Opposing the whales, shrimps buy up Bitcoin's dip

October risks being the quietest month in Bitcoin history, but behind the external calm, there are two opposing forces. Whales (>1,000 BTC) continue to get rid of coins in anticipation of further worsening macroeconomic conditions, while shrimps (<1 BTC) are building up their reserves.

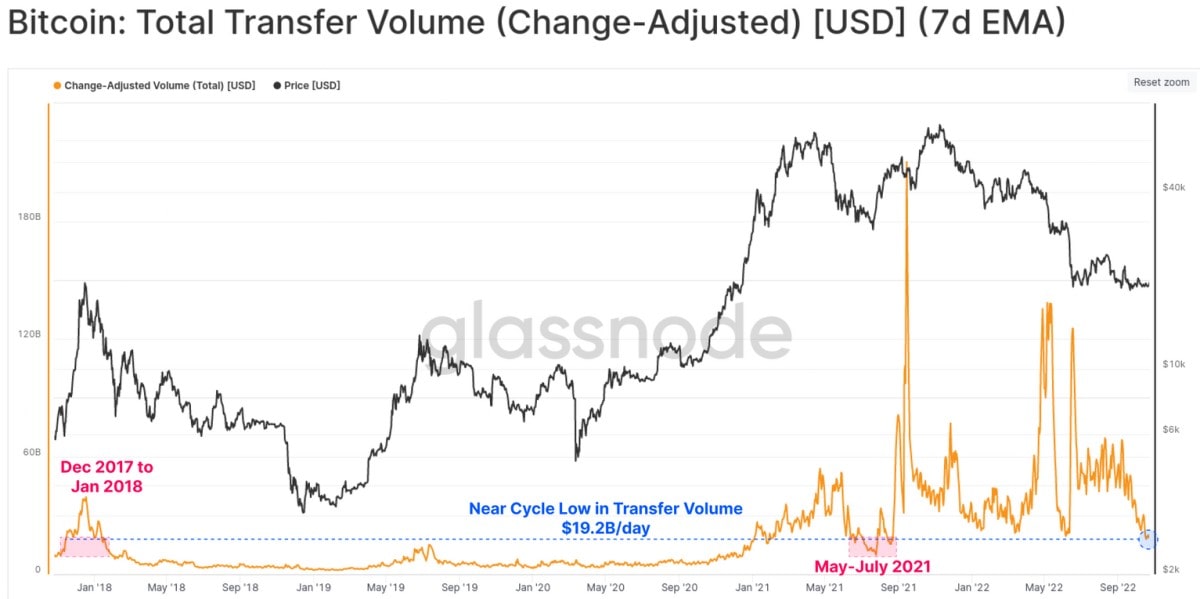

Stagnation is seen in the low network activity, and the rate of new addresses is at a level last seen in mid-2017. The total volume of transfers expressed in US dollars shows a similar picture, dropping to $19.2 billion per day.

Bitcoin's uncharacteristic calm came after a number of crypto projects went bankrupt and crypto tourists fled, leading to the price consolidating around the $20,000 level.

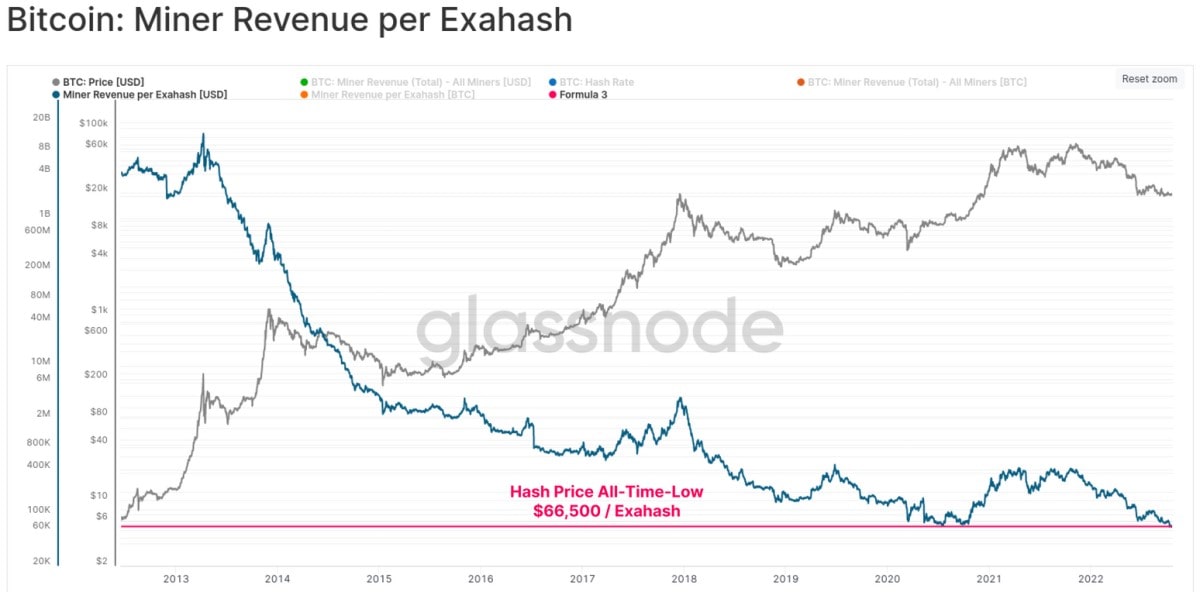

But participants' assessments of the level vary. For example, whales reduced their reserves by 3.3% to 5.61 million BTC during the consolidation period. Public miners, whose current holdings are estimated to be at least 78,000 BTC, stand out in this group. BTC per month. During the summer months, mining companies sold more coins than they mined due to unbalanced financial policies and sharply reduced cash flow. Yields per capacity hashrate continue to update all-time low levels.

