How crypto funds survived 'Black Monday'

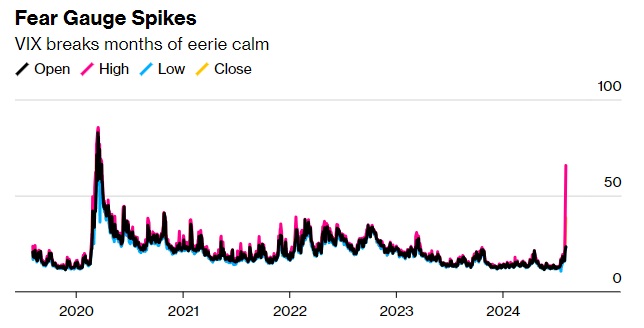

On 5 August, financial markets saw a mass sell-off of assets, ranging from stocks to precious metals. The VIX volatility index, also known as the Fear and Greed Index, jumped to its highest point since the coronavirus pandemic.

There were two primary reasons for this. The first is that Japan raised its key interest rate to 0.25% for the first time since 2006, which resulted in carry trades losing their previous appeal. The strategy for this kind of trade was to take out loans in Japanese yen at near-zero interest rates and exchange the yen for US dollars to buy US stocks and bonds. The increased interest rate made loans more expensive and strengthened the yen. After this, carry traders began liquidating their positions.

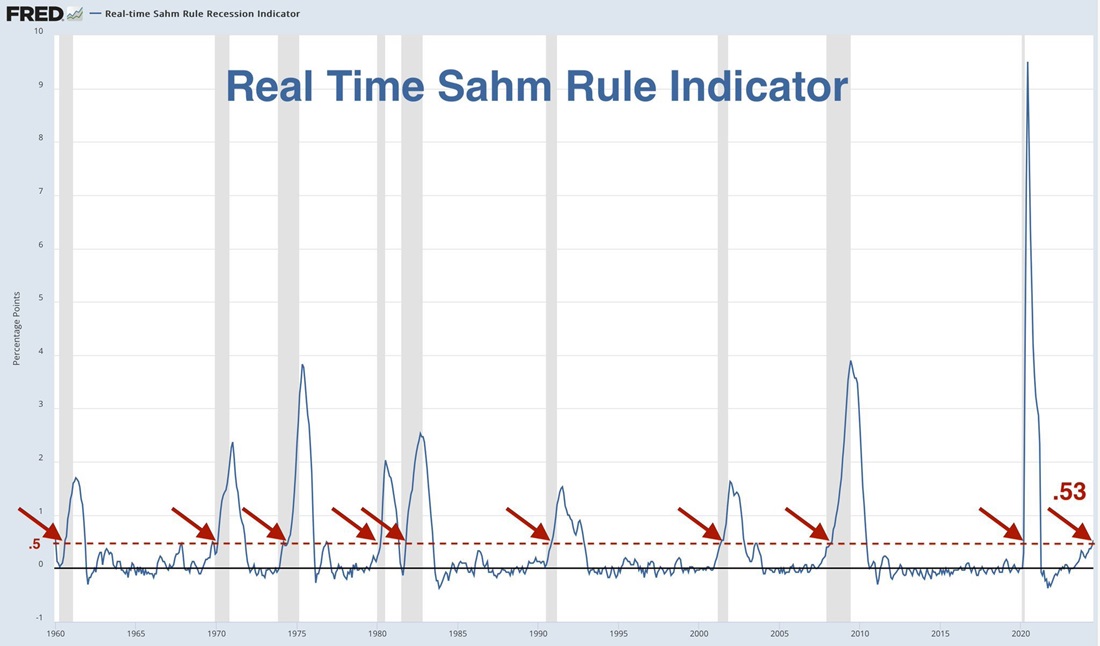

The second reason was that falling tech sector returns and disappointing US economic data for July led to a reassessment of risks. The Sahm Rule, developed by former Federal Reserve and White House economist Claudia Sahm, exceeded the crucial 0.5% threshold. Historically, this indicator has been surprisingly accurate at predicting economic downturns.

We see that the flight from risk and falling financial assets are based on objective reasons. What's more, fundamental factors for cryptocurrencies remained in the green zone. These include increased recognition around the world, the impact of new ETFs in the United States, the introduction of MiCA in the EU, and the increase in the number of companies with crypto reserves.

