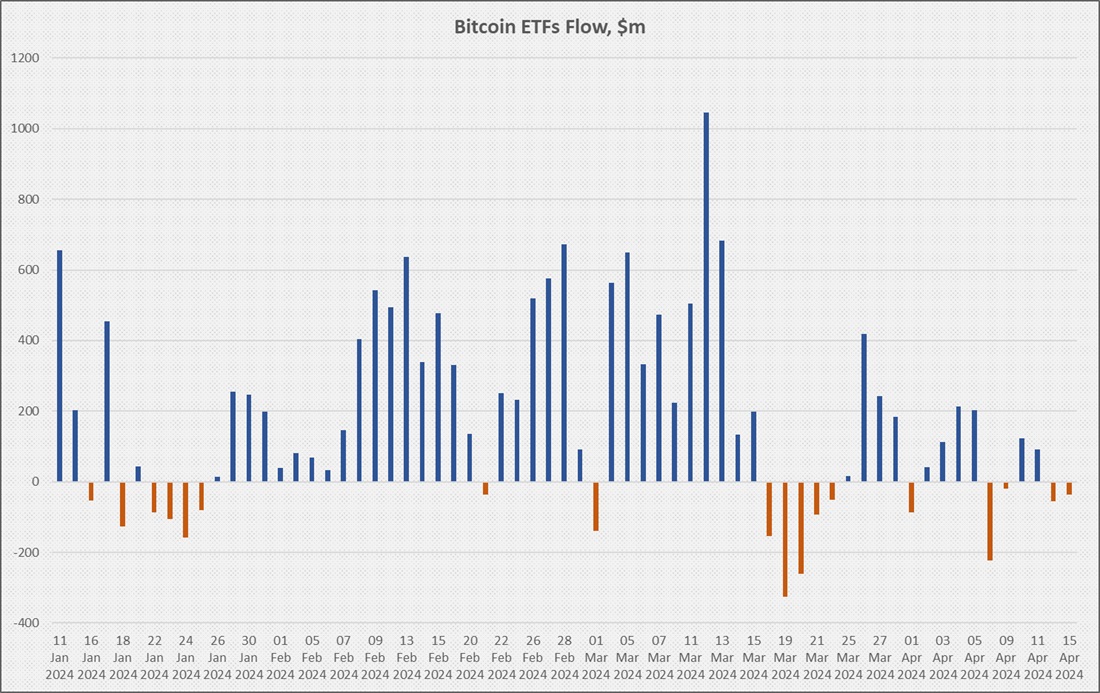

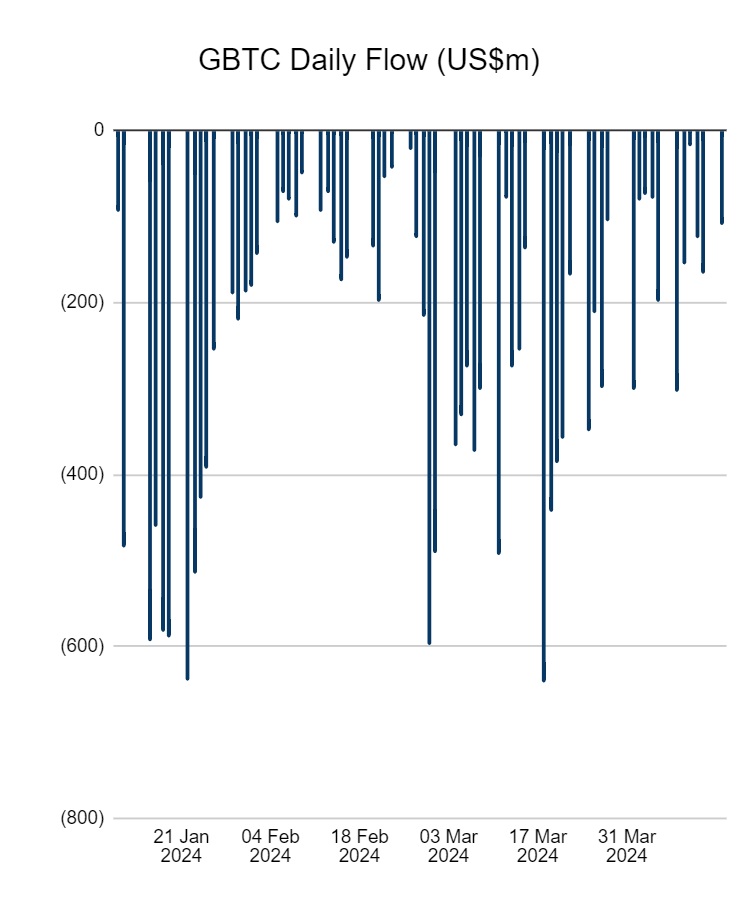

Last week, the outflow from ETFs reached $126 million, with spot ETFs in the United States accounting for $83 million of that. Yesterday, this trend only consolidated further after experiencing another $37 million loss.