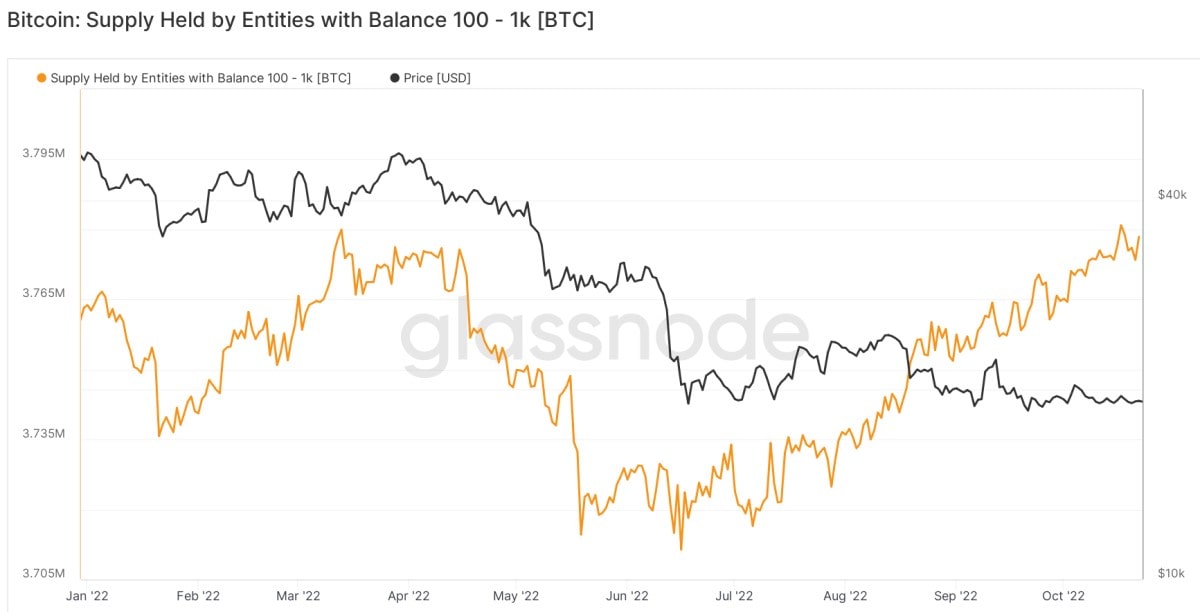

On the other hand, shrimps are enthusiastic and trying to find the bottom of Bitcoin. Between June and October, they increased their reserves from 3.71 million BTC to 3.77 million BTC.

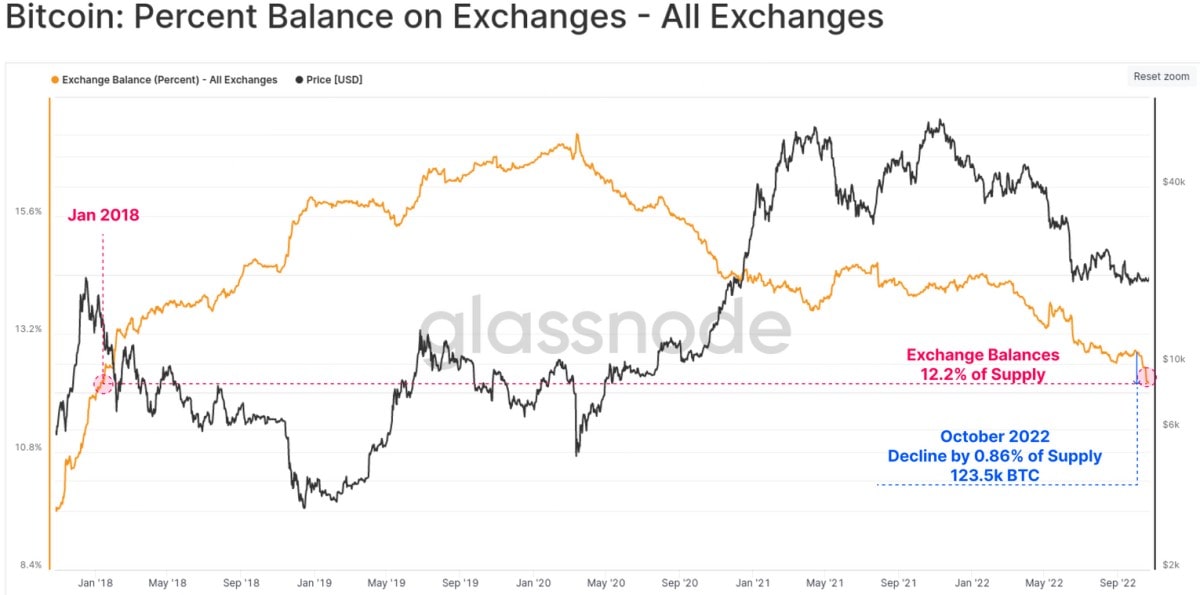

Another positive factor for the price is the continued outflow of coins from cryptocurrency exchanges to cold wallets. This usually indicates a reluctance of participants to part with Bitcoin and a willingness to wait out the storm in a safe place. The total volume of coins on exchanges has fallen to January 2018 levels, with 123,500 BTC withdrawn in the current month alone. BTC per month.

However, one should bear in mind that the current environment isn't favourable for investing in risky assets. With a 97.2% probability, CME's FedWatch tool predicts another 0.75% Fed interest rate hike. The regulator's next meeting is scheduled for 2 November.

A tighter monetary policy will increase financial outflows in favour of US Treasury bonds and the US dollar. For whales, this is another reason to continue offloading their accumulated BTC in anticipation of another wave of Bitcoin declines.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.