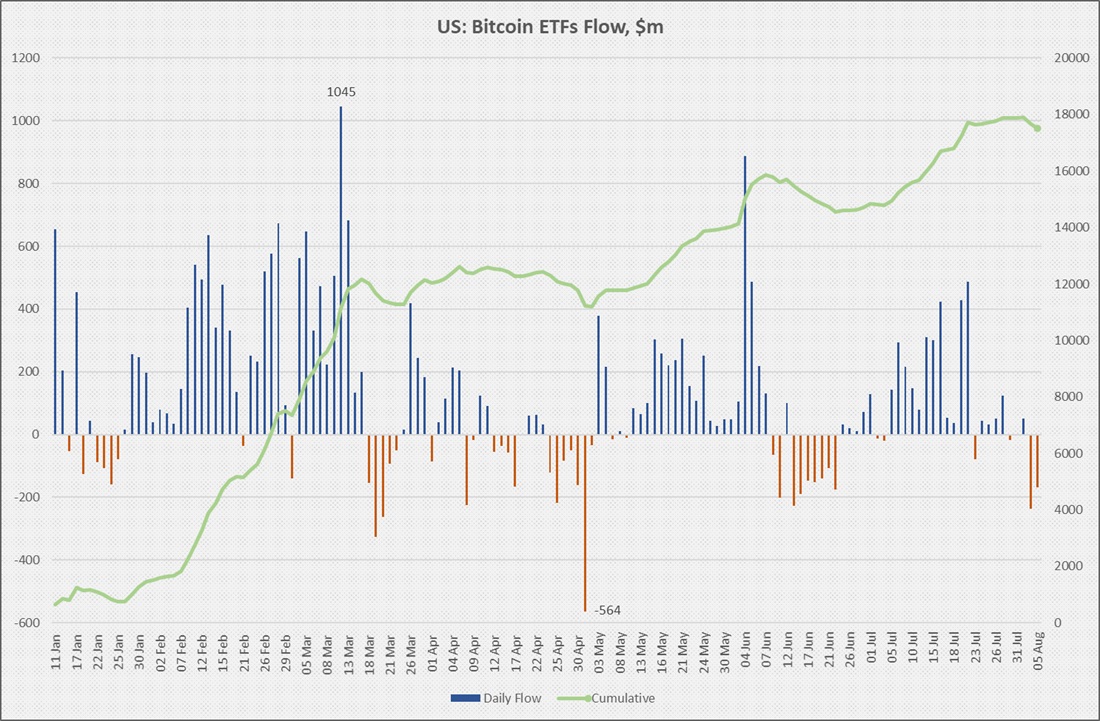

As such, the future movement of Bitcoin and Ethereum largely depends on investors' resistance to panic attacks. US spot ETFs, a key driver in 2024, have seen an outflow of $406 million in the past two days. However, that's far from the record-high seen on 1 May, when the indicator hit $564 million.

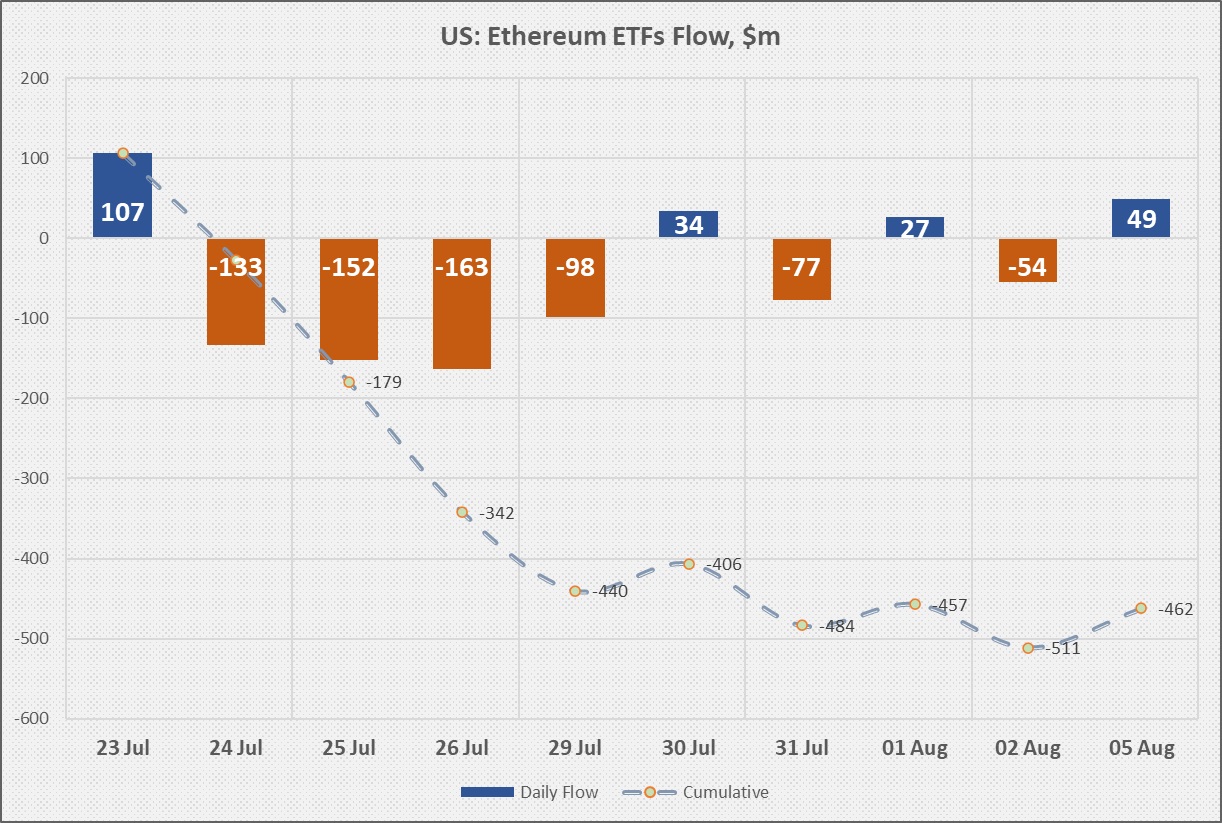

Things with spot Ethereum ETFs are even more interesting. Investors in this type of product bought the dip on 5 August.

However, Ethereum has reacted to recent events much worse than Bitcoin. We have repeatedly warned that the altcoin's movement will continue to lag behind the pioneer cryptocurrency's. This is, first and foremost, due to the large weight Grayscale has and the natural negative net inflow since the ETFs launched.

Leading market makers' sell-off of coins also negatively impacted Ethereum. In one day, Wintermute got rid of 47,000 ETH, while Jump Trading sold 36,000 ETH, worth a combined $250 million. The value of ETH staked in DeFi fell by 2.4 million ETH or $6 billion in one day.

Meanwhile, Ethereum ETF investors saw the altcoin's 48% decline from its March high as a great opportunity to build on their positions. They posted a net inflow of $48.8 million on Monday.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.