Institutional investors exit Bitcoin and invest in Ethereum

Institutional investors (predominantly companies with investments of $1 million or more) are opting to invest in exchange-traded instruments, buying ETF units or shares in investment trusts. Rigorous reporting makes overall sentiment easy to track.

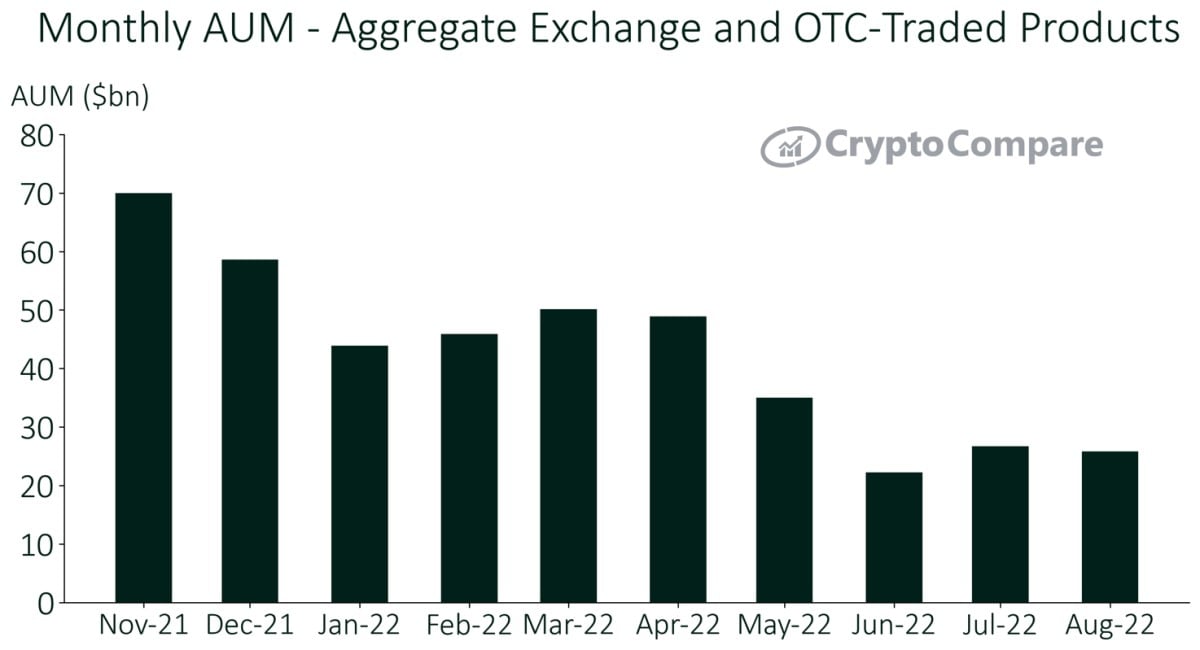

Since March, for example, total assets under management (AUM) have halved to $25.8 billion.

