Bloodbath for miners

In the space of just a year, the cryptocurrency market has lost almost 70% of its value, putting weaker players under significant pressure. However, such a state of affairs beggars belief when you look at Bitcoin's hash ribbon: the network's total computational capacity has increased by 65% over this same period.

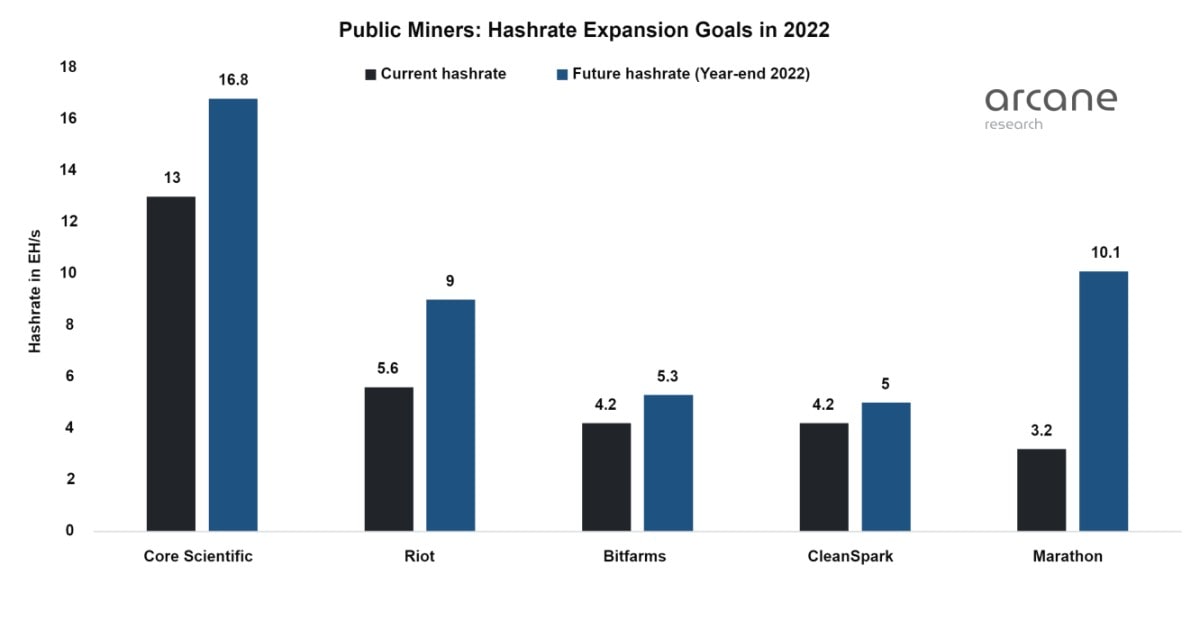

Viewed in month-over-month terms, miners have continued to purchase new equipment despite the macroeconomic situation and Bitcoin's decline to new local lows.

