Investments in crypto ETFs grew by 120% over the year

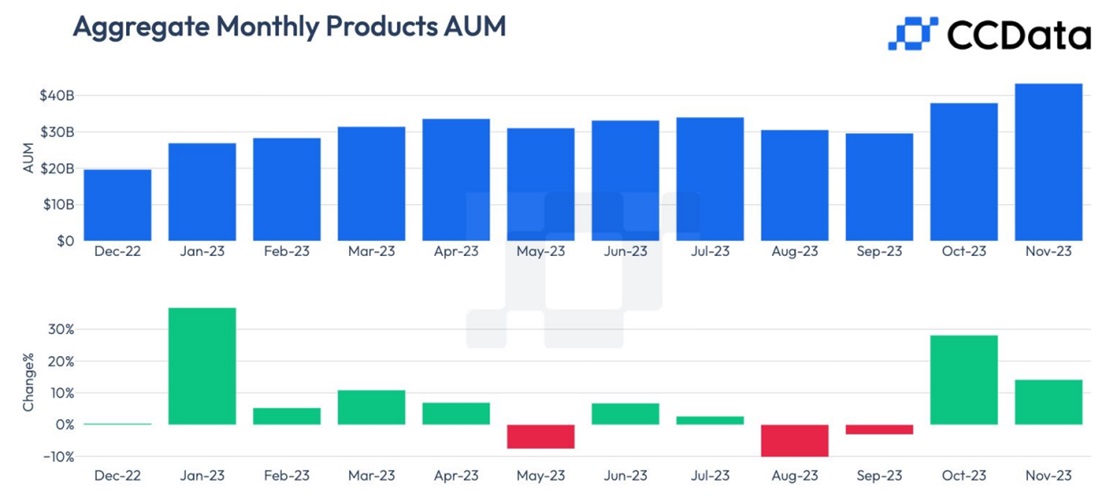

The current year is becoming a transition period between bearish 2022 and bullish 2024. This can be seen in the change in the sentiment among institutional investors (companies with investments of $1 million or more). This group of participants increased their investments in crypto ETFs by 120% in 2023, bringing the total to $43.3 billion.

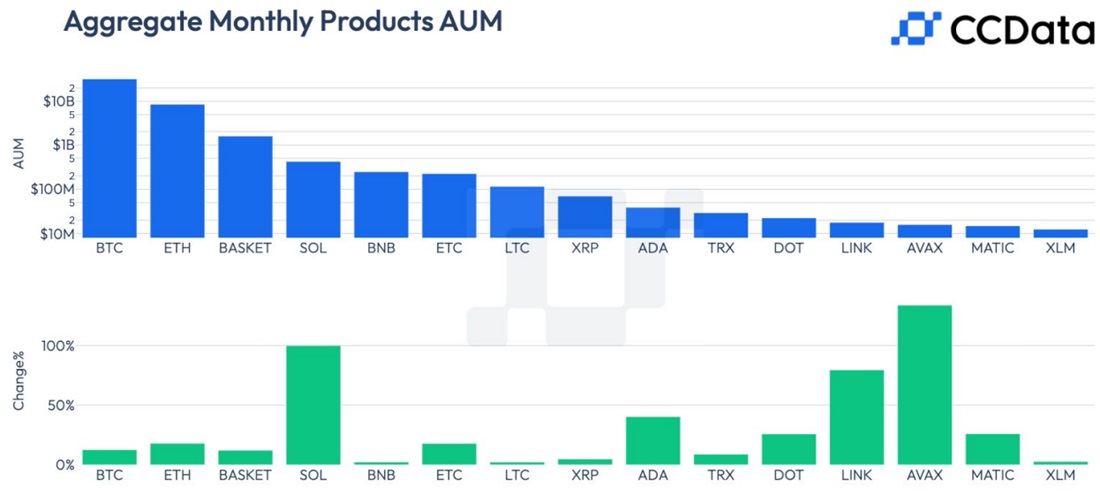

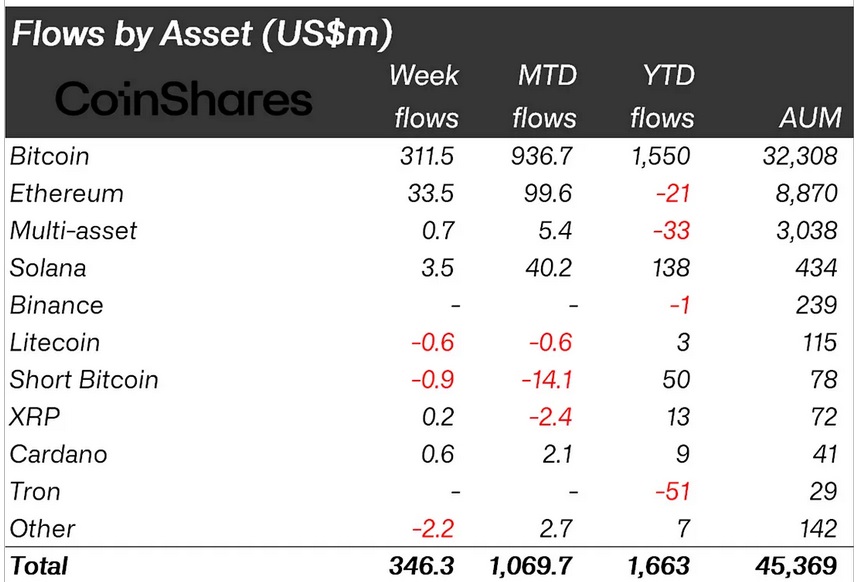

Bitcoin remains the absolute leader among institutional investors. During the year, the volume of funds under management in Bitcoin funds increased by 140% to $32.3 billion. There was also significant interest in Solana. We covered the reasons why previously.

Ethereum, on the other hand, has seen capital outflow for a while now, and only in recent weeks has the situation started to improve. The annual dynamics are still negative, though.

As you can see from the table above, $1.1 billion of the $1.7 billion invested over the year came in the last month. This is due to the increased chances of approval of a Bitcoin spot ETF in the US.

First, a pre-trial agreement has been reached with Binance with a $4.3 billion fine and the crypto exchange leaving the US. Under these circumstances, it'll be easier for the SEC to approve ETFs, as dissatisfaction with the crypto exchange has been dragging on since 2018. Second, the SEC held a series of meetings with applicants in November to allow them to edit applications in line with requirements. This dialogue is perceived by market participants as a signal that ETF approval is soon to come.

Most applications will likely be approved in bulk on or before 10 January 2024. This is the deadline for approval of the joint application from ARK Invest and 21Shares. If the SEC rejects it, it'll have to justify its decision. The regulator previously lost to Grayscale on appeal, where, in similar circumstances, a court found the SEC's actions to be "arbitrary and capricious".

Due to the high chances of the emergence of the long-awaited financial instrument, institutional investors have ramped up their investments. Bitcoin continues its victorious 2023 march, having grown 2.3-fold in value.

The emergence of ETFs will allow investment and pension funds, as well as insurance companies and other US financial market participants (which have legal restrictions) to invest in cryptocurrency. According to various estimates, in the first year after the launch of ETFs, there will be $14 to $100 billion in new investments, and Bitcoin's price will rise to between $70,000 and $100,000.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.