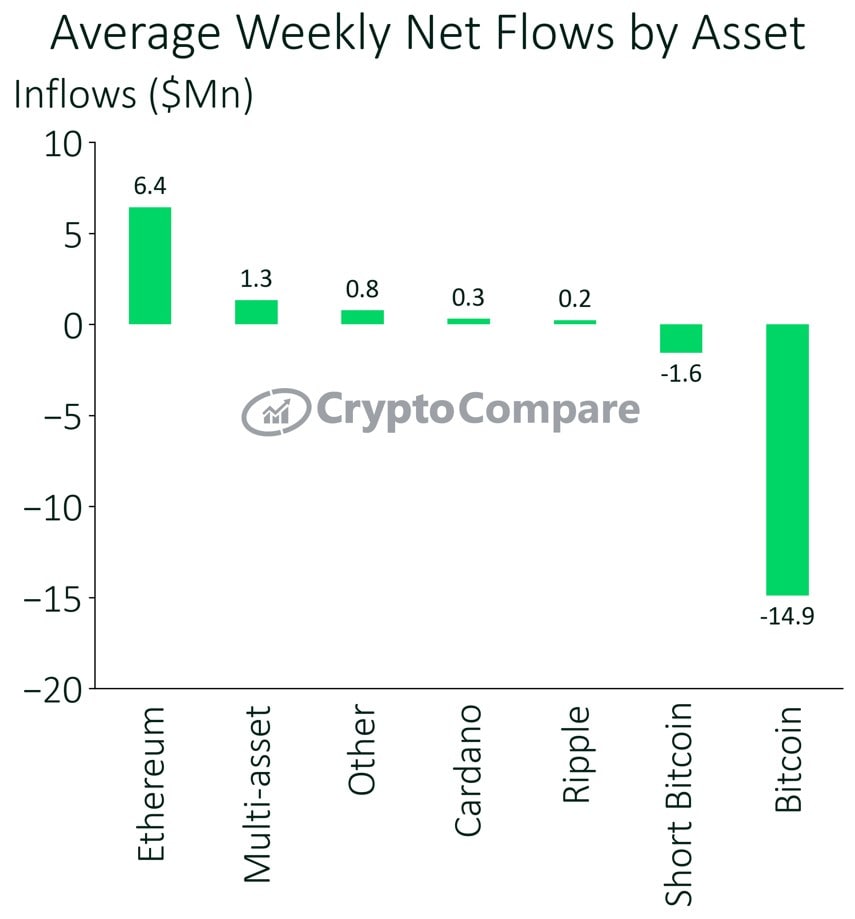

Meanwhile, institutional investors have recently been pulling out of Bitcoin and increasing their positions in Ethereum. In August, the average weekly outflow from Bitcoin was $14.9 million, while Ethereum saw an inflow of $6.4 million.

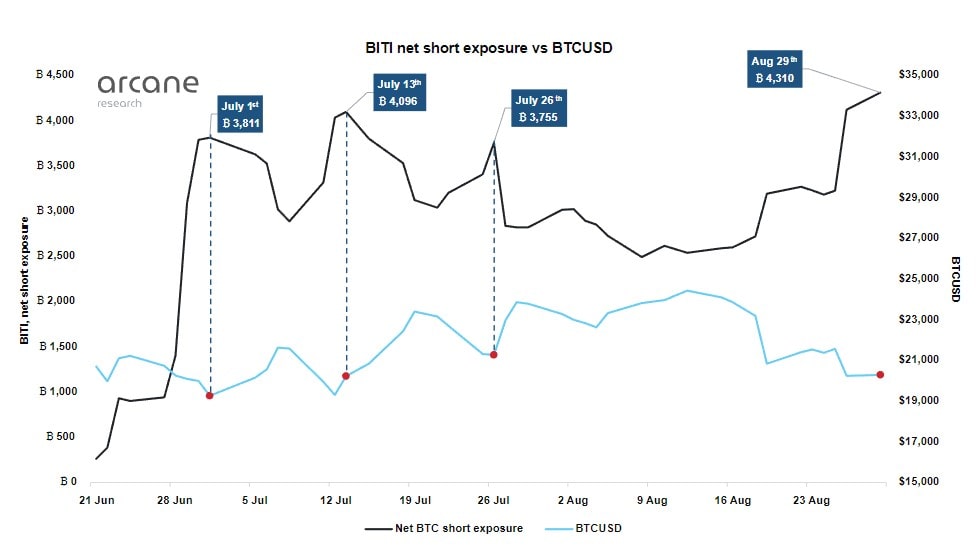

To safeguard investments against macroeconomic headwinds, institutional investors are investing in Ethereum and shorting Bitcoin ETF. The latter position earns on falling Bitcoin prices. In this way, investors are offsetting the impact of the US dollar on the crypto market by buying ETH over BTC. Over the past two weeks, investments in the short Bitcoin ETF from ProShares have increased by 70%, reaching a record high of 4,310 BTC.

