Inflows into Bitcoin ETFs followed by record-high outflows

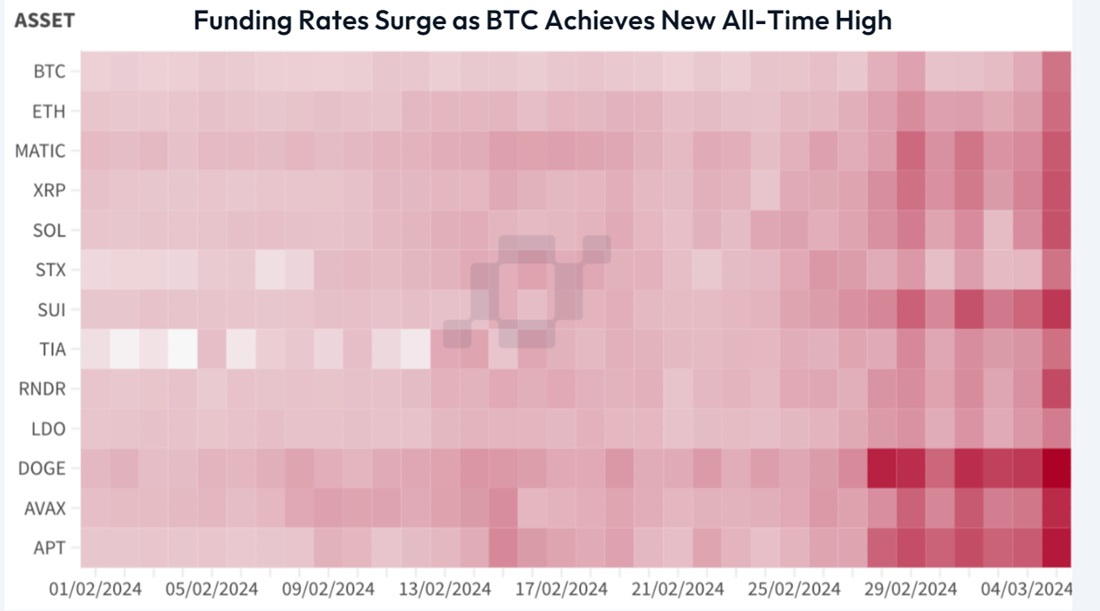

After hitting an all-time high, all the conditions for a correction were ripe, including increased leverage by derivatives traders, rising debt in the DeFi lending market and coin dumping by whales and long-term investors.

