Miners dump Bitcoin in anticipation of the halving

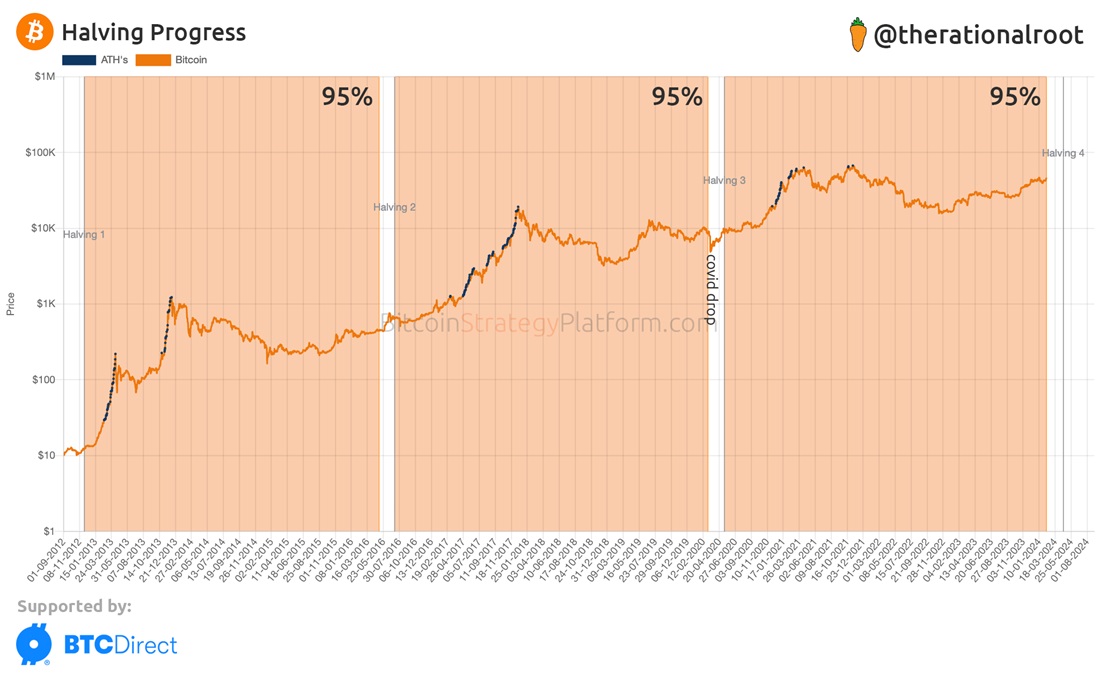

For the bulk of crypto-enthusiasts, halving is a positive phenomenon, as halving Bitcoin issuance leads to a lower supply and higher prices. Historically, the price triples or more 6-18 months after halving.

