JPMorgan: Bitcoin spot ETFs to be approved by 10 January

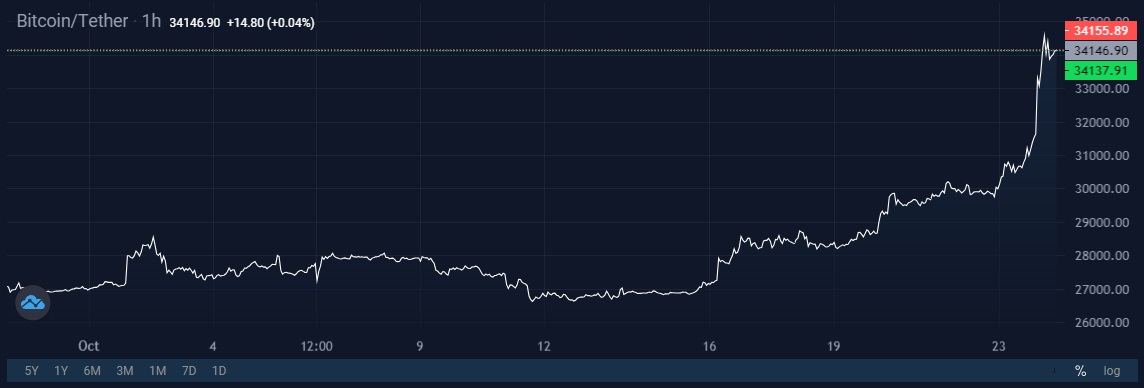

Bitcoin is once again approaching a six-month high of around $30,000, gaining 13% in October.

This growth is due to the approaching deadline for approving Bitcoin spot ETF applications and the SEC's refusal to appeal the court's decision on Grayscale.

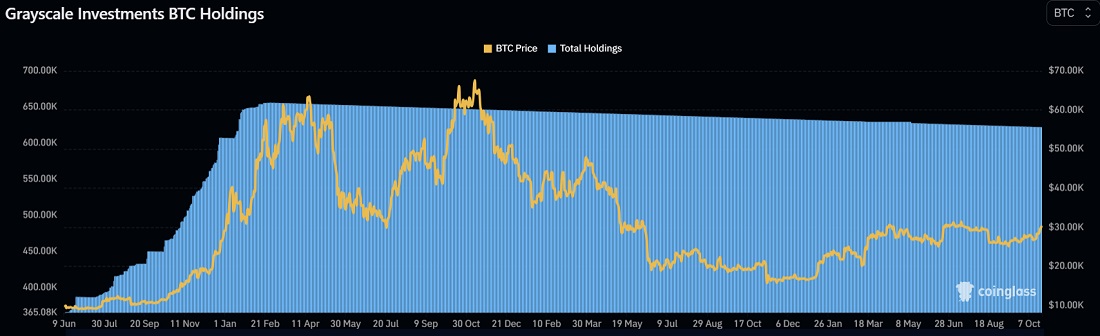

The regulator became famous for its negative attitude towards cryptocurrencies and instruments based on them. In August, the SEC learned its lesson from a federal appeals court that dealt with the case about the regulator's refusal to convert a Grayscale Bitcoin trust into a spot ETF. The judges called the regulator's position "arbitrary and capricious" due to the lack of clear reasoning.

SEC could have appealed this decision by providing new evidence to explain the refusal. However, the deadline for an appeal was 20 October. This dramatically increases the chances for automatic conversion of the Grayscale fund in 2024 and the emergence of spot ETFs from other applicants. JPMorgan analysts suggest that the SEC will approve all applications in bulk by 10 January so as not to give a competitive advantage to any of the players.

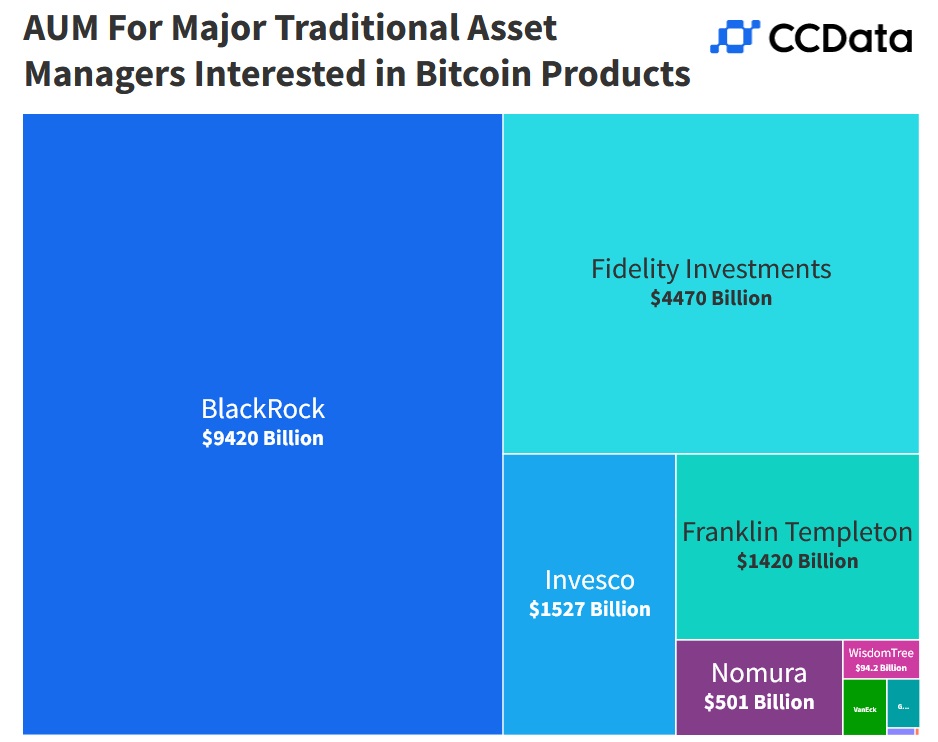

The emergence of Bitcoin spot ETFs will likely lead to a cryptocurrency rally. The world's largest investment company, BlackRock, which also applied to create an ETF, manages $10 trillion. 1% of the funds in its management that can be used to diversify the portfolio accounts for 1/6 of Bitcoin's current capitalisation.

The inflow of institutional capital will ensure significant cryptocurrency growth. In 2021-2022, institutional investors were the main reason behind Bitcoin's growth from $10,000 to $60,000. The Grayscale Trust Fund alone has bought 300,000 BTC (about $9 billion at current prices) despite the fund having significant cons against spot ETFs.

According to Skybridge Capital's Head, Anthony Scaramucci, after the long-awaited ETF approval, the long-term Bitcoin capitalisation will increase from $600 billion to $15 trillion, with the asset's price jumping to $250,000 in the new cycle and $750,00 by the decade's end.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.