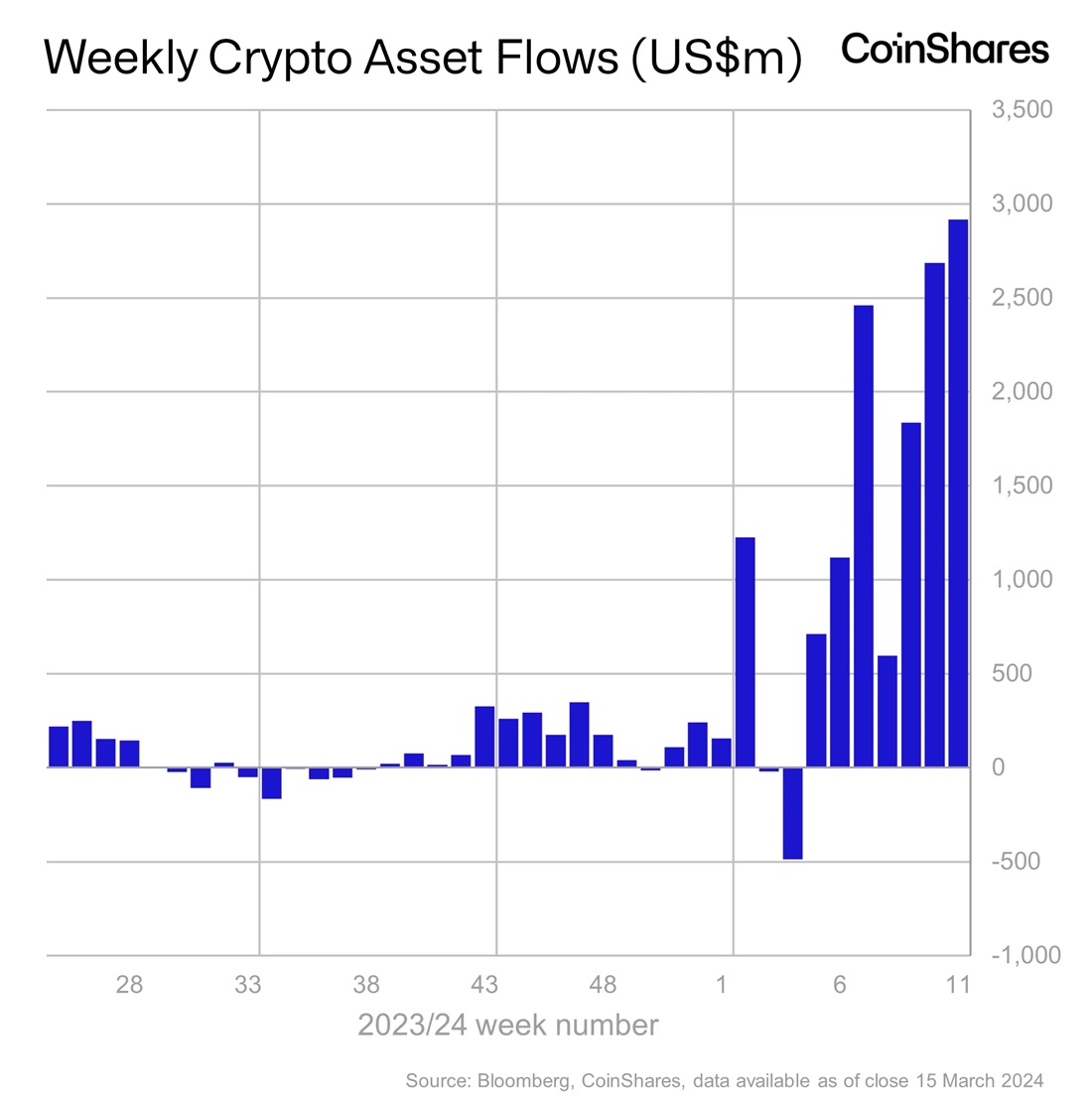

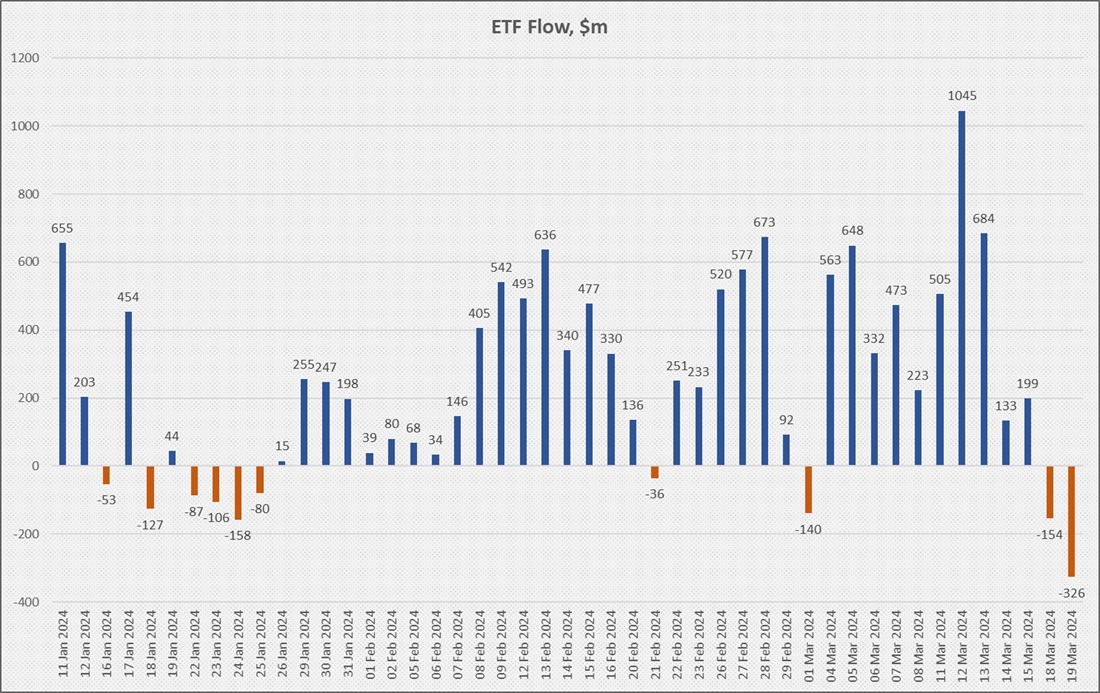

The price was kept from correcting only by a significant inflow of investments into crypto exchange-traded funds, which last week reached a previously unseen $2.9 billion. Of that amount, 99% went to Bitcoin.

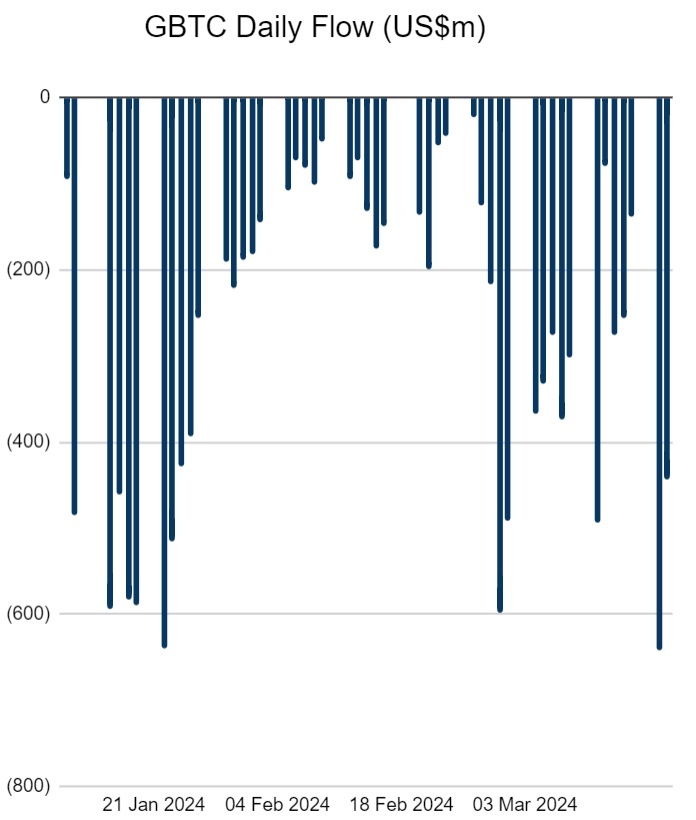

This week, inflows have been replaced by net outflows, with yesterday's outflow totalling a record $326 million.

On 18 March, the negative performance was driven by a record-high $643 million outflow from Grayscale's GBTC fund, which had the highest management fee. Then, on 19 March, BlackRock's IBIT delivered one of the worst results, bringing in just $75 million.

Once inflows into exchange-traded funds waned, Bitcoin went into a correction, sweeping away hundreds of millions of dollars worth of margin traders' positions in the process.

This is a common reaction to the market overheating due to over-optimism. The only issue that's somewhat intriguing is whether exchange-traded fund investors will succumb to the panic. As was recently revealed, the main influx is from retail investors, and the average investment in IBIT is only $13,000. Without experience with such a volatile instrument, these investors may rush to the exits, which will amplify the correction.

However, there is a positive side to this news: institutional investors have yet to fully join in on Bitcoin investments. Among these players is the world's largest pension fund, Japan, with $1.5 trillion in assets, which sees cryptocurrency as a tool to hedge risk.

Goldman Sachs head of digital assets Mathew McDermott confirmed yesterday at the Digital Asset Summit that Bitcoin's rise to new highs is mainly driven by retail trading. However, the company also noted increased interest from institutional investors. Over time, this group will incorporate exchange-traded funds into their investment portfolios, which will eventually lead to the cryptocurrency reaching new heights.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.