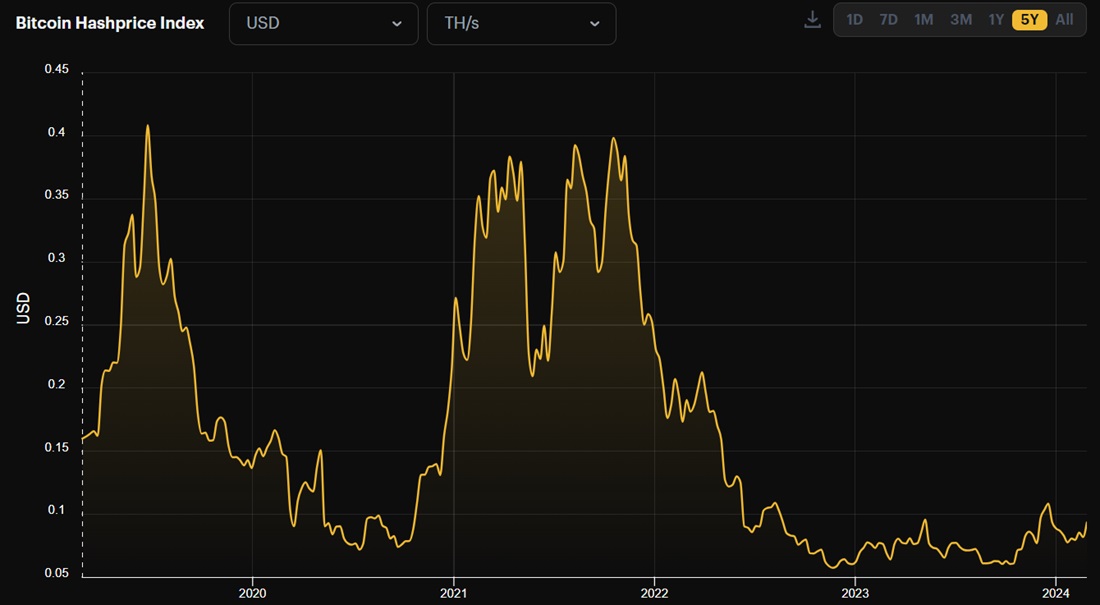

But this has significant implications for Bitcoin miners, as they experience a corresponding reduction in their revenue stream. The situation is exacerbated by stiff competition, which translates into a lack of meaningful yield growth from the hashrate, despite Bitcoin's excellent performance over the past 12 months. Last March, the price was $0.06 per terahash per day, but now it's just $0.09 TH/D.

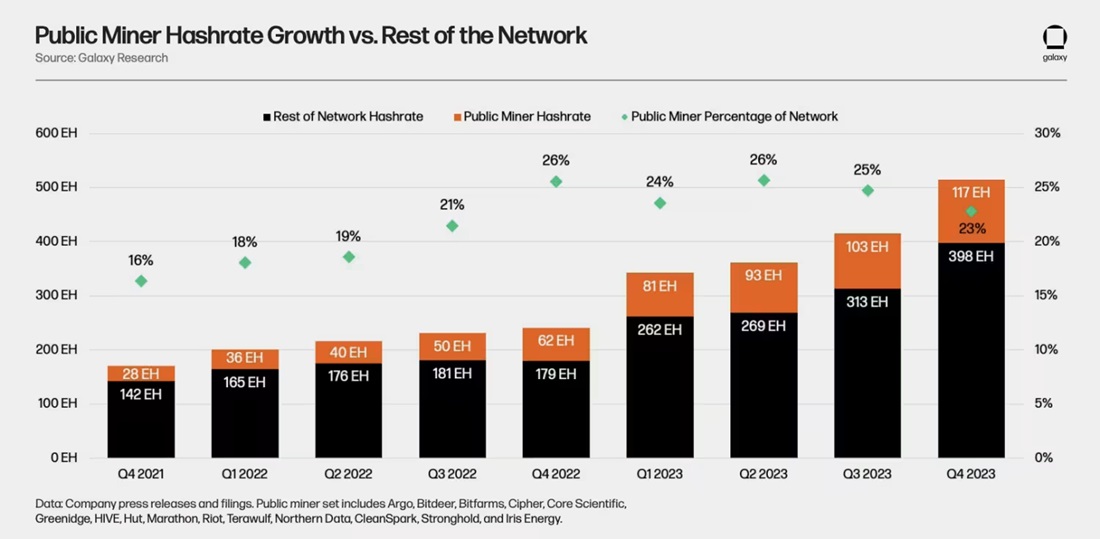

Before institutional capital entered the market (in the era of 'balcony mining'), the price reached $3.5 TH/D. Now publicly traded mining companies account for a quarter of the global network capacity, and their share continues to grow.

To maximize profits, they build power plants with renewable-sourced energy or connect directly (not via distribution grids) to nuclear power plants. At the same time, they are continuing to aggressively increase production capacity, which leads to an increase in difficulty and eats up much of the profit from Bitcoin's growth (Bitcoin uses a mechanism called difficulty adjustment to ensure a constant mining speed of 10 minutes per block).

Mining companies are fighting hard for every cent: some have managed to get the best energy rates, others have built optimal logistics between departments, and others have bought equipment from bankrupt colleagues at throwaway prices. In any case, halving will put some of them in an extremely difficult position.

For this reason, most have unloaded reserves and are selling Bitcoin to build a financial cushion. Over the past 12 months, miners' reserves have been reduced by 26,000 Bitcoins. BTC (~$1.6 billion) to 1.823 million BTC.

For the same reason, JPMorgan predicts Bitcoin will fall to $42,000 post-halving, as the first wave of hype around ETFs subsides and miners start selling with renewed vigor due to lower yields.

The $42,000 prognosis is also supported by the fact that the average cost of mining after halving for public mining companies is approximately at this level.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.