Hype or recognition: Why Bitcoin is rising

Despite the overwhelming amount of objective statistical data, some experts and economists still see Bitcoin's growth as hype and "speculative madness". For example, economist and CEO of brokerage company Euro Pacific Capital Peter Schiff argues that Bitcoin's growth in 2023 is caused by speculation around spot ETFs:

The surge in Bitcoin's value… could be its 'swan song', indicating a significant decline.

He is supported by John Reed Stark, a former SEC official:

Crypto prices go up for two reasons: First, because there is no regulatory oversight to prevent market manipulation and Second, because people are able to sell hyped, FOMO'd and overpriced crypto to a 'greater fool'...[The same goes for speculation about] the reported 90% likelihood of the SEC's approval of a bitcoin spot ETF.

For the past two months, the talk about Bitcoin has revolved around ETFs, which would provide access to the crypto to market participants in the US who can't work directly with it due to legal restrictions (e.g., insurance companies and pension funds). Even allocating a small part of their investment portfolios would lead to solid growth in Bitcoin's price due to its modest capitalisation.

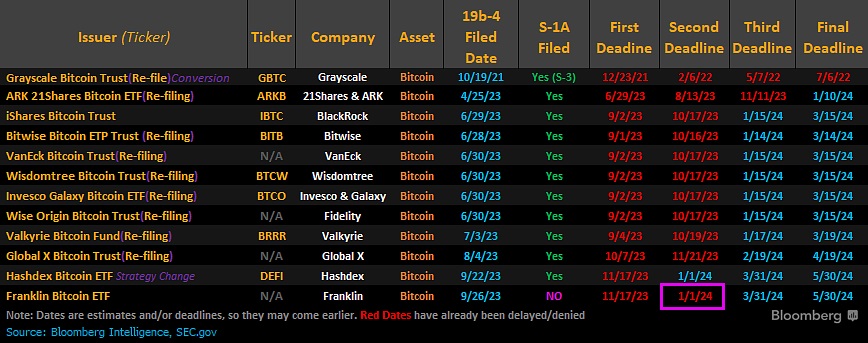

Twelve companies with a total of over $20 trillion of assets under management have applied to the SEC to create ETFs. Bitcoin's entire market capitalisation is $0.8 trillion. These companies will offer existing customers the chance to diversify their investments with crypto and attract new ones.

If the SEC refuses to approve the ETFs, which is unlikely after Grayscale won an appeal in June and the appeal period elapsed, it would likely lead to a correction in BTC's price as the resulting capital inflows from institutional investors would decrease. Their activation is clearly evidenced by the growth in open interest on the Chicago Mercantile Exchange, which has outperformed Binance this year.

