The biggest mining company is on the verge of bankruptcy

The cryptocurrency market's fall and the continuing 'arms race' among public mining companies are leading to the restructuring of the crypto mining market. Leading company Core Scientific (CORE) sold off its entire Bitcoin holdings and is warning investors of the risk of bankruptcy. After the news emerged, its stock fell by 80%.

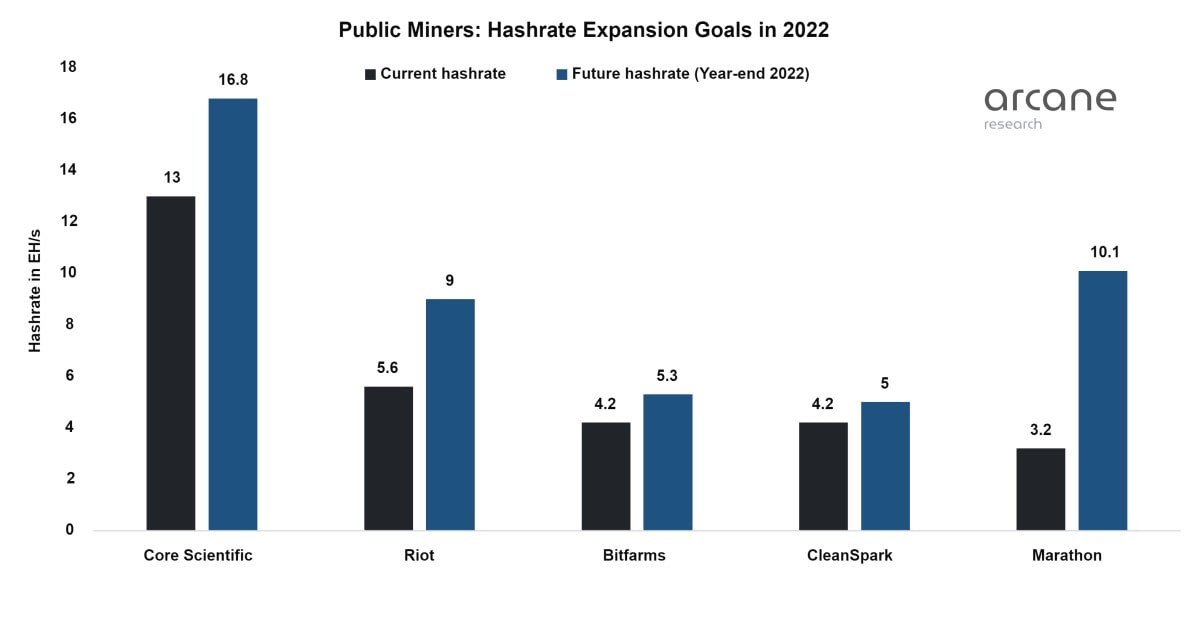

Core Scientific has the largest hashrate among public companies, and, until recently, it's been announcing plans to increase its capacity. The equipment it uses allows it to mine over 1000 BTC per month.