Since long-term holders and miners are continuing to reduce their reserves, the price has taken a downward turn. As of today, Bitcoin has fallen by 15% from the high it reached in March.

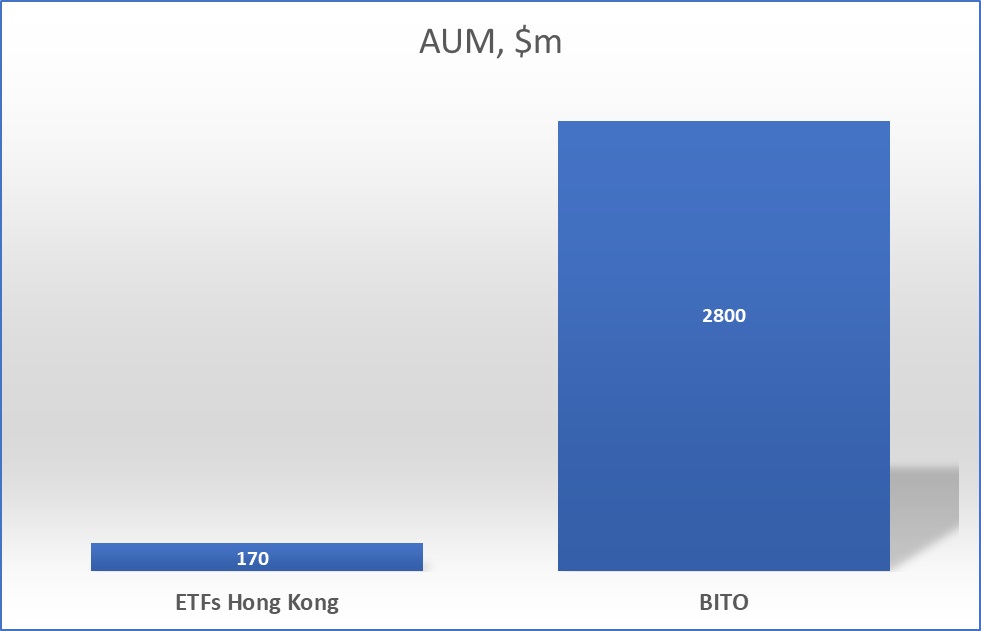

In April, a new argument emerged for the end of the cryptocurrency's correction: the launch of spot ETFs in Hong Kong in the next two weeks. This factor is ambiguous, however. Bloomberg's Eric Balchunas says that, in the best-case scenario, the Chinese financial product will garner $500 million in investments.

The primary reasons for the pessimism lie in the following:

- Hong Kong's entire ETF market is only worth $50 billion. For comparison, BlackRock's Bitcoin ETF alone has attracted $15.3 billion in three months.

- Investors in mainland China won't have access to the ETFs.

The latter circumstance puts an end to optimistic forecasts of an influx of billions of dollars, even taking into account some loopholes that allow enterprising citizens to invest in Hong Kong-based products.

The potential for the emergence of spot ETFs is clearly visible in the influx of investments in futures ETFs that were much earlier, just as in the United States. The total assets under management (AUM) in Hong Kong crypto ETFs is a modest $170 million. In the US, BITO alone has raised $2.8 billion.

We wrote about the impact of halving and the risk of a correction as a result of it on 1 April. According to the analytical agency 10x Research, the lower income will force miners to reduce reserves by $5 billion within 4-6 months after the halving. All other things being equal, this will create conditions for at least Bitcoin to consolidate in the medium term.

Last week, the only ETF to see an outflow of funds was Grayscale, whose management fee is 5-6 times higher than competitors.

If investors in other funds start to panic, the correction will easily reach the usual 30-40%, and Bitcoin's price will drop to around $50,000.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.