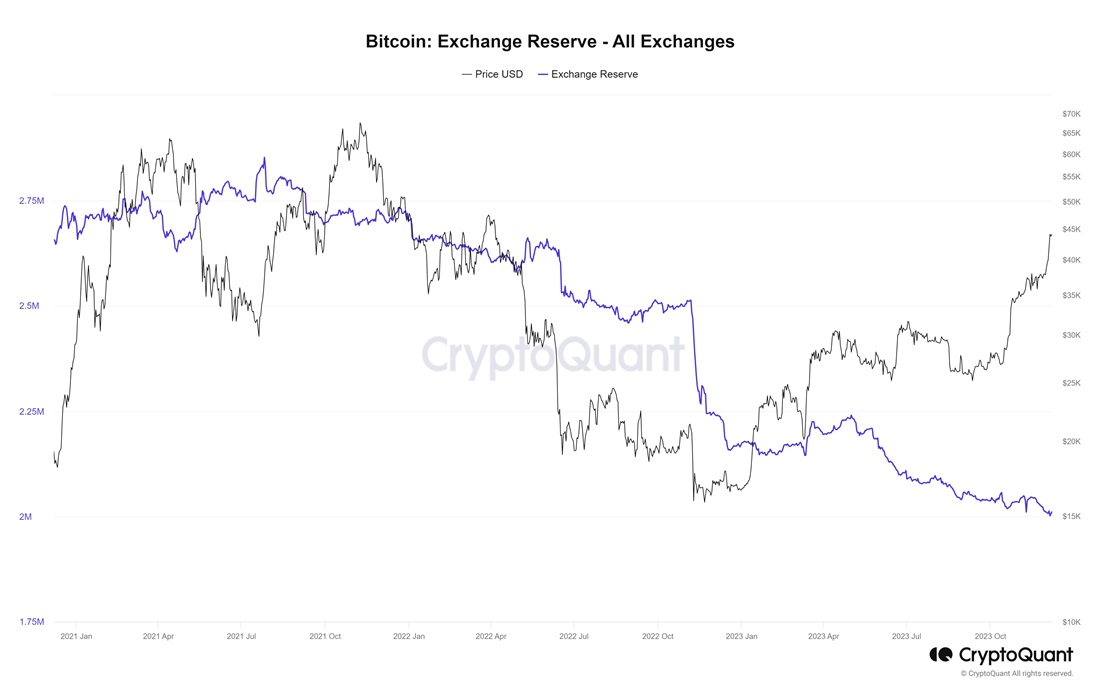

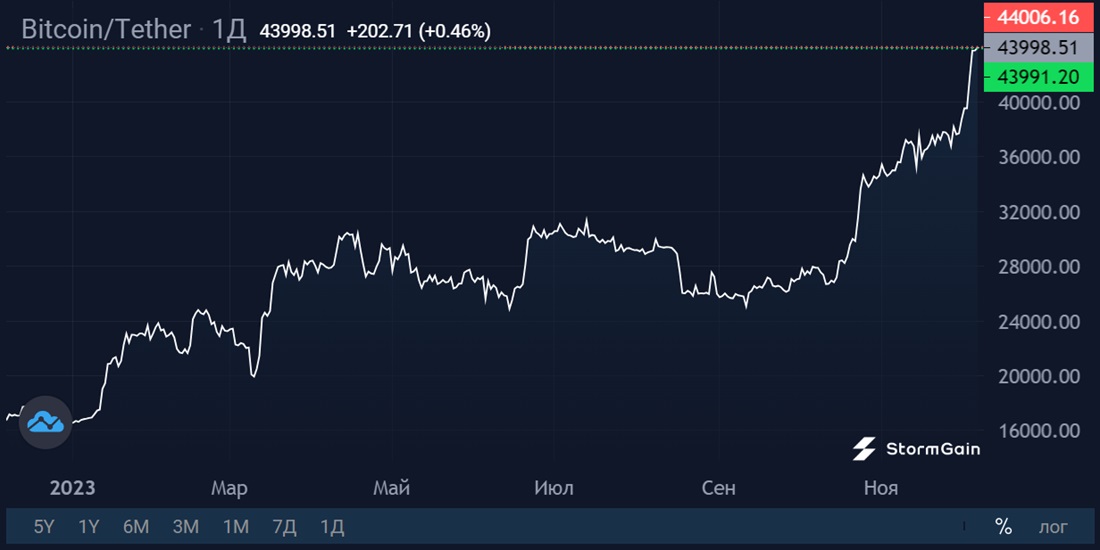

The correction won't be Bitcoin's "black swan", however, since the hype around ETF only accounts for the growth seen in the last two months. Objective interest in Bitcoin has been present throughout 2023. Firstly, this year, crypto exchanges' reserves have declined by 8% to 2.01 million BTC. This signals that more holders are increasingly moving coins to cold wallets for long-term storage.