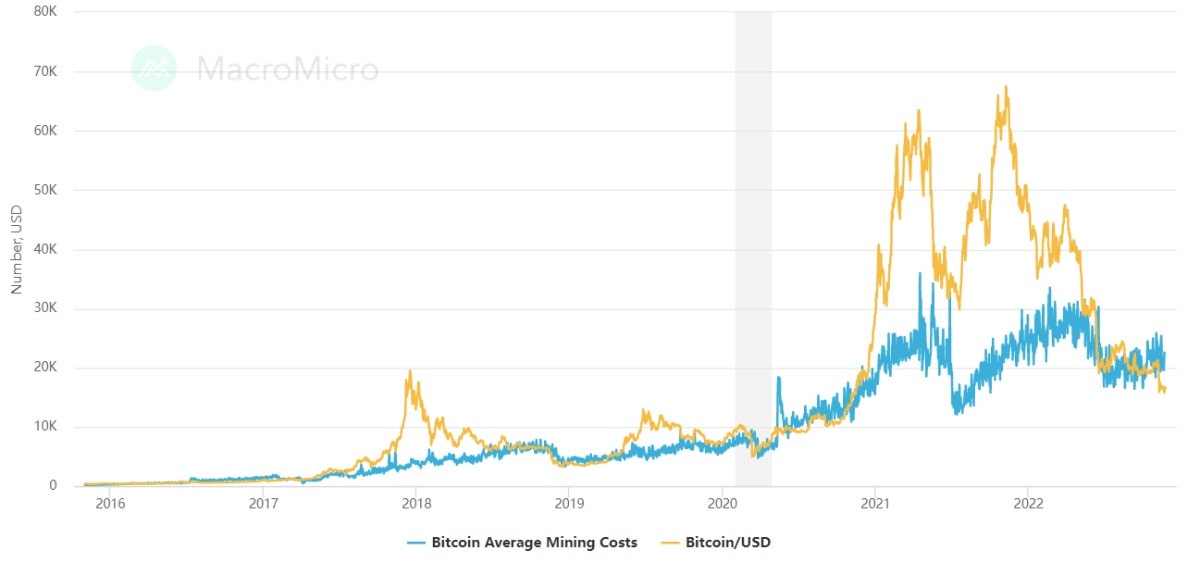

The addition of new equipment has led to an increase in computational difficulty, which, in combination with lower Bitcoin prices, has seen mining rewards hit all-time lows. Miners are already operating at a loss, with MacroMicro calculating the current mining breakeven price at somewhere around $20,000 per coin (these estimates are always given as an indication only since electricity tariffs, the equipment in use, and the amount of invested capital vary wildly from company to company).

Since Bitcoin mining is mainly the preserve of large companies with long-term strategic outlooks, some of these are prepared to mine at full capacity even when returns are negative in a bid to squeeze out competitors, so they can buy up ASICs at low prices.

There is a full-blown turf war currently taking place on the mining market. Core Scientific, which is the industry leader in terms of capacity and at one time in terms of reserves too, recorded $1.7 billion worth of losses in 2022 as it warned investors that it could be at risk of bankruptcy. This comes after it published plans to roll out more ASICs as recently as the middle of this year.

Iris Energy took out a $100 million loan, which included provisions for the purchase of new equipment. On 21 November, the company notified the SEC that it was powering down machines on account of the present low profitability, warning that it might be unable to meet its financial obligations.

In November, Argo Blockchain sold 3,843 S19J Pro ASICs that it had only just bought from Bitmain for $5.6 million as it warned investors that it could be forced to wind up operations. Back in early 2022, the company was one of the TOP 10 miners in terms of reserves, but much like Core Scientific, it was forced to sell all its coins.

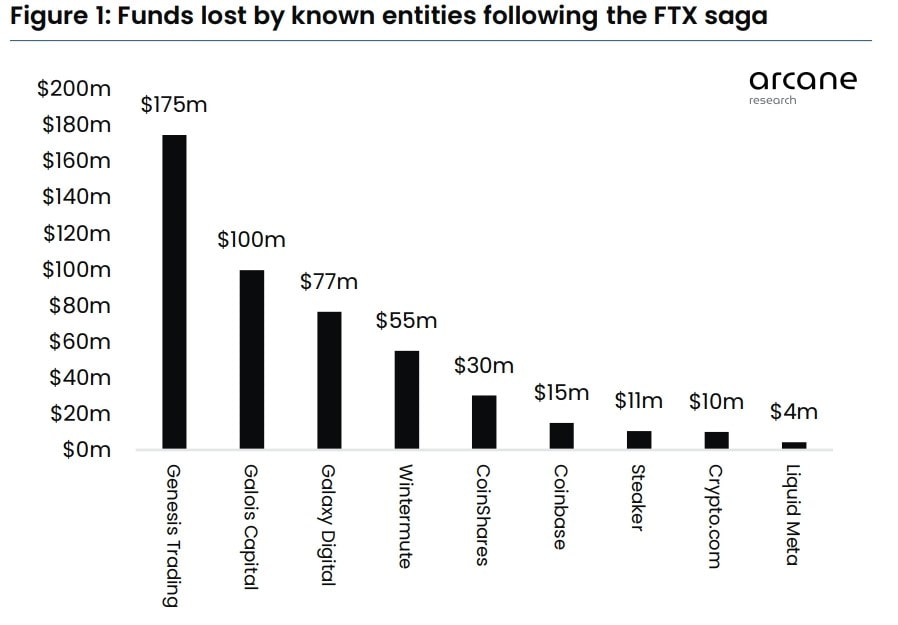

Foundry, which is owned by major global mining pool Foundry USA, announced that it was buying the business of recently bankrupt Compute North. Foundry is a subsidiary of Digital Currency Group, which itself is experiencing serious difficulties as a result of investments made by another one of its subsidiaries (Genesis Trading) in the now-defunct FTX project.

Companies who have managed to hold their capital in reserves are buying equipment from their bankrupt competitors, whilst simultaneously ordering ASICs from manufacturers at "unprecedented discounts", as CleanSpark bragged in early autumn. However, the opportunities for miners are becoming fewer and fewer, and an increasing number of new companies are reporting being unable to continue working under these current conditions. Capriole fund founder Charles Edwards termed the situation on the market as a "bloodbath for Bitcoin miners", pledging that a series of bankruptcies were to come.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.