JPMorgan: BNB to win in the long term

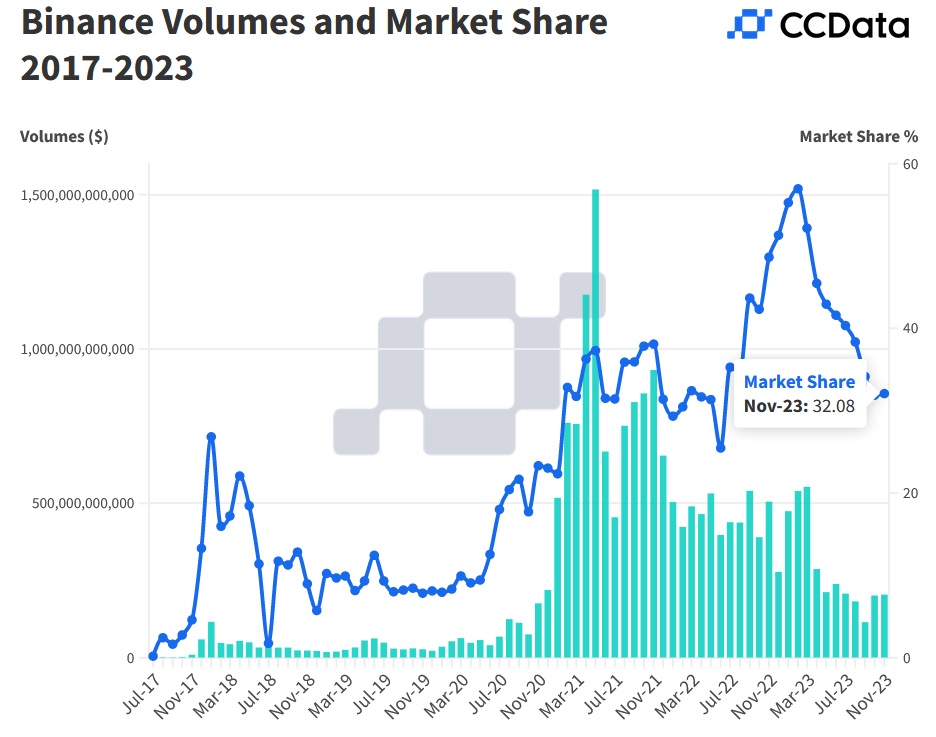

Binance's share of the spot market in 2023 has fallen from 57% in February to 32% in November. The US division, which at its peak had an 8% share of the regional market, must cease to exist under an agreement with the US Department of Justice. An independent overseer will stay at the global headquarters for three years to assess compliance with US and international laws.

The company must also pay an industry-record fine of $4.3 billion. This amount may increase, as the agreement with the Department of Justice was concluded without the SEC's participation. The regulator has issues with the crypto exchange because it deals with securities without having the appropriate licence. The SEC considers BNB to be a security, and court proceedings are still ahead.

The decline in market share, ongoing legal woes and loss of US market share have consequently affected the value of the cryptocurrency exchange's coin. BNB's price lost 6% in 2023 amid Bitcoin's doubling in value.

However, the confrontation between Binance and the US government has had two positive outcomes. First, there is no longer a risk of the crypto exchange going bankrupt and repeating what happened to FTX. The fine amount is sizeable but not a critical blow for the largest player in the cryptocurrency market. At the same time, the crypto exchange won't face charges that could damage its business.

As JPMorgan analysts wrote in a note to investors, "Binance's market share loss will be more moderate in the future and will probably reverse once the effects of the agreement are resolved".

Traders are already opening predominantly bullish positions in the derivatives market, causing the funding rate to rise and open interest to reach three-month highs.

Secondly, the departure of the crypto exchange that irritated American regulators so much opens the way for the approval of spot ETFs. The inflow of American investments will be directed toward more 'law-abiding' companies. However, legal action against Coinbase is still ongoing, and the SEC again has claims against Kraken, despite reaching a pre-trial agreement in February and the exchange paying a $30 million fine.

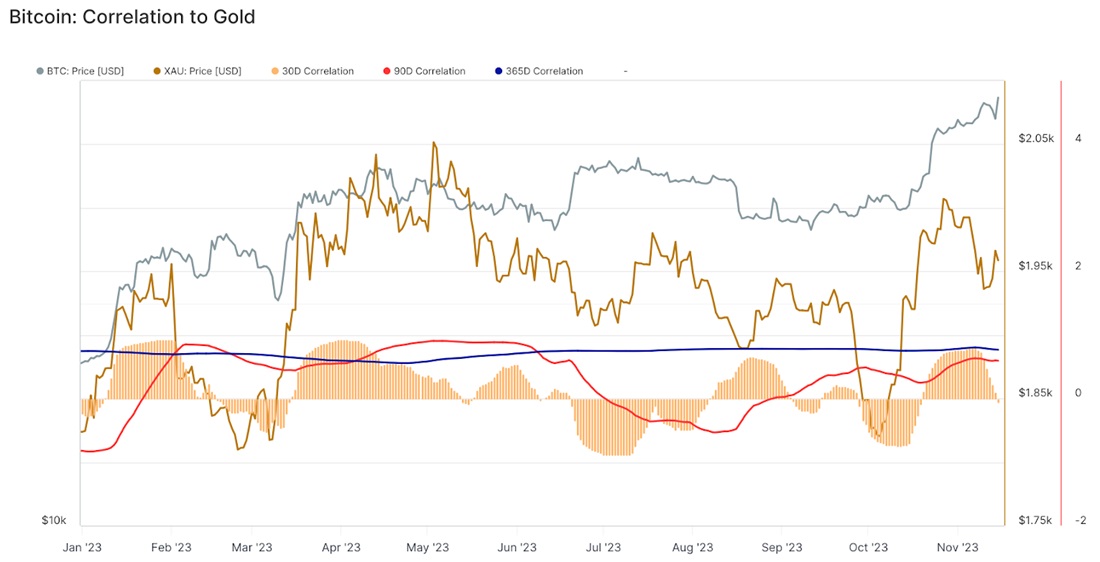

According to the Glassnode analytical agency, the emergence of spot Bitcoin ETFs will attract $60.6 billion from stock and bond ETFs and $9.9 billion from the gold market. The number of investors who consider Bitcoin to be 'digital gold' increases every year, and the current correlation between financial instruments is 0.65.

Riding Bitcoin's coattails, altcoins will also see higher interest. They currently account for 47.4% of the crypto market's total capitalisation.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.