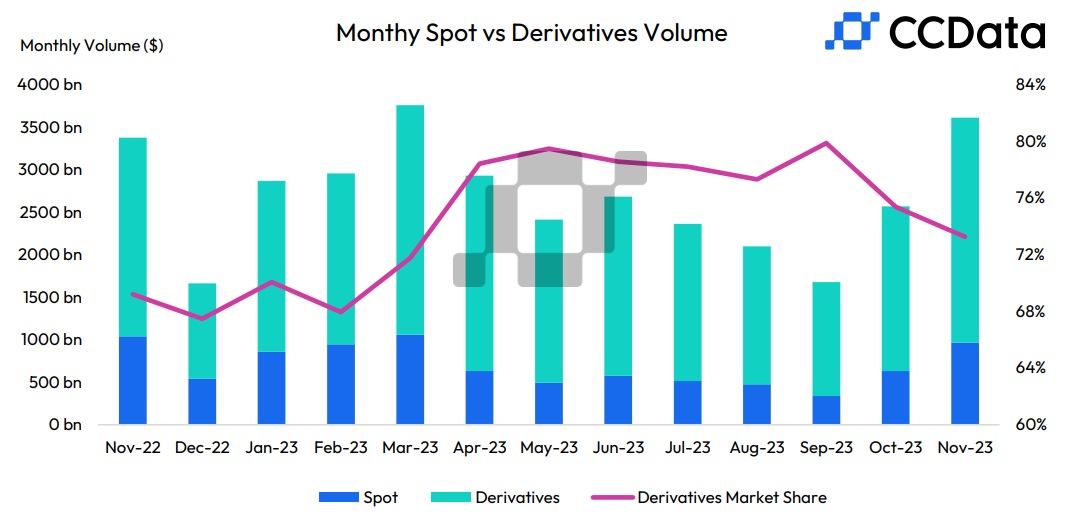

Secondly, the trading volume on the spot and derivatives markets still hasn't surpassed the March figures when the bankruptcy of some US banks led to a boost in interest in Bitcoin. Moreover, spot trading volumes are growing faster than derivatives trading volumes. This again emphasises long-term rather than speculative demand.

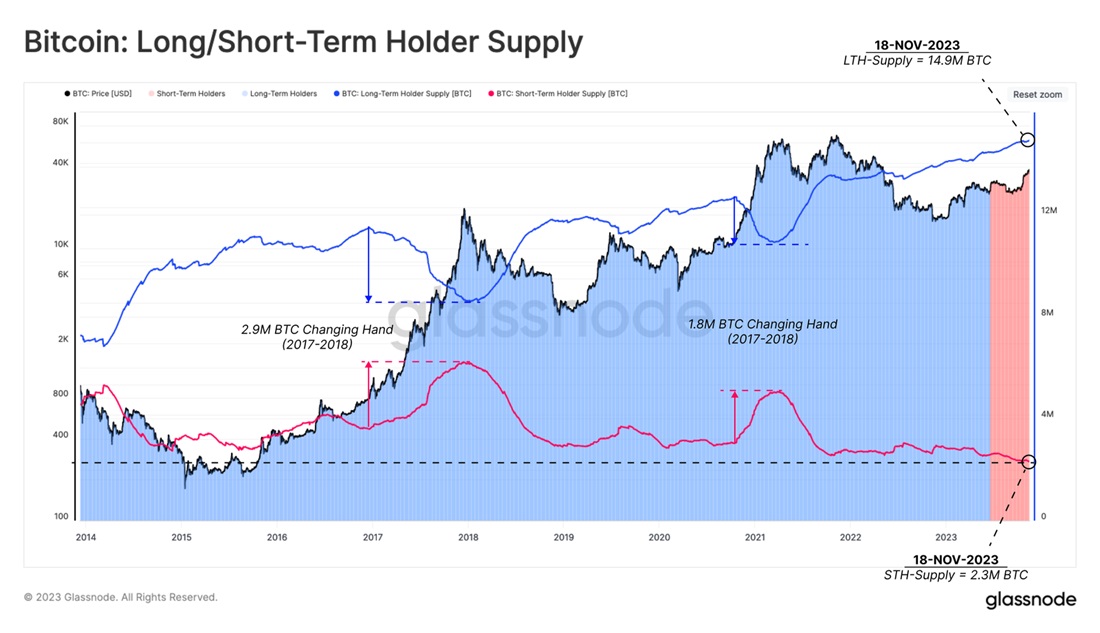

Thirdly, the reserves of long-term holders are growing, while short-term holders, on the contrary, have reduced their share to all-time lows as a result of opting for 'quick' profits.

The trend to reduce circulating supply has been going on since 2020, as more and more coins settle in wallets for longer periods. BTC's upcoming halving event will strengthen this trend even more.

ETFs will certainly create a strong momentum for Bitcoin, likely leading to a record update as early as next year.

But even without ETFs, Bitcoin has enough reasons to maintain its momentum. Crypto adoption is growing every year as more people discover crypto's benefits, and there's talk of its demise or 'tulip fever' decreases. That said, supply is limited to 21 million coins, which creates a supply shortage and leads to higher value as demand increases.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.