Things are much simpler in the perpetual futures market, as traders deal directly with the ETH/BTC pair. In the past two months, it has risen by 40%.

The increased interest in Ethereum is due to the platform's upcoming transition to the Proof-of-Stake algorithm, which will take place in mid-September. The cryptocurrency community is divided into two camps. Some are predicting a bright future for Ethereum and that it will rise to the top spot in the overall capitalisation ranking. Others are warning of risks of increasing centralisation and a significant loss of market share for the leading altcoin.

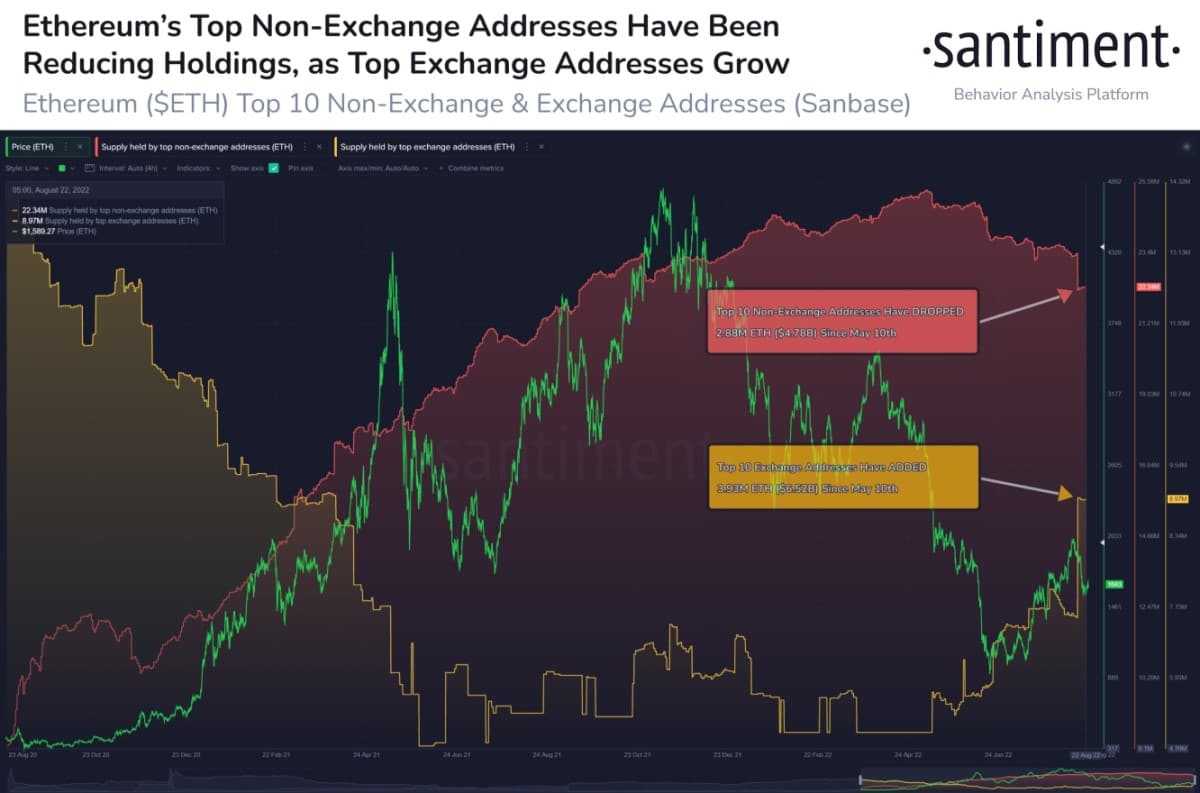

Clearly, September will be a volatile month, with institutional investors ramping up purchases and whales gearing up for a provocation. The top 10 players sold a total of 2.9 million ETH, while cryptocurrencies saw an inflow of 3.9 million ETH.

Apparently, the whales plan to take advantage of the investment frenzy to sell some of their holdings without causing panic in the market.

StormGain analytics team

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.