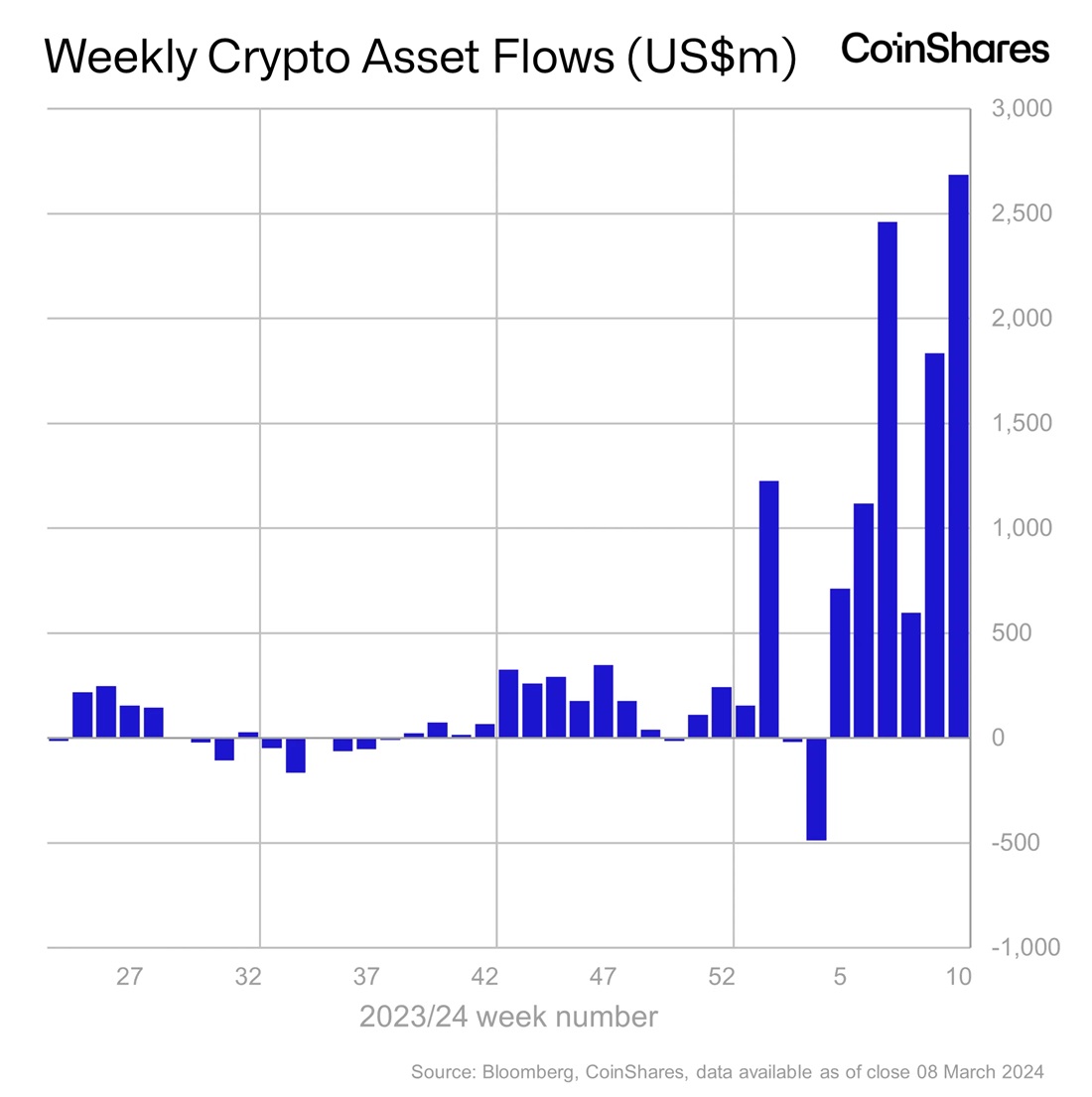

Inflows into crypto funds hit a record high

Spot ETFs continue to pump Bitcoin with fresh investments. In just the past week, $2.7 billion has flowed into crypto funds, setting a new all-time high. Bitcoin accounted for 98% of the new funds.

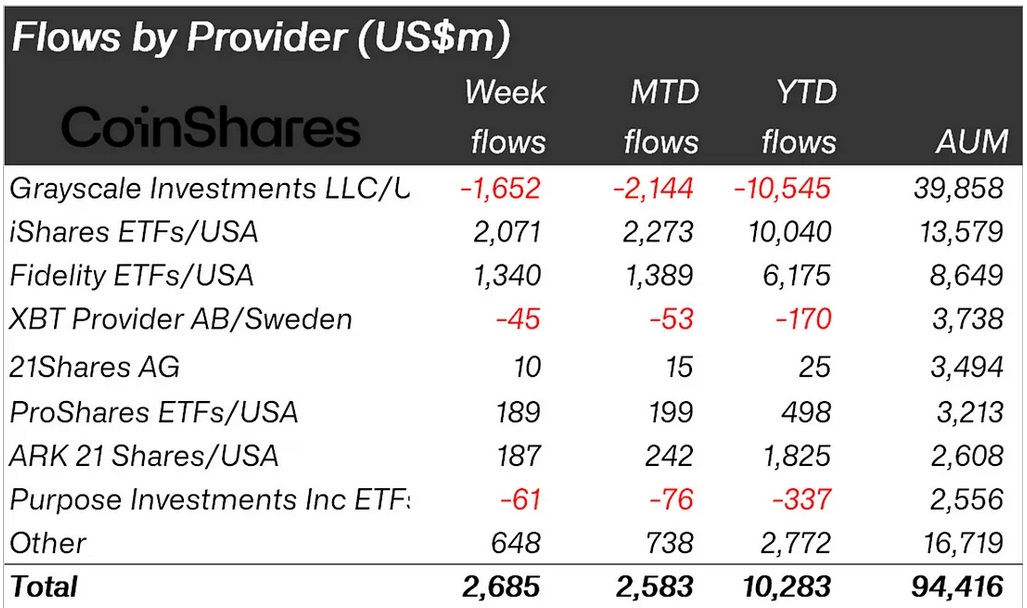

Among the spot Bitcoin ETFs, BlackRock alone raised $2 billion, with Fidelity coming in second place at $1.3 billion. The outflow from Grayscale remains high, but it no longer has a meaningful impact on the overall statistics.

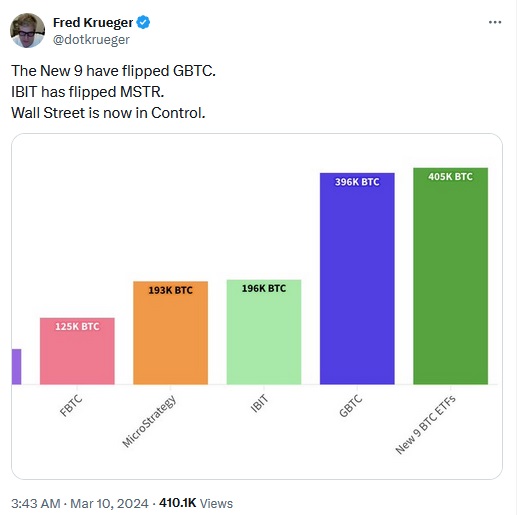

Last week, nine newly launched funds overtook Grayscale in terms of assets under management (AUM), while BlackRock overtook MicroStrategy, the largest publicly traded cryptocurrency holder, in terms of the same indicator. However, on Monday, MicroStrategy regained the lead after it announced the purchase of an additional 12,000 BTC. Its reserves now hold 205,000 BTC.

This explains why Bitcoin's price is rising without any significant correction. New buyers are still arriving, and the bulk of holders (including whales) are in no hurry to part with their crypto holdings.

At the same time, market participants forecast a further increase in the rate of capital inflows into Bitcoin. Firstly, this is due to the fact that not all major investment platforms have joined the race. Matt Hougan, the investment director at Bitwise, believes the monetary inflow will pick up pace in Q2, when numerous hedge funds, venture capital firms and retail investors will start investing.

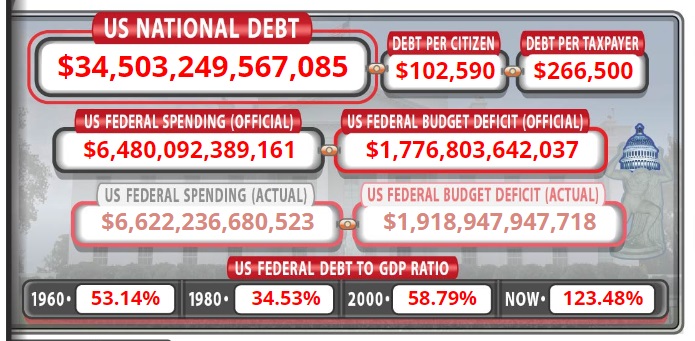

Secondly, the Federal Reserve's expected change in its monetary policy will create extra momentum. The high interest rate is dealing a blow to the US banking sector and leading to higher costs to service the national debt, which has risen by a quarter to $34.5 trillion since 2020.

Meanwhile, a rate cut will weaken the US dollar and strengthen the inflow of investments into risky assets. Former Coinbase CTO Balaji Srinivasan said of the US's increased national debt, "We're in the looting-the-treasury phase of imperial collapse." He advised his followers on X (formerly known as Twitter) to turn to Bitcoin, which is independent of any particular country or government.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.