Institutional investors are returning to Bitcoin

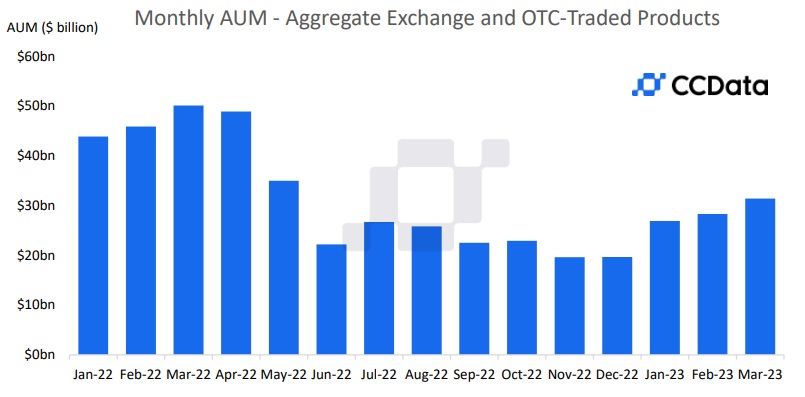

In March, total investments in crypto funds (assets under management) jumped by 11% to $31.4 billion. This is the best result since the crypto sell-off last May triggered by the collapse of Terra and the third-biggest stablecoin UST. According to CCData (previously, CryptoCompare), if there had been no pressure on the industry from supervisory authorities, the increase in investment would've been much greater.

A significant difference in the current volume of investment is the strong predominance of Bitcoin. Its share reached 72.4%, or $22.7 billion, with Ethereum accounting for another $7.2 billion. Other coins only account make up $1.5 billion, or 5% of total crypto assets under management, compared to 13% in January 2021.

The Bitcoin trend is brought on by several factors. First, in 2023, US regulators launched a campaign against PoS coins, calling them securities. As a result, cryptocurrency exchange Kraken was forced to stop providing staking services, and Paxos stopped minting BUSD for Binance on 21 February. In the eyes of investors, the pressure on altcoins increases the value of Bitcoin, which both the SEC and the CFTC recognise as a commodity in their working papers.

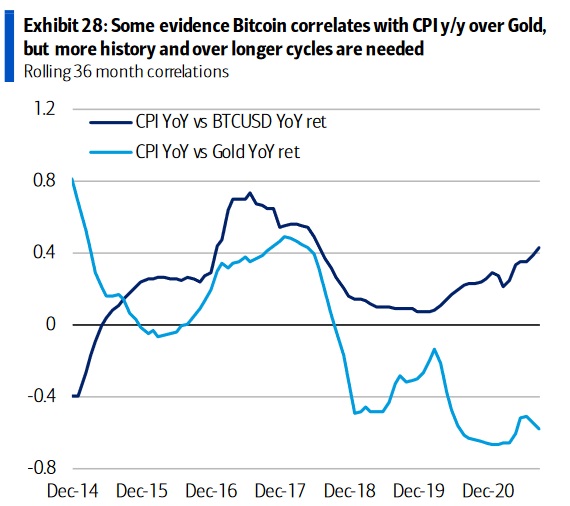

Secondly, like gold, Bitcoin is considered by many experts (e.g., the analytical division of Bank of America) to be a store of value. With rising inflation, the collapse of a number of banks and the lack of insurance in the US for deposits over $250,000, interest in Bitcoin is reemerging. Previously, analysts from BofA noted that the cryptocurrency has a higher correlation with inflation than gold does.

Simply put, as inflation rises, Bitcoin is likely to grow stronger than gold. At the same time, the Fed faces increasing difficulty in combating it, as the tightening of monetary policy has led to a crisis in the banking sector. The regulator printed almost $400 billion in two weeks and launched the Bank Term Funding Program (BTFP) to avoid new crises. This step contradicts the increase in the key interest rate and the regulator's attempt to slow down price growth.

Under such conditions, the attractiveness of goods with limited supply, which can't be printed to cover excessive government spending, increases dramatically. The same circumstance encourages institutional investors to boost their investments in Bitcoin, despite increased regulatory pressure.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.