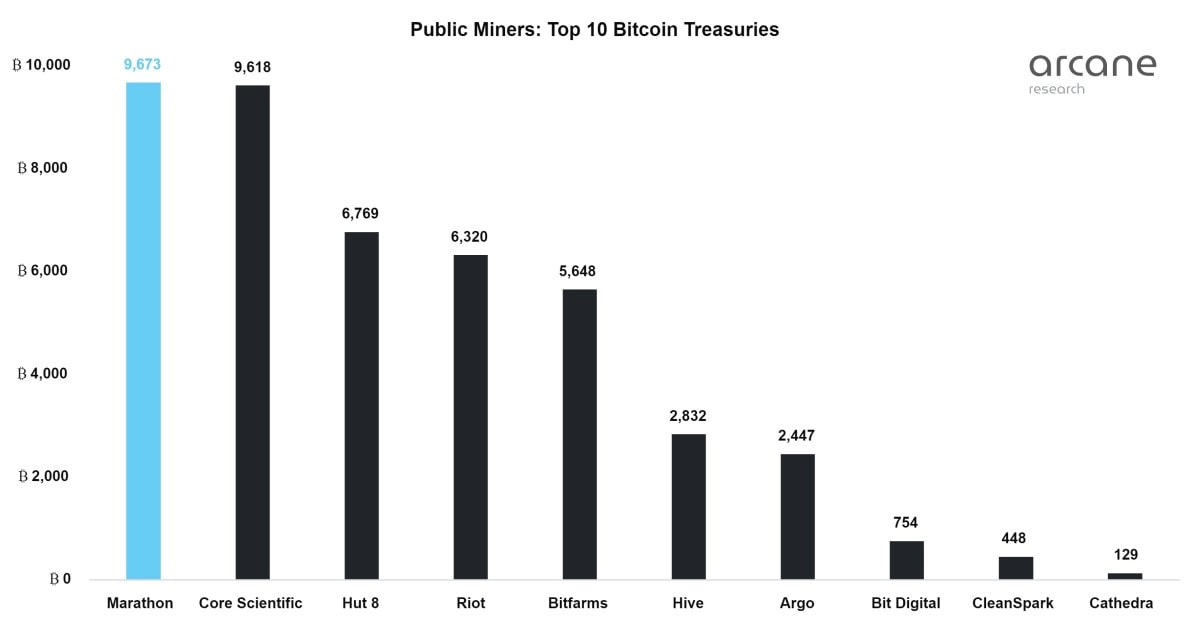

Before the crypto market's crash in May, CORE ranked second among miners in terms of BTC reserves, naming hodling as its main strategy. If it had continued to hold coins, the company would have become the leader in this indicator back in June.

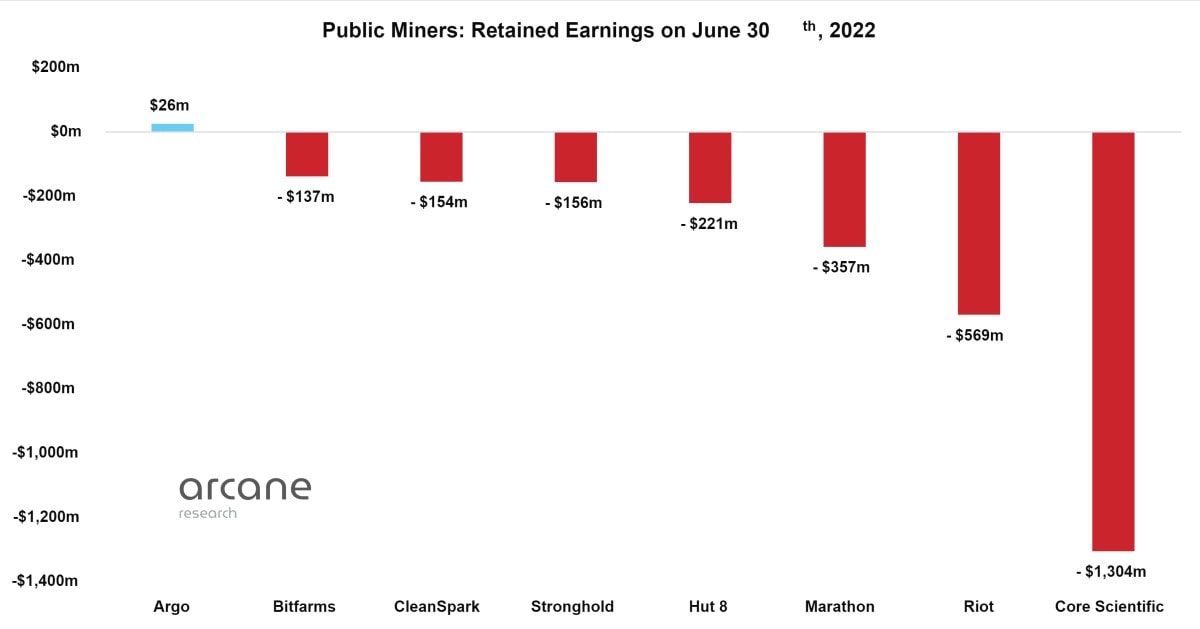

However, all factors combined led the miner to the edge of bankruptcy. This was primarily influenced by excessive optimism in assessments of the prospects for 2022 and the absorption of smaller players along with their debts. For instance, in July 2021, CORE acquired Blockcap for $1.2 billion, although the company had a modest net asset value of $142 million. As a result, the company became the market leader in another indicator: cumulative loss.

In an attempt to tie up loose ends, CORE has sold off its entire Bitcoin stock in the past four months, a total of 15,000 BTC per month. It currently has 24 BTC in its balance. It also reached an agreement with B. Riley regarding the right to sell $100 million worth of stock. However, all of these actions didn't have a meaningful impact on the situation. On 25 October, the company filed form 8-K with the SEC.

CORE is advising the regulator that, starting in October, it will freeze payments on obligations and that it's at risk of defaulting on convertible bonds maturing in 2025. The company is also warning of the expectation that existing cash resources will run out by the end of 2022 or sooner and expects bankruptcy proceedings among the potential consequences.

The ruin of the largest public miner will not have a negative impact on the cryptocurrency market. It's highly probable that CORE will be absorbed by a more successful player that's to top the ratings. In an extreme scenario, its equipment will go under the hammer and be deployed